S&P 500 2026 Outlook: Why Strategists Are Calling for 10%+ Gains

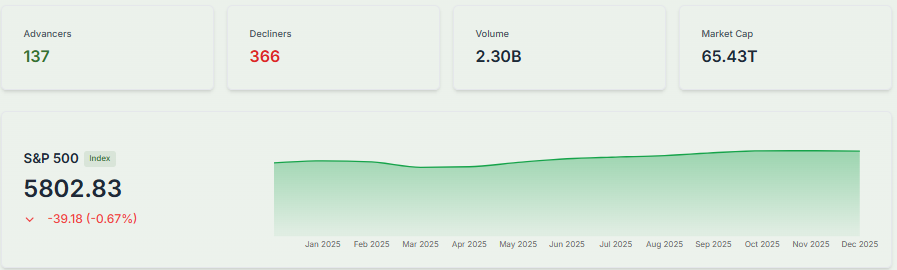

As of early December 2025, the S&P 500 index sits near 6,830, a level that has many Wall Street analysts looking ahead with optimism. Investors and strategists are whispering a familiar number: 10%+ gains by the end of 2026. That would push the S&P 500 toward roughly 7,500 or more.

Why the confidence? The U.S. economy remains resilient. Corporate earnings are holding up. Tech companies especially those tied to AI and innovation look poised to drive growth. At the same time, many expect a stable interest‑rate backdrop from the Federal Reserve.

In short: the setup feels right. But forecasts are never certainties. With that in mind, this article explores the reasons behind the bullish 2026 outlook.

S&P 500: How 2025 Set the Stage?

During 2025, the S&P 500 regained lost ground after a tough early year. The index rose more than 9 % by early September. The rebound reflected better economic data, stronger corporate earnings, and renewed investor interest in growth sectors.

At the same time, sluggish growth early in the year turned around in the second quarter. U.S. gross domestic product (GDP) grew about 3.3 % in Q2 2025 a sharp recovery from a weak start to the year. That bounce helped build confidence that the economy could support a rising market.

Tech and innovation‑heavy firms led the way. Big technology and AI‑related stocks gained strong momentum as investors bet on future growth.

At the same time, there was growing talk that policy could shift with the central bank possibly easing interest rates if inflation cooled and labor markets softened. Together, these dynamics created a favorable backdrop for stocks entering 2026.

What Is Fueling the 2026 Optimism?

Many forecast models point to three main drivers for a 10 %+ rise in 2026.

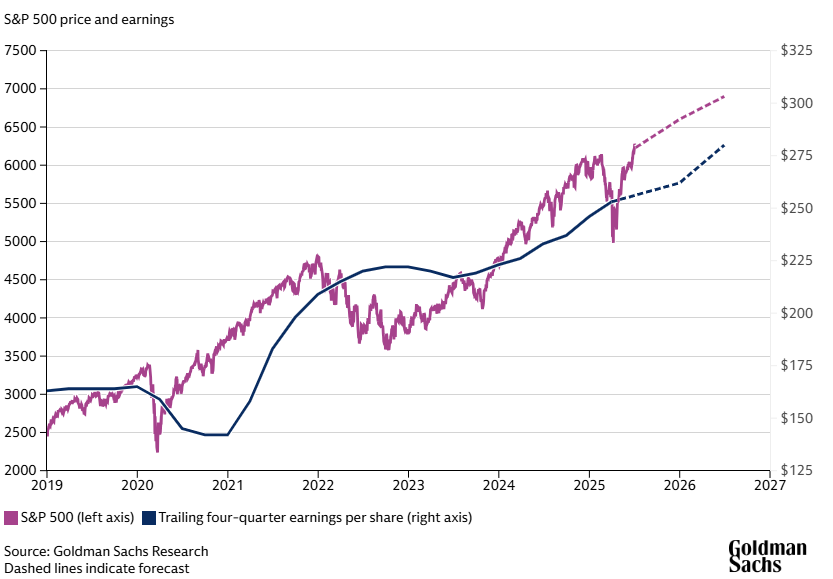

First, earnings growth remains the cornerstone. For example, Goldman Sachs projects that earnings per share (EPS) for S&P 500 companies will grow about 7 % in 2026 after similar growth in 2025.When companies earn more, their stocks usually rise. That creates a solid foundation for index‑wide gains.

Second, innovation especially linked to AI and technology continues to shape the rally.The push for automation, cloud services, AI infrastructure and more has boosted growth expectations beyond traditional tech firms. Many believe that the AI-driven productivity wave is still in early stages, and its full impact may show up in 2026 and beyond.

Third, a more friendly macroeconomic and policy environment could help. Some strategists foresee that loose monetary policy or rate cuts by the Federal Reserve (the Fed) might support risk assets. Also, broader economic stability, modest inflation, stable growth, resilient consumer demand could support corporate profitability.

A combined effect of these factors could push the S&P 500 to levels between 7,500 and 7,800 by the end of 2026. That would represent roughly 10-14 % gains from many current levels.

Differing Forecasts: Bullish and More Cautious Views

Not all forecasts are equally bullish. Many firms expect double‑digit growth, but their targets vary. For instance, HSBC estimates a 2026 year‑end S&P 500 target of around 7,500.

Meanwhile, Morgan Stanley sees even stronger potential a 14 % rise over 2026, with the index reaching about 7,800 if conditions remain favorable.

On the more cautious side, some analysts warn that elevated valuations leave little room for error. If earnings disappoint or interest rates stay high, gains could be limited or reversed. Therefore, 2026 might deliver moderate to strong gains but outcomes depend heavily on how these underlying conditions play out.

What Could Go Wrong? Key Risks to Watch

A few significant risks could derail the bullish forecast.

One is inflation and interest‑rate uncertainty. If inflation stays sticky, the Fed might delay rate cuts or even raise rates again. That would weigh on growth stocks, especially those in AI and tech, the very firms driving much optimism.

Another risk: corporate earnings missing expectations. Many forecasts rely on companies delivering double‑digit profit growth. If that fails to materialize perhaps because of rising costs, weak consumer demand, or margin pressure valuations could suffer.

Finally, over-reliance on a narrow set of sectors mostly tech and AI could make the index vulnerable. If investor enthusiasm for those sectors fades, overall gains could be muted.

What Could Make 2026 a Great Year for Investors?

If things go right, 2026 could be a rewarding year for long-term investors. A diversified portfolio leaning on growth- and innovation-driven firms might deliver solid returns.

Companies outside big tech in sectors like industrials, healthcare, or financials may benefit too if economic growth remains broad. Some analysts at Morgan Stanley see value in widening the scope beyond just growth stocks.

Also, if rate cuts happen and liquidity returns, the stage could be set for renewed investor interest. That could fuel a broad-based rally, not just a narrow tech‑led one. Having a diversified approach may help manage risk while capturing potential upside.

Conclusion: A Balanced but Promising Outlook

The picture for 2026 is cautiously optimistic. Many leading analysts expect the S&P 500 to rise 10-14 %, pushing into the 7,500-7,800 range. That optimism rests on earnings growth, ongoing

AI and tech-driven innovation, and a supportive economic environment. But upside is not guaranteed. Inflation, earnings disappointments, or a slowdown in key sectors could temper gains.

Ultimately, 2026 could be a good year for investors especially those who stay diversified, watch fundamentals, and adapt as conditions evolve.

Frequently Asked Questions (FAQs)

Many firms like J.P. Morgan and BNP Paribas see the S&P 500 reaching about 7,500 by end‑2026. In contrast, Meyka’s AI‑based forecast suggests a 2026 level around $6,209.51.

They expect strong company profits, rising earnings across many firms, growth in technology and AI‑linked firms, and possible interest‑rate cuts to support stock gains.

If company earnings shrink, interest rates stay high, or tech/AI optimism fades the rally might slow or reverse. Market volatility is also a key risk.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.