Stock Market Live: Sensex up 650 points, Nifty Bank leads the rally amid positive global cues

The Indian stock market started the week with a strong rally. This showed rising confidence among investors. On October 17, 2025, the Sensex gained over 650 points, and the Nifty Bank index led the move with solid gains in major banks. This rally was not random. Global markets were positive as inflation cooled and hopes of interest rate cuts increased.

Strong signals from the U.S. and Asian markets lifted local sentiment. Domestic economic data stayed stable, adding more support. Investors bought banking, financial, and IT stocks, showing a shift back to growth sectors. More stocks gained than fell, which proved that market momentum was healthy.

The rally came after weeks of market swings when traders were unsure. The strength of Nifty Bank showed that big investors believe credit demand will rise and asset quality will remain stable. Overall, the market’s move reflects a blend of global recovery and local strength, creating hope for more upside ahead.

Key Market Highlights of the Day (Oct 17, 2025)

The market turned bullish on October 17, 2025. The BSE Sensex climbed strongly intraday and ended higher. The NSE Nifty50 also rose and moved toward recent highs. Bank stocks led the gains as the Nifty Bank index hit fresh levels. Trading activity showed broad participation across large- and mid-cap names. These moves came after positive cues from global markets and encouraging domestic data.

Why the Sensex Jumped?

Several factors combined to push the Sensex up. Global markets traded mostly positively, lifting risk appetite. Market participants reacted to signs of easing inflation pressure abroad and hopes of a slower pace in policy tightening. Domestic inflows from mutual funds and strong buying by some institutional players added fuel. Corporate earnings news and sector-specific strength also helped sustain the rally. Reuters and Business Standard captured the main drivers and timing of the move on October 17.

Nifty Bank Leads the Rally: What Drove the Banks?

Banking stocks outperformed on optimism about credit growth and stable asset quality. Traders priced in better profit prospects ahead of big banks’ earnings. A mix of good quarterly updates from some lenders and positive brokerage notes pushed buying into the sector. That lifted the Nifty Bank to fresh highs on October 17, signaling strong sector momentum. Analysts tracking bank fundamentals cited improving credit demand as a key reason.

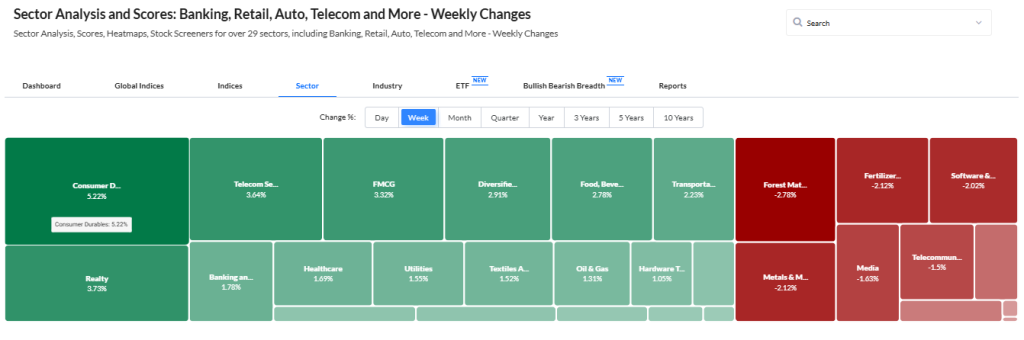

Sectoral Performance Overview

Banking and financials were the day’s star performers. Consumer goods, automobiles, and some industrial names also posted gains. Information technology stocks lagged, as profit margin worries and specific company updates weighed on the segment. Mid-cap names showed mixed action, with pockets of strength in cyclical plays and select industrial stocks. Market breadth favored advancers over decliners for most of the session.

Global Cues Supporting Indian Markets

U.S. markets and other Asian bourses provided a positive backdrop on October 17. Traders reacted to softer inflation prints and commentary from major central banks. That eased fears about aggressive rate hikes. Asian market movements were mixed, but the overall tilt was supportive for risk assets. The global mood helped foreign portfolio investors moderate selling and, in some pockets, buy back positions.

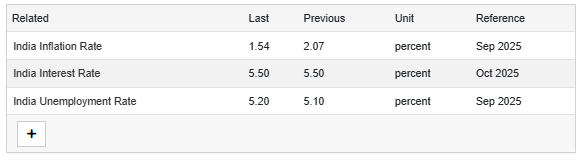

Domestic Macroeconomic Drivers

Domestic data and corporate results added local support. Recent GDP and PMI reads showed steady activity, which reduced some growth worries. Oil prices were stable to lower for the session, helping sentiment for rates and inflation. The rupee’s movement was calm and did not upset flows. Analysts noted that a balanced macro picture allowed markets to focus more on earnings and sector stories.

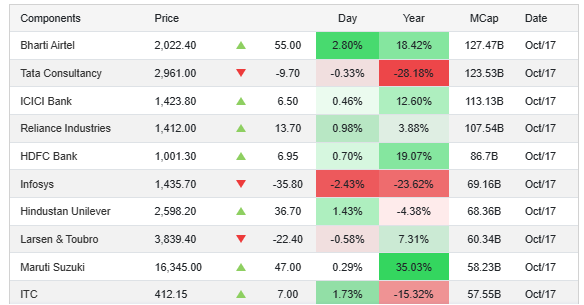

Top Gainers and Losers of the Day

Large private banks and some financial names were among the top gainers. Reliance Industries showed resilient moves ahead of its results and helped the headline indices. IT names such as Infosys and Wipro underperformed and trimmed some of the index gains. Small pockets of profit-taking appeared in stocks that had run up earlier in the week. Live market feeds and closing reports list the day’s biggest movers.

Investor Sentiment and Market Participation

Trading data showed strong retail and domestic mutual fund participation. Foreign institutional flows were mixed but less negative than in prior sessions. Option chain and F&O activity indicated bullish bias in near-term contracts. Market breadth and volume patterns supported the view that the rally had genuine participation and was not limited to a handful of heavyweights. The NSE and Moneycontrol live feeds provide daily FII/DII snapshots.

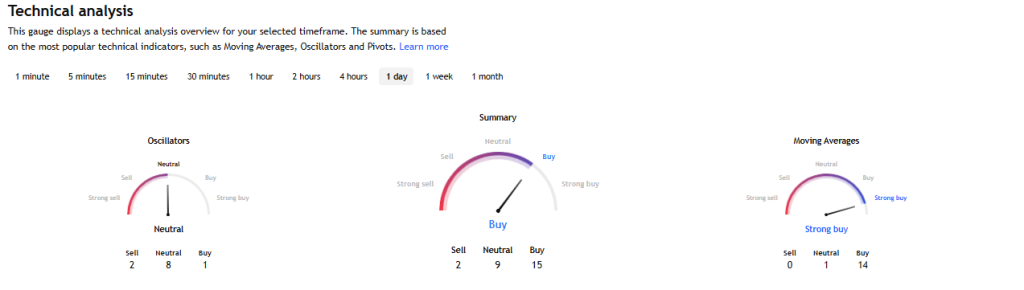

Technical Analysis Snapshot

From a technical view, headline indices cleared near-term resistance on intraday moves. Key moving averages held as support in many cases. Bank Nifty’s breach of previous peaks is a positive technical sign for sector rotation. Momentum indicators suggested room for more upside, but overbought readings could bring periodic pullbacks. Short-term traders may watch support levels closely for entry and exit signals.

Expert Views and Risks to Watch

Analysts applauded the healthy breadth but pointed to risks. Geopolitical tensions, a sudden spike in crude, or a surprising inflation print could reverse sentiment. Earnings from major banks and corporates over the next few sessions will be closely watched. Some experts recommended selective buying and proper risk limits. The phrase AI stock research analysis tool appeared in some research notes as brokers used tech-driven models to filter names during the run.

What does This Rally mean for Investors?

Short-term traders may find opportunities in bank and cyclical stocks. Long-term investors should focus on quality companies with clear earnings growth. Diversification remains important, as rallies can correct. Monitoring earnings and macro updates will help in deciding whether to hold, add, or trim positions. Use a clear plan and risk limits rather than chasing one-day gains.

Near-Term Outlook

The market may extend gains if domestic earnings meet estimates and global inflation trends stay tame. Watch key events in the coming days, including major bank earnings and any central bank signals. If selling pressure appears, support zones around recent moving averages will be important. Overall, sentiment looks constructive as of October 17, 2025, but caution is advised.

Final Thoughts

The market’s strong rally on October 17, 2025, reflects a powerful mix of global optimism and domestic strength. The Sensex crossing 650 points and Nifty Bank leading the charge signal growing confidence in economic recovery, credit demand, and earnings stability. However, the rally is not just momentum; it is backed by improving data, steady inflows, and strong sector rotation.

Still, investors must stay alert to risks like global rate decisions, oil price swings, and upcoming earnings. If key banks and large-cap companies deliver strong results, the market could move to new highs. This rally offers opportunity, but smart strategy, disciplined entry levels, and focus on fundamentally strong stocks will decide long-term success.

Frequently Asked Questions (FAQs)

The Sensex rose over 650 points on October 17, 2025, due to strong global markets, cooling inflation hopes, and heavy buying in banking and financial stocks.

Major private and public banks like HDFC Bank, ICICI Bank, and SBI led the Nifty Bank rally with a strong earnings outlook and rising credit demand on October 17, 2025.

The market may continue to rise if global inflation stays low, earnings remain strong, and investor confidence holds, but sudden rate or geopolitical changes can slow momentum.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.