Stock Fall Continues Amid Bank Sector Concerns Over Credit Fraud Exposure

On October 17, 2025, global stock markets dropped sharply. Bank stocks led the fall after two U.S. regional lenders revealed big losses tied to fraudulent or bad loans. Investors now fear that more hidden credit fraud could start surfacing.

This decline is not random. It reflects growing doubts about bank lending practices. When loans go bad, banks must absorb heavy losses. That hurts profits. That shakes confidence.

In recent days, Zions Bancorporation disclosed a $50 million loan write-off linked to alleged fraud. Western Alliance also admitted it is suing a borrower over possible fraud: These events stirred panic in credit markets.

Let’s explore how worries about credit fraud exposure are dragging down stocks. We will see how investors, regulators, and banks react. And we will ask: can markets recover if fraud risks are contained?

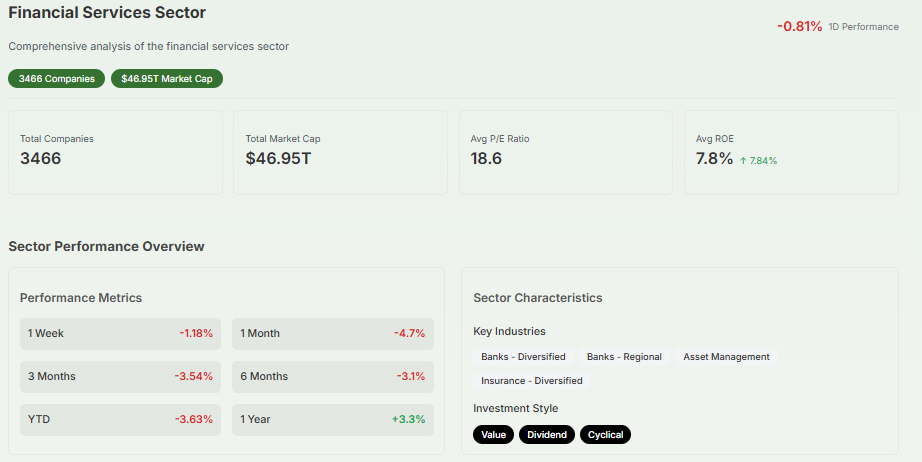

Market Overview: Extent of the Stock Fall

Markets slid sharply on October 17, 2025. U.S. index futures dropped after fresh disclosures about bad and possibly fraudulent loans at regional banks. The SPDR S&P regional banking ETF fell as investors dumped bank shares in premarket trade. Global equity markets felt the shock. European and Asian banking stocks fell on the same day. Gold rose as traders sought safe havens.

Volume surged during the sell-off. The VIX and other volatility gauges spiked. This showed that traders expect more dramatic moves in the near term. Large banks also lost ground, though regional lenders took the worst hits.

Banking Sector Under Scrutiny

Two U.S. regional banks disclosed losses tied to alleged fraud on October 16-17, 2025. Zions Bancorporation reported a $50 million charge-off tied to two bad loans. Western Alliance flagged a loan involving alleged borrower fraud. These announcements came within hours of each other. Markets reacted quickly.

Investors now question how many similar loans exist across the sector. Attention shifted from isolated loan losses to the quality of credit underwriting. Lenders that rely heavily on commercial real estate and private credit look especially exposed. Analysts warned that hidden losses could surface in earnings reports.

About Credit Fraud Exposure

Credit fraud exposure means lenders lose money because borrowers misrepresented facts. This can include fake collateral, inflated revenues, or double-pledged assets. Fraud can be hard to detect. It often appears only after default or through legal action.

Losses from fraud cut into bank capital. That reduces lending capacity. It also raises funding costs. Rating agencies and investors treat fraud-linked losses as signs of weak controls. That can push stock prices lower and increase borrowing costs for affected banks.

Shadow banking and non-bank lenders add complexity. Some borrowers route deals through these channels. Those structures can hide risk and make oversight harder. Regulators have less visibility into these areas. That raises systemic risk if large defaults follow.

Investor Reactions and Market Sentiment

Investors moved to safety quickly. Money flowed into treasuries and gold. Market makers and hedge funds reduced positions in bank stocks. Retail investors followed the selling in many cases. The mood turned defensive.

Exchange-traded funds that track regional banks saw notable outflows. Options activity suggested traders bought puts to hedge further declines. Short interest in some regional bank names rose. The drop in sentiment was broad. It affected lenders, brokers, and firms with private-credit exposure.

Some investors used specialized tools to scan loan tapes and covenant language. An AI Stock Research Analysis Tool helped some firms flag suspicious patterns faster than manual checks. This use of technology increased after the disclosures.

Regulatory and Policy Response

Regulators and central banks watched the situation closely. On October 17, 2025, officials emphasized monitoring credit quality. No major emergency action was announced that day. However, regulators said they would probe loan underwriting and disclosure practices.

Expect calls for tougher audits and more frequent stress tests for banks with large commercial credit books. Some policymakers may push for clearer reporting on exposures to private credit and non-bank intermediaries. That could force banks to disclose riskier loans sooner.

Markets often react to uncertainty about oversight. If regulators move slowly, investor anxiety can persist. Rapid, transparent audits tend to calm markets. Delays tend to amplify fear.

Broader Economic Implications

If fraud-linked losses spread, banks could tighten lending. Tighter credit would hit businesses that rely on bank loans. Small and medium firms could face higher borrowing costs. This could slow investment and hiring.

Commercial real estate could come under stress if lenders cut new loans. Housing markets might feel indirect effects through higher mortgage spreads. Corporate bond markets could also see higher yields if banks reduce market-making activity. These ripple effects can slow growth.

Global investors may reprice risk for other financial sectors. Cross-border flows could slow. Emerging markets that depend on external financing could face tighter conditions. The full economic impact depends on how widespread and deep the credit losses become.

Expert Opinions and Market Outlook

Analysts gave mixed views on October 17, 2025. Some said the losses are isolated and manageable. Others warned of deeper problems in shadow lending and off-balance-sheet financing. The split reflects uncertainty about how many loans could be affected.

Short-term outlook: more volatility likely. Earnings reports and loan-by-loan disclosures will matter. Markets will watch new filings from banks and legal actions tied to borrower fraud.

Long term: if controls tighten and regulators act fast, stability can return. If problems spread, the recovery will take longer.

Wrap Up

The October 16-17, 2025 disclosures by Zions and Western Alliance shook markets. The event highlighted risks in credit underwriting and shadow lending. Investors moved to safety. Regulators signaled closer scrutiny. The coming weeks will show if losses are isolated or systemic. Markets will follow loan disclosures, bank earnings, and regulatory steps closely. Quick, clear reporting will help restore confidence.

Frequently Asked Questions (FAQs)

Bank stocks are falling because, on October 17, 2025, reports showed some regional banks faced losses from credit fraud, causing investors to worry about more hidden risks.

Credit fraud exposure hurts trust. It reduces bank profits and increases fear among investors. This often leads to quick stock sell-offs and higher market uncertainty.

On October 16-17, 2025, Zions Bancorporation and Western Alliance reported loan losses linked to fraud. Their announcements triggered broader declines in other regional bank stocks.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.