Stock Analysis | Kimberly-Clark Outlook Weakens as Technicals Signal Downturn

Kimberly-Clark, the company behind household names like Kleenex, Huggies, and Kotex, has long been seen as a safe choice for investors. Its products are part of our daily lives, making it a classic defensive stock in uncertain times. But today, the story looks different. Recent numbers and chart patterns show signs of weakness that we cannot ignore.

We see demand softening in key markets, while rising costs continue to squeeze profits. At the same time, competition is getting tougher, and private-label brands are taking a bigger share. Even though Kimberly-Clark has managed to protect margins with price hikes in the past, consumers are starting to push back. This shift is showing up in the company’s latest results and in its stock performance.

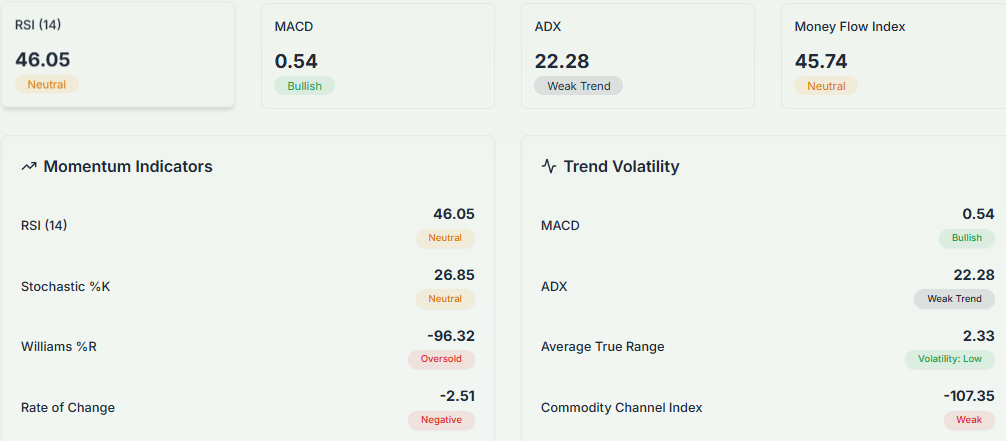

On the technical side, the signals are flashing red. Moving averages, volume trends, and momentum indicators suggest a possible downturn ahead. For investors who rely on stability, this is a wake-up call.

Let’s break down Kimberly-Clark’s current challenges, what the charts are telling us, and whether there are still reasons to stay invested despite the pressure.

Company Background & Market Position

Kimberly-Clark has roots going back to 1872. Based in Irving, Texas, it makes well-known products like Kleenex, Huggies, Kotex, and Cottonelle. It once ran its own paper mills but closed its last mill in 2012. Today, the firm is a solid name in personal care and consumer tissue. It is a familiar presence in many homes worldwide.

Recent Financial Performance

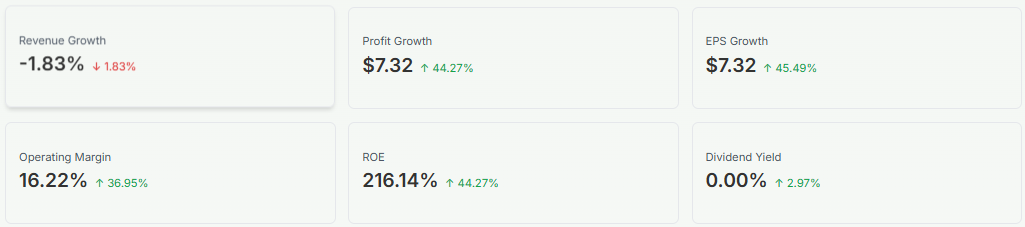

In its first quarter of 2025, Kimberly-Clark reported $4.84 billion in revenue. That missed analyst forecasts and represented a 6 percent drop from a year earlier. Adjusted earnings per share came in at $1.93, slightly above forecasts, but net income still fell, from $647 million to $567 million. The fall in revenue reflected lower volumes, price cuts, and some business exits.

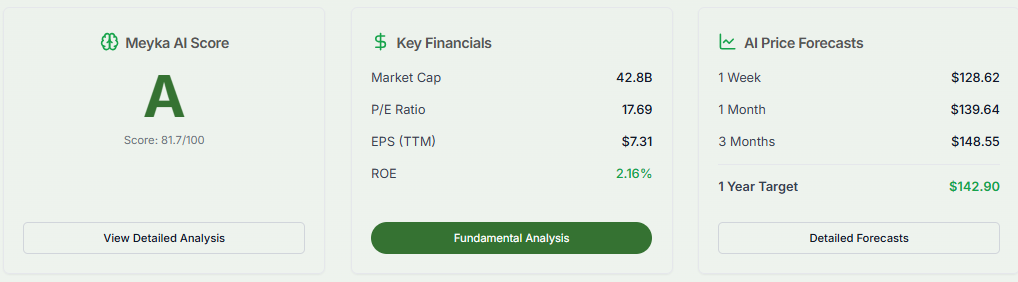

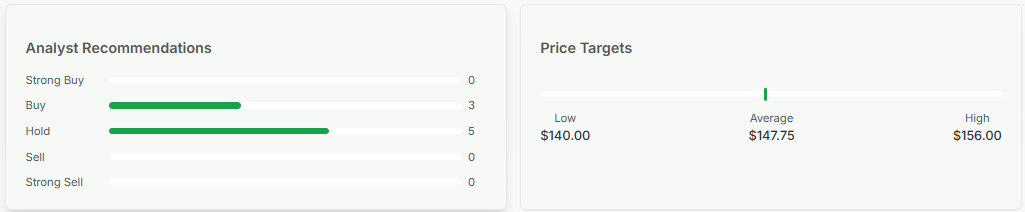

EPS projections show modest growth ahead. Forecasts estimate $7.51 per share in 2025 and $7.92 in 2026. Analysts currently rate the stock as Hold or Moderate Buy. The average 12-month price target is around $143-$144, suggesting an upside of about 10-11 percent from current levels.

Weakening Outlook: Key Challenges

One big hit to the outlook comes from tariffs. Kimberly-Clark expects to incur about $300 million in extra costs this year. Two-thirds of that stems from U.S. tariffs on Chinese goods. The company had previously forecast mid- to high-single-digit profit growth. Now it expects flat to slightly positive adjusted operating profit and EPS in constant currency terms.

Sales in North America fell 3.9 percent, hit by divestitures and its exit from private-label diapers. International personal-care sales dropped 8.9 percent, while family care and professional segments also suffered. The tariff burden and currency headwinds weigh on growth. The company is trying to adjust supply chains instead of passing costs to consumers.

Technical Analysis: Bearish Signals

The stock has shown technical warning signs. It dropped 3.17 percent recently and earned a low 1.63 out of 10 diagnostic score, driven by bearish setups like a MACD death cross and a Marubozu candle. Some days, the stock lost 2-3 percent in short spans under these weak patterns. Advice from models is to avoid entry until there are signs of reversal.

At the same time, stockinvest.us notes a slight horizontal drift in price with resistance near $130.56-$130.73 and support around $128.29. A break above those levels could trigger positive signals, but for now, moving averages still point to negative.

Analyst & Market Sentiment

Wall Street is divided. Among 23 analysts, only a small share rate the stock a Strong Buy; most say Hold, and a few suggest Sell. On a broader note, 15 analysts show a Neutral consensus, with six Buys, one Sell, and the rest Hold. Price targets range from $118 to $162, with an average around $142.

Opportunities Amid Weakness

There are still potential upsides. Kimberly-Clark holds a strong balance sheet and has lowered its debt levels. Its debt-to-EBITDA ratio stands near 2×, and interest costs remain manageable. The firm still pays a reliable dividend, making it attractive to income investors.

Another glimmer comes from technical charts. In spring, its Relative Strength (RS) rating rose from 68 to 72. It now forms a flat base with a potential breakout above $150.45 if volume picks up.

Risks to Watch

Risks remain high. Tariffs and trade tensions could continue eating margins. Demand in key markets struggles. Exiting product lines has trimmed revenue, and international competition pressure remains strong. Any prolonged inflation or supply chain shocks could hurt further.

Bottom Line

Kimberly-Clark faces a tough case right now. Trade costs, falling sales, and bearish technical signals raise red flags. Analysts remain mixed, with a modest bias to neutral. Still, the firm’s steady income and ability to adapt offer some comfort. Caution seems wise in the short term. A turnaround may come only if fundamentals improve or technical patterns reverse.

Frequently Asked Questions (FAQs)

Kimberly-Clark looks neutral for now. Analysts rate it as a “Hold.” Some see a possible 8-10% upside over the next year.

In Q2 2025, revenue dipped slightly, but organic sales rose about 3.9%, the best volume growth in five years. The company raised its profit forecast.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.