Sensex Today: GMDC, Piccadily Agro Hit Fresh 52-Week Highs

The Indian stock market witnessed another strong session today with the Sensex holding steady near record levels. Among the notable performers, Gujarat Mineral Development Corporation (GMDC) and Piccadily Agro stole the spotlight by touching their fresh 52-week highs. The broader stock market sentiment remained upbeat, supported by investor interest in energy, mining, and agro-based companies.

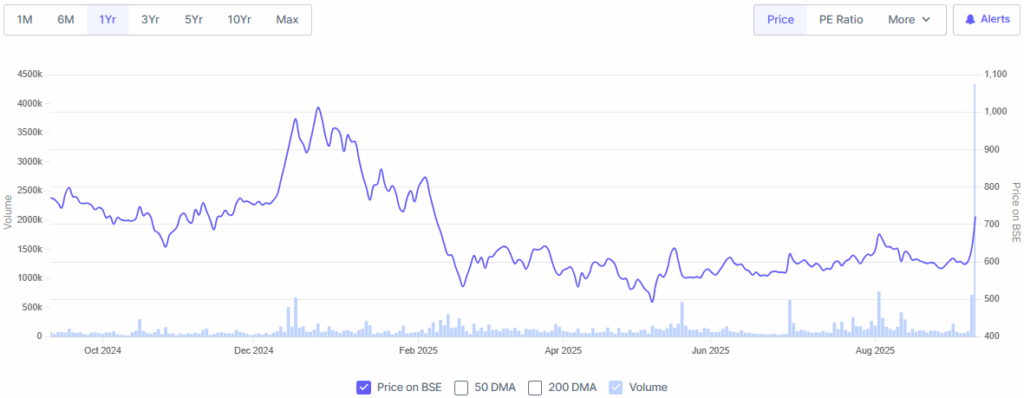

GMDC Surges to New Highs

GMDC, a state-owned mining and mineral processing company, has been one of the top gainers in recent weeks. The stock hit a fresh 52-week high during intraday trading, reflecting strong demand for natural resources and investor confidence in the company’s growth strategy.

Analysts point out that GMDC’s performance is linked to the rise in lignite, bauxite, and other minerals that are essential for India’s growing energy and industrial sectors. The company’s recent expansion into renewable energy also boosted sentiment, as global markets continue to shift toward sustainable energy sources.

Investors are showing increased interest in mining and energy-related stocks as global supply concerns, coupled with India’s infrastructure push, create opportunities for long-term growth. Strong financial results and improved efficiency at GMDC’s mining operations further fueled today’s rally.

Piccadily Agro’s Strong Momentum

Another major highlight was Piccadily Agro, a company engaged in the manufacturing of sugar, liquor, and distillery products. The stock also reached its 52-week high, riding on robust demand in the consumer goods and alcohol sector.

The company’s recent foray into premium liquor brands and steady improvement in capacity utilization have made it attractive for investors. With consumer demand for alcohol and sugar-based products climbing, Piccadily Agro’s stock has been on a strong upward trend.

The Indian sugar sector has been under focus due to changing ethanol-blending policies and export opportunities. Companies like Piccadily Agro, which align their strategies with government reforms, are expected to maintain steady growth.

Sensex Market Sentiment and Key Drivers

The Sensex today traded with optimism, supported by global cues and strong buying across mid-cap and small-cap counters. Energy, metals, consumer goods, and agro-based companies led the rally.

Market analysts attribute this momentum to:

- Rising global commodity prices that support companies like GMDC

- Consumer demand in the liquor and sugar sector is benefiting Piccadily Agro

- Positive inflows from foreign institutional investors (FIIs)

- Renewed focus on India’s economic growth trajectory

While some volatility remains due to inflationary pressures, the stock market outlook remains constructive as long as corporate earnings continue to show resilience.

GMDC’s Strategic Outlook

The strategic direction of GMDC makes it a significant player in India’s natural resources sector. With mining operations across Gujarat and an increasing presence in renewable energy projects, the company is aligning with India’s long-term sustainability goals.

Investors are particularly drawn to GMDC for:

- Strong balance sheet and consistent dividend payouts

- Expansion into solar and wind power

- Increasing demand for lignite and bauxite in domestic and export markets

- State government backing, which enhances stability

For long-term investors focusing on stock research, GMDC represents both a growth and value opportunity.

Investor Interest in Agro and Consumer Stocks

The rise of Piccadily Agro reflects a broader trend in the Indian market, where consumer demand-driven companies are performing well. Rising disposable incomes, urbanization, and policy reforms in ethanol blending continue to support the sector.

Investors are closely watching companies in the liquor, sugar, and ethanol industries, given the government’s emphasis on renewable fuel alternatives. Piccadily Agro, with its diverse portfolio, remains positioned to benefit from this trend.

Global Market Influence

Global market cues also played a role in today’s trading. While volatility in oil prices and inflation concerns remain, India’s economic fundamentals continue to attract investors. The stock market rally in AI stocks and technology-driven sectors worldwide has also contributed to positive risk appetite.

However, experts caution that investors should be mindful of potential corrections, especially in small and mid-cap stocks that have seen sharp run-ups recently. A balanced portfolio strategy combining AI stocks, energy companies, and consumer-driven businesses is recommended for those seeking stability and growth.

Stock Market Research and Outlook

Based on stock research, companies like GMDC and Piccadily Agro are benefitting from both macroeconomic and sector-specific factors. The Sensex today reflected that momentum, with market breadth remaining positive.

Looking ahead, analysts expect:

- Continued support from government infrastructure projects

- Higher investor participation in mining and agro-based companies

- Growth opportunities in renewable energy and ethanol production

- Positive liquidity flows supporting mid-cap and small-cap rallies

For investors, today’s session reinforces the importance of long-term investing backed by research rather than short-term speculation.

Conclusion

The Sensex today highlighted the strength of India’s stock market, with GMDC and Piccadily Agro hitting fresh 52-week highs. While GMDC benefits from rising demand in minerals and renewable energy expansion, Piccadily Agro is thriving in the sugar and liquor sector. Together, these companies reflect the diverse opportunities available in the Indian stock market.

As investor sentiment stays upbeat, and with global trends favoring sustainable energy and consumer growth, both stocks are expected to remain on the radar for those seeking strong returns. Prudent stock research and portfolio diversification will remain essential for navigating market volatility while capturing future gains.

FAQs

GMDC stock is performing well due to strong demand for minerals like lignite and bauxite, expansion into renewable energy, and consistent financial results that attract investor confidence.

Piccadily Agro’s stock is rising because of strong consumer demand, expansion into premium liquor brands, and favorable ethanol-blending policies that benefit sugar and liquor companies.

Both stocks are performing strongly, but investors should conduct proper stock research and consider their long-term goals before making investment decisions. Market corrections are possible, so a balanced strategy is recommended.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.