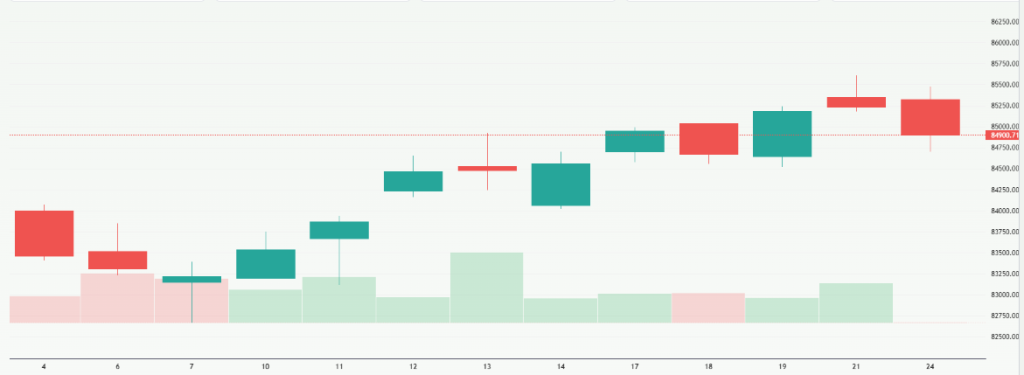

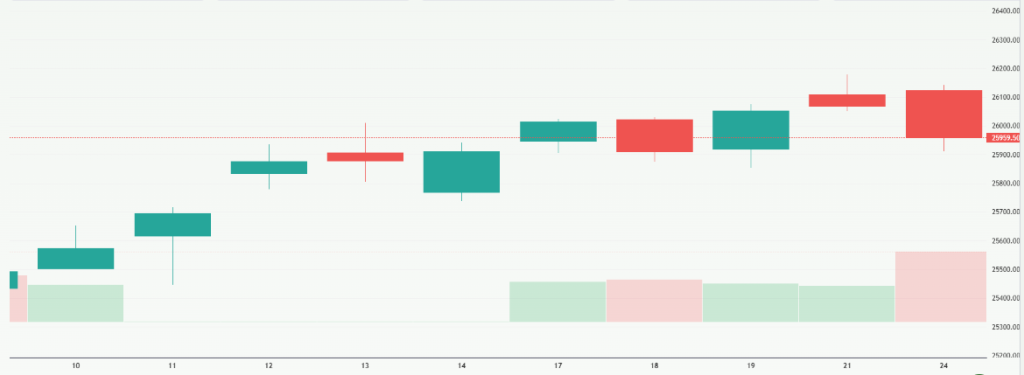

Stock Market Today, Nov 25: Sensex Near 84,800 as Nifty50 Opens in Red

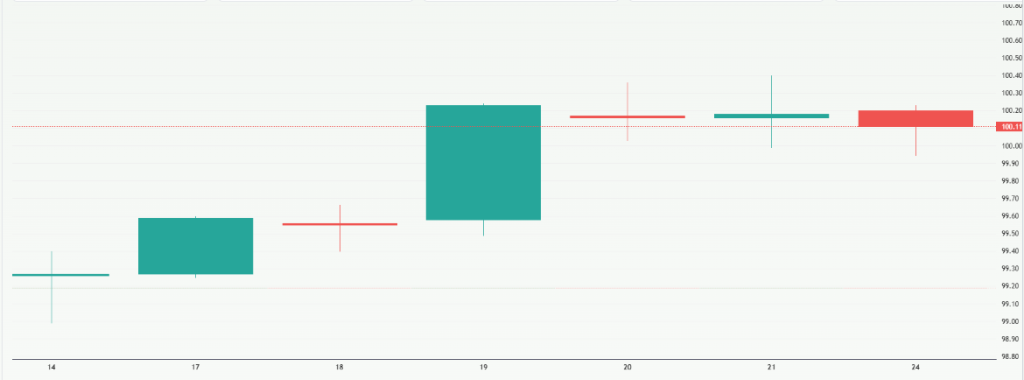

The stock market opened with mixed signals on November 25, 2025. The Sensex moved close to the 84,800 mark, showing early strength. But the Nifty50 started in the red, which shows that investors are still careful. This split trend tells us that the market is watching many different forces at the same time. Global markets are not steady. Oil prices are rising again. The dollar index is also strong. All of this affects the trading mood in India.

At the same time, local factors matter too. Investors are waiting for new economic updates. They are also watching foreign fund flows, which have been changing a lot this month. Some sectors are doing well, but others are under pressure. Because of this, the market is jumping between gains and losses in the early hours.

Today’s session is important because it may set the tone for the week. Traders want clear signs. Long-term investors want stability. This mix creates a tense but active start to the day.

Morning Market Snapshot

The market opened with mixed signals on November 25, 2025. The BSE Sensex traded close to 84,800 in the early hours. The Nifty50, however, started in the red and slipped below the 26,000 mark during the morning session. Trading began with low conviction.

Investors reacted to global cues and domestic flows. Volatility was visible across large-cap names and midcaps. The split between Sensex strength and Nifty weakness showed selective buying rather than broad market optimism.

Key Drivers Influencing Today’s Market

Global markets set the tone. Comments from Federal Reserve officials increased bets on a December rate cut. That hope pushed U.S. indexes higher on November 24 and helped Asian equities early on November 25. Traders used that as a reason to take fresh positions in some sectors. Yet risk was balanced by mixed corporate news and sector rotations.

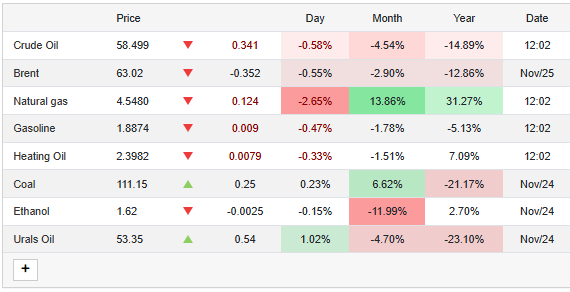

Crude oil moved in a narrow band. Slight declines in oil eased pressure on energy importers. That provided limited relief to the rupee and some consumer-linked stocks. The dollar index stayed firm, which kept pressure on certain export plays.

Domestically, foreign portfolio flows mattered. FPIs have shown mixed activity through November. Some recent reports show continued net buying in equities for the week ended November 21. At the same time, tech sector outflows persisted, driven by profit booking from foreign funds. These flows shaped sector-level moves on November 25.

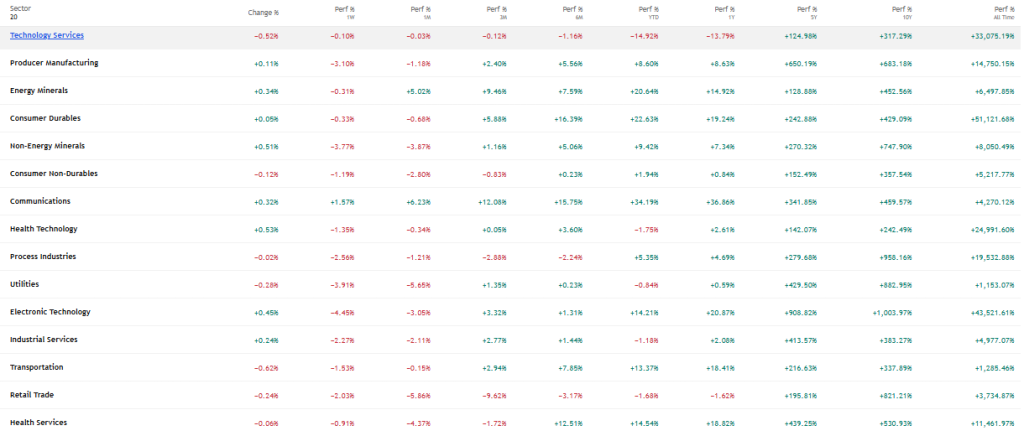

Stock Market Sector-wise Performance

Banking and financials opened unevenly. Large private banks saw steady demand. State-owned banks had mixed trading sessions. The energy patch reacted to oil movement. Consumer stocks showed resilience in early trades. IT names faced selling pressure. That selling followed continued FPI exits from the software space this month. Metals and capital goods showed episodic gains on stock-specific triggers. Overall, sector returns leaned toward selectivity rather than broad leadership.

Mid-cap and small-cap segments began the day with higher intraday swings. Some midcaps outperformed due to company-specific news. Other names drifted lower as traders pared positions. Market breadth at the open was mixed, with roughly equal numbers of advancers and decliners in the first hour.

Major Gainers and Losers of the Stock Market

Several large-cap names showed sharp moves. Reports during the morning highlighted stocks like Hindalco, Bharat Electronics, and State Bank of India among early gainers. Gains were tied to fresh flows and positive sector sentiment. On the flip side, major IT names led the losers. Heavy volumes in Infosys, HCL Tech, and similar names pushed the Nifty downward in the first half. These moves reflected profit booking and FPI sector rotation.

Intra-day momentum also surfaced in a few cyclical names. Traders reacted to broker notes and recent quarterly trends. Sudden block deals and asset re-rating chatter amplified moves in select midcaps. That made intraday patterns harder to predict.

Market Expert Commentary

Market experts shared mixed but cautious views on November 25, 2025. Vatsal Bhuva, Technical Analyst at LKP Securities, noted that Nifty could see a deeper pullback if it closes below the 10-day EMA at 25,950, which may drag it toward 25,850. Shrikant Chouhan, Head of Equity Research at Kotak Securities, said sentiment will likely stay weak as long as the index trades below 26,000, adding that Nifty may slip toward the 25,900-25,850 zone. Broader outlooks were also conservative.

Rakshit Ranjan, Co-founder of Marcellus Investment Managers, said the next market rise will be “selective,” with leadership shifting to specific sectors rather than a broad-based rally, while cyclicals and some financials appear less attractive at current levels. These views reflect a cautious market where traders watch intraday levels closely, and investors wait for clearer economic signals.

Impact of Global Commodities

Crude oil trends influenced specific pockets like airlines and oil-marketing firms. A mild dip in oil prices reduced immediate input cost pressure for fuel-dependent sectors. Gold remained a safe-haven reference point, yet it did not dominate trade flows on November 25. The dollar’s firmness limited gains in export-heavy names and put mild pressure on rupee-sensitive companies. Overall, commodities nudged market sentiment but did not drive a broad directional trend.

Rupee Movement and FPI Activity

The rupee showed modest recovery in early trade on November 25. Spot quotes moved toward the low-89s versus the U.S. dollar. The recovery followed RBI intervention signals and softer crude trends. Still, the currency remained volatile after recent swings close to the 90 mark. Traders kept an eye on any further central bank action.

Foreign portfolio flows were mixed in November. Net buying was visible at a weekly level, while sectoral flows favored certain non-tech pockets. Continued IT outflows and selective purchases in financials and cyclicals were key features. These patterns shaped index behavior during the morning session on November 25. Data from the NSDL and exchange trackers confirmed this mixed flow picture.

What Investors Should Watch Today?

Traders should monitor support and resistance zones for the Nifty and Sensex. Near-term resistance sits around the prior intraday highs near 26,200 for the Nifty. Immediate support holds in the 25,800-25,900 band, where buyers may re-enter. Watch for any major data print or corporate announcements that could widen intraday moves. Also track FPI headlines and U.S. inflation-related updates. The market may react sharply to shifts in Fed expectations. Use of an AI tool for quick data scans can help intraday decision-making.

Keep an eye on names scheduled to report earnings or reveal guidance. These companies often lead intraday sector moves. Block deals, promoter activity, and regulatory updates can also cause sharp stock-level swings. Finally, monitor crude and currency trends. They remain reliable background drivers for the Indian market.

Wrap Up

Stock market action on November 25, 2025, opened with mixed signals. Sensex neared 84,800, while Nifty began in the red. Global rate hopes lent some support. Yet sector rotation and FPI moves created selective weakness. Traders should expect choppy intraday trade. Longer-term investors must focus on company fundamentals and upcoming data. Watching flows, currency, and crude will remain crucial through the day.

Frequently Asked Questions (FAQs)

Nifty50 opened in the red on November 25, 2025, because global markets were mixed, foreign investors were cautious, and early selling in big IT stocks pulled the index lower.

The Sensex moved close to 84,800 on November 25, 2025, as strong buying in major banking, metal, and consumer stocks helped support early trade and lifted overall market mood.

On November 25, 2025, banking, consumer, and metal sectors showed strength due to steady demand. The IT and pharma sectors lagged because traders booked profits and waited for new updates.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.