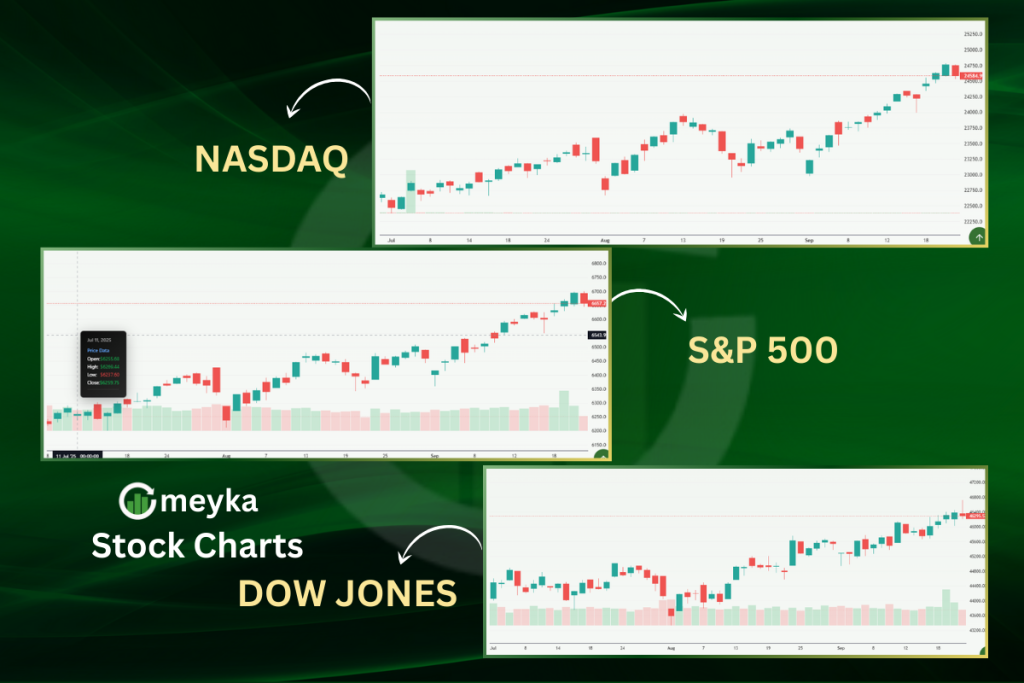

Stock Market Today (US): Dow, S&P 500, Nasdaq Futures Rise Ahead of Fed and Tech Earnings

Major U.S. stock market futures opened higher as traders priced in expected Federal Reserve rate cuts and awaited key tech earnings. The Dow futures, S&P 500 futures, and Nasdaq futures all showed gains, driven by the prospect of easier monetary policy and strong tech sector momentum.

Investors watched Microsoft, Meta, and Alphabet as those results could set the tone for the week.

Why is the market moving now, and what should traders watch next? The answers are below with clear takeaways for U.S. investors.

Stock Market snapshot: futures and early movers

Futures tied to the Dow rose meaningfully, while S&P 500 futures and Nasdaq futures climbed ahead of today’s open. Technology names led premarket strength, as traders expected the Federal Reserve to signal more easing after recent cooling in labor market data.

Why the optimism? Markets are pricing a higher chance of Fed rate cuts and calmer US-China trade chatter.

Federal Reserve expectations and market implications

The Federal Reserve’s upcoming decision is central to this move. Economists and traders expect another 25 basis point reduction in the federal funds rate, following the central bank’s earlier cut in September.

Lower rates generally support higher stock valuations, especially for growth and technology companies.

What will investors watch at the Fed meeting? They will look for language on future rate cuts and guidance on economic data that could change policy timing.

Why is the market rising today? Traders anticipate an easier policy and a clear path for earnings to improve as borrowing costs decline.

Stock Market drivers: tech earnings and corporate reports

Big tech earnings are front and center. Microsoft (MSFT), Meta, and Alphabet (GOOG) will report results that could swing markets. Strong revenue and margin beats from these firms often lift the whole market, while disappointments can weigh heavily on indexes.

Analysts will focus on cloud growth, ad revenue trends, and AI-related spend.

How could tech earnings affect the broader market? Solid results could validate higher multiples across the S&P and Nasdaq, while weak guidance may prompt profit-taking.

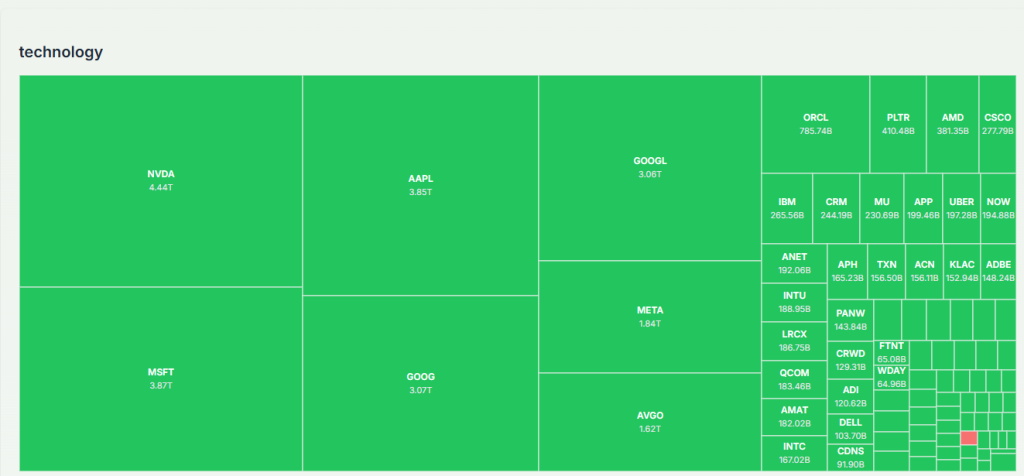

Sector performance and premarket movers

Technology was the top premarket sector. Financials and industrials showed mixed signals, as rate cut expectations help borrowing-sensitive stocks but also compress bank net interest margins.

Consumer discretionary names moved in response to retail data and confidence readings. Energy lagged slightly amid stable oil prices.

Which sectors benefit most from rate cuts? Growth and tech names typically benefit the most, while banks and insurers may face margin pressure.

Stock Market and global cues: China and trade flows

Global cues also matter. Signs of easing in US-China relations boosted risk appetite. Asian markets rallied on optimism over trade talks and supply chain normalization. That global lift fed into U.S. futures, as multinational firms rely on smoother trade for revenues.

Is the China angle decisive? It is a strong sentiment driver; any sudden escalation would reverse risk appetite swiftly.

Market sentiment, social echoes, and expert comments

Investor sentiment showed a bullish tilt. On social platforms, traders flagged optimism and shorter-term positioning changes. For example, a market commentator noted positive momentum in futures, while crypto observers and market analysts shared bullish premarket threads.

These social signals mirror institutional positioning ahead of earnings and the Fed. Embed tweets naturally from market voices to capture live sentiment:

Mark Cullen on premarket moves:

Crypto market reaction and sentiment:

Analyst view on tech earnings pressure:

A regional market update tying global flows to U.S. futures:

What are traders posting about? Many highlight the Fed timeline, while others focus on whether tech earnings will confirm resilient demand for AI and cloud services.

How AI and research themes are shaping investor decisions

AI is an active theme in earnings calls and analyst models. Firms that show durable AI revenue streams are receiving premium valuations. Institutional research on AI sector winners is driving flows into chipmakers and cloud providers. For investors seeking deeper analysis, consider reading focused AI Stock research reports that blend product adoption metrics with revenue implications.

How to use AI themes in stock selection? Look for companies with recurring revenue streams from AI, strong cloud partnerships, and visible customer traction.

Trade strategies and volatility considerations

Traders should prepare for volatility. Earnings from major tech companies can produce sharp intraday moves. A balanced approach is prudent: use protective sizing, watch for earnings surprises, and monitor the Fed’s tone.

Options traders may find value in volatility plays around earnings, while longer-term investors should weigh fundamentals against macro shifts.

What are investors watching next? Earnings beats or misses from Microsoft, Meta, and Alphabet, plus the Fed’s forward guidance on cuts and labor market data.

tock Market outlook: near term and what to watch

In the near term, the Stock Market outlook depends on three items: Fed signals, tech earnings, and global trade narratives. If the Fed signals a clear sequence of cuts and tech reports beat expectations, the rally may broaden beyond large-cap growth. Conversely, cautious guidance or renewed trade tensions could curb gains.

Key data points and calendar risks

- Fed decision and minutes, focus on forward guidance

- Microsoft, Meta, Alphabet earnings and guidance around cloud and ads

- US labor market prints and inflation readings that influence rate expectations

Will the market rally continue? It depends. Earnings strength and clearer Fed easing increase the odds, but unexpected data or weak guidance could stall momentum.

Conclusion

U.S. stock market futures rose as traders bet on more Fed easing and looked to major tech earnings for confirmation. The week’s moves will hinge on Fed language, Microsoft, Meta, and Alphabet results, and how global trade sentiment evolves.

For now, momentum favors risk assets, but volatility around earnings and policy events remains likely. Keep watch on the Fed’s guidance, tech earnings surprises, and real-time market flows to navigate the days ahead.

FAQ’S

U.S. stock futures are climbing as investors expect the Federal Reserve to hint at more rate cuts while awaiting strong earnings from major tech firms like Microsoft, Meta, and Alphabet.

Traders are focused on the Fed’s policy decision, tech sector earnings, and new economic data that could shape interest rate expectations and market direction.

Rate cuts generally boost stock prices by lowering borrowing costs, supporting business growth, and increasing investor appetite for equities.

Technology and growth-oriented sectors are leading as optimism around AI and cloud-related earnings drives investor confidence in big tech stocks.

That depends on the Fed’s tone and tech earnings results. If both are positive, the rally may extend, but cautious guidance could slow momentum.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”