South Korea Exports Set for Growth on Semiconductor Demand, Calendar Shift

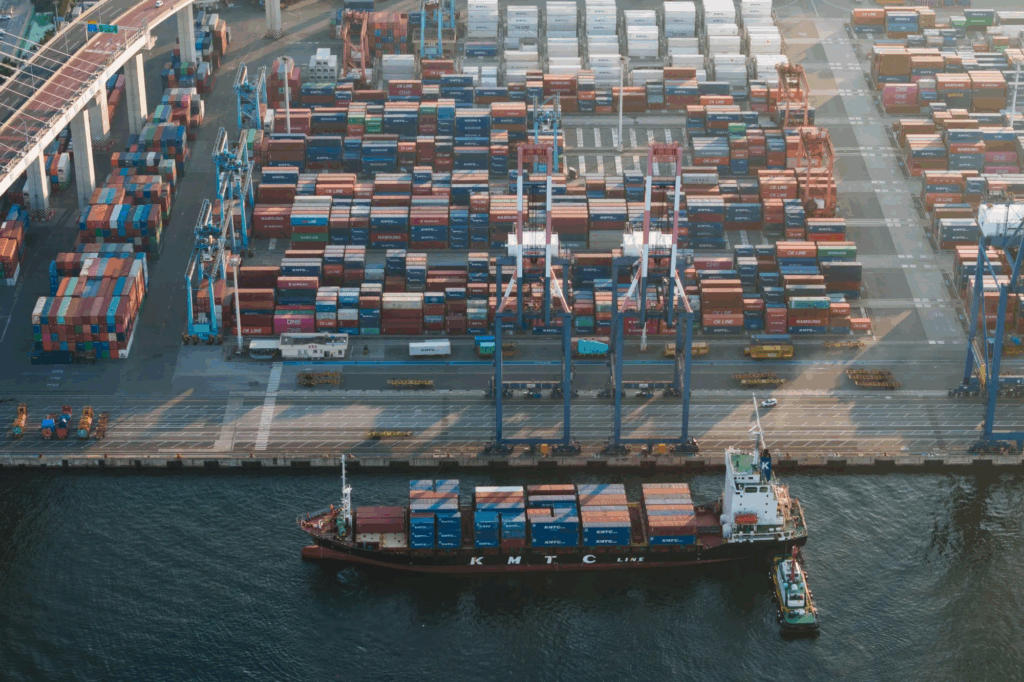

South Korea is one of the world’s most export-driven economies. In fact, exports account for nearly 40% of its GDP in 2024, making them the lifeline of the nation’s growth. As we step into September 2025, all eyes are on South Korea’s trade data, which shows promising signs of recovery.

The big story is semiconductors. Chips are not just another product. They are the backbone of AI, cloud computing, smartphones, and electric vehicles. South Korea is home to giants like Samsung Electronics and SK Hynix, which lead the global memory chip market. Rising global demand, especially from the U.S. and China, is pushing export numbers higher.

But there is also a technical reason. A calendar shift in September 2025 added more working days, giving exports an extra boost. This means we must look closely at the numbers to separate real growth from temporary gains.

Together, structural demand and statistical effects are shaping South Korea’s export outlook. Let’s explore how these forces are driving momentum, what risks remain, and where the next opportunities lie.

South Korea’s Export Landscape: A Snapshot

South Korea depends heavily on exports. In 2024, exports made up a large share of GDP. Major export items include semiconductors, petrochemicals, cars, batteries, and ships. Top trading partners are China, the United States, ASEAN, and the EU. The country faced shipping slowdowns and weaker demand in prior years. Still, recent trade numbers show recovery signs as of September 2025.

Semiconductor Demand as the Growth Engine

Semiconductors lead the export rebound. Memory chips and advanced HBM products are in strong global demand. Demand rises because of AI, cloud computing, 5G, and electric vehicles. Samsung Electronics and SK Hynix are key suppliers. Recent data show a sharp rise in chip shipments in September 2025, with semiconductor exports up markedly and acting as the main driver of headline export growth. This surge helped push early-September exports to multi-month highs.

Calendar Shift: A Technical Boost

A calendar effect added to the headline gain in September 2025. More working days in the reporting period raised total shipments. Korea’s customs office reported 16.5 working days in the first 20 days of September 2025 versus 13 days a year earlier. That lifted the aggregate export figure. But average daily exports fell after adjusting for extra days. The pattern shows the rise is partly statistical. Analysts caution that such boosts do not always reflect stronger underlying demand. Official full-month data were due on October 1, 2025.

Sectoral Analysis Beyond Semiconductors

Automotive exports showed recovery signs. Electric vehicles and hybrid models helped lift shipments to the U.S. and EU. Petrochemicals also improved with higher global manufacturing activity. Battery exports for EVs rose as global automakers source more from Korean suppliers. Shipbuilding saw niche strength in LNG carriers and specialized vessels. However, not all sectors grew at the same pace. Machinery and some capital goods faced pressure from tariffs and weaker demand in specific markets.

Key Export Markets and Trade Partners

China remains the largest market for Korean chips and other goods. The U.S. strengthened demand for semiconductors and batteries. ASEAN gained ground as a hub for intermediate goods and assembly. The EU showed steady interest in EVs and green tech. Recent trade moves from the U.S. have complicated supply links for chipmakers with China exposure. This is altering trade flows and prompting firms to diversify routes and partners.

Risks and Challenges Ahead

Several risks could limit export gains. First, the semiconductor industry is cyclical. Price swings could reverse gains quickly. Second, U.S.-China tensions create policy risk. New U.S. rules on equipment and exports can affect Korean firms with China operations. Third, average daily export figures suggest weaker core demand once calendar effects are removed. Fourth, currency swings for the Korean won could compress margins. Also, rising competition from Taiwan and China in advanced chips will test market share.

Government and Policy Support

The Korean government is boosting support for tech R&D. Public funds aim at advanced chip research and local supply chains. Trade diplomacy and free-trade talks remain on the agenda. Policy measures also include incentives for battery and green-tech production. Authorities monitor tariff risks and seek to stabilize energy and logistics costs for exporters. Such support helps firms scale production and keep export capacity competitive.

Short-Term Signals vs Structural Trends

The September 2025 jump in exports combines two forces. One is an extra working-day boost. The other is genuine tech-driven demand. Adjusted daily figures show softness. But gains in memory prices and HBM certification wins point to deeper shifts. Samsung’s progress on HBM3E and SK Hynix’s HBM4 work are examples of structural improvement in tech supply. These steps suggest longer-term export potential beyond one-off statistical lifts.

Market and Investment Angle

Investors and analysts watching Korean trade will track two things. First, full monthly customs data to confirm if growth holds after the calendar effect is removed. Second, semiconductor orders and price trends for memory chips and HBM. Tools such as an AI stock research analysis tool can help spot shifts in supplier revenue and order books quickly. Company-level updates from Samsung and SK Hynix will remain crucial for market sentiment.

Outlook for Late 2025 and Beyond

If chip demand for datacenters and AI hardware stays strong, exports can continue to grow into late 2025. Diversification into batteries and green tech will help reduce reliance on memory chips. Trade tensions and policy changes remain the main downside risks. Overall, the medium-term outlook is cautiously positive. Expect volatility. But capex cycles and new product ramps could support sustained export momentum into 2026 if global demand holds.

Wrap Up

The September 2025 export bounce shows two truths. One, semiconductors are the main growth engine. Two, statistical calendar effects inflated short-term figures. Close reading of average daily exports and full-month customs data is needed to judge real strength. Policy shifts and global tech demand will shape the path forward. If memory and HBM markets keep rising, South Korea’s export lead could last. If global demand cools or trade rules tighten, gains could reverse quickly.

Frequently Asked Questions (FAQs)

South Korea’s exports rose in September 2025 because of stronger semiconductor demand and more working days that month. Daily average exports, however, showed slower growth.

Semiconductors made up about 18.9% of South Korea’s total exports in 2022. Chips remain the country’s largest export item and a key growth driver.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.