SoFi Stock Today: Investors Watch for Growth Signs Before Q3 Results

The fintech firm SoFi Technologies, Inc. (NASDAQ: SOFI) is about to reveal its third-quarter results on October 28, 2025. Investors are paying close attention. Why? Because SoFi has been growing fast across lending, investing, and its tech platform. At the same time, the economy is dealing with rising interest rates and more competition in the fintech space. This means Q3 is not just another quarterly update; it could determine whether SoFi can turn its rapid growth into lasting strength.

The number of members, the size of its loan portfolio, and how the tech-platform business performs will all matter. In short, the upcoming earnings report could be a turning point for the stock and its long-term story.

SoFi Stock Recent Performance

SoFi’s shares have shown strong momentum into late October 2025. The stock moved higher after the company released third-quarter results on October 28, 2025. Investors reacted to both revenue beats and raised guidance. Trading volumes rose as analysts and retail traders re-rated the story. Short interest had been elevated earlier in the year, but that eased around the results. Overall, market sentiment moved from cautious to cautiously optimistic after the Q3 beat.

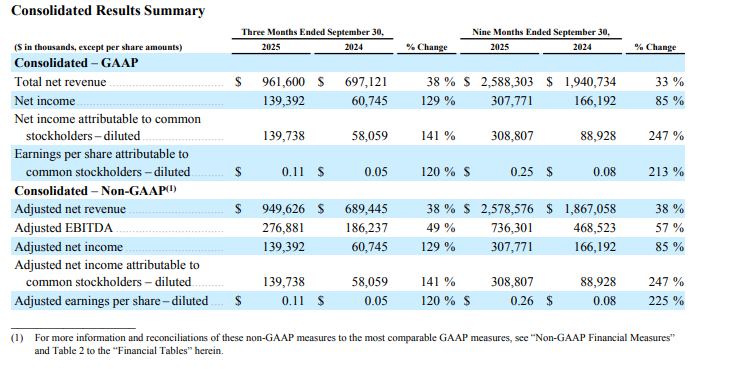

Q3 Results vs. Street Expectations

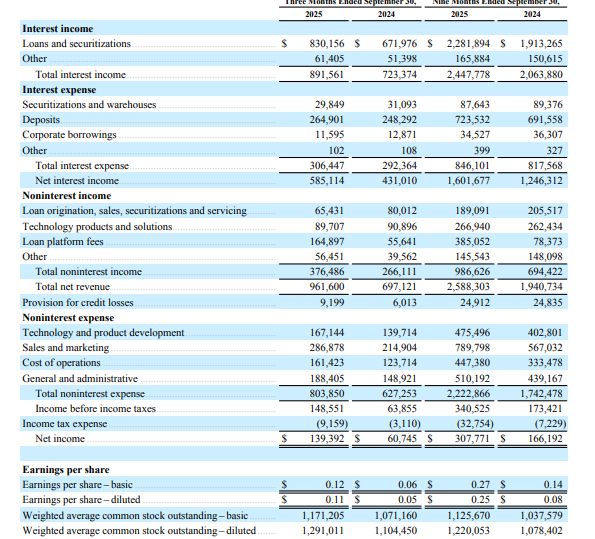

Analysts expected a solid quarter, but the results topped many forecasts. SoFi reported third-quarter net revenue of $962 million and adjusted EPS of $0.11 per share for the quarter ended September 30, 2025. That revenue figure beat FactSet consensus and marked strong year-over-year growth. The company also reported net income of about $139 million for the quarter. These outcomes prompted management to raise full-year guidance for 2025.

Growth Drivers and Business Segments

Lending led much of the quarter’s gains. Total loan originations rose sharply. Personal loan originations and student loan originations each posted large increases. The bank charter continues to strengthen deposit funding and margins. The financial-services segment (consumer banking, investing, credit cards) showed higher member engagement and more product cross-sells. The tech-platform segment also grew.

Galileo and related partnerships added volume and recurring revenue. The Galileo network reported growth in enabled accounts and continued platform traction through mid-2025. These three pillars, lending, financial services, and the tech platform, balanced revenue growth across the business.

Profitability and Balance Sheet Health

Profitability moved into clearer view in Q3. Contribution profit and contribution margin rose meaningfully compared with the prior year. Contribution profit improved due to revenue gains and contained directly attributable costs. The company reported improved net income compared with the same quarter last year.

Deposit growth from the bank charter helped fund lending without as much wholesale market dependence. Loan portfolio quality remained a focus. Recent disclosures showed stable credit metrics amid higher originations. Overall, the balance sheet looked healthier going into the fourth quarter.

Market and Investor Sentiment

Analyst reactions were mixed but shifted positively after the results. Several outlets noted the revenue beat and guidance lift. Pre-market trading moved the stock higher on the day of the release.

Still, some brokers point to valuation and execution risk. Institutional commentary emphasized the need to watch ongoing margin trends and the planned capital raise announced earlier in the year. Retail investor interest remained high on social channels and trading platforms. An AI tool used by some research desks also highlighted the outsized member adds as a key positive signal.

Key Risks to Watch

A few clear risks remain. First, high interest rates could slow loan demand or compress some spread dynamics. Second, valuation is a concern for many analysts, given the stock’s rapid run. Third, a previously announced equity offering raised dilution worries among some shareholders. Fourth, regulatory shifts in fintech and banking rules could add cost or limit certain products. Finally, competition from established banks and nimble fintechs keeps product pricing and retention under pressure.

What to Watch in Upcoming SoFi Stock Updates?

Investors and analysts should focus on a handful of items in the next updates and calls. Key metrics include member adds, average revenue per member, lending originations and margins, tech-platform revenue growth, deposit trends, and contribution margin. Guidance for Q4 2025 and full-year 2026 outlooks will be critical. Management commentary on capital allocation and the timing of any further offerings will also influence sentiment. Finally, watch for any commentary about crypto or new product launches that could alter the growth mix.

Outlook and Long-Term Potential

If SoFi sustains revenue growth and expands contribution margins, the long-term case strengthens. The combined model of lending, consumer finance, and a payments/tech platform creates multiple monetization routes. Profitability improvements reduce investor reliance on future multiple expansion alone. That said, the stock still carries execution risk. Valuation will remain a sensitive factor until consistent quarter-to-quarter margin progress is visible. Analysts will be looking for steady progress across all three segments before calling SoFi a stable, mature franchise.

Wrap Up

Q3 2025 was a milestone quarter for SoFi stock. The company delivered stronger revenue, membership growth, and a surprising profit lift on October 28, 2025. The raised guidance suggests management sees sustained momentum. Yet risks persist. Investors should watch the next few quarters for repeatable margin improvement and controlled capital moves. Those outcomes will decide if the stock’s rally has a durable foundation or if volatility will return.

Frequently Asked Questions (FAQs)

SoFi earns money through personal loans, student loans, banking, investing, and its tech platform, Galileo. Growth comes from more users, new services, and steady digital expansion.

High interest rates, loan defaults, or new fintech rules could slow growth. Market swings and strong competition may also affect SoFi’s stock performance in late 2025

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.