Stock Market Update 8 Oct: Futures Edge Higher While Gold Hits Record $4,000

Futures in the United States opened slightly higher as traders parsed mixed signals from corporate earnings, economic data, and central bank chatter. At the same time, gold jumped to and briefly topped $4,000 an ounce, a record level driven by safe-haven demand and geopolitical uncertainty.

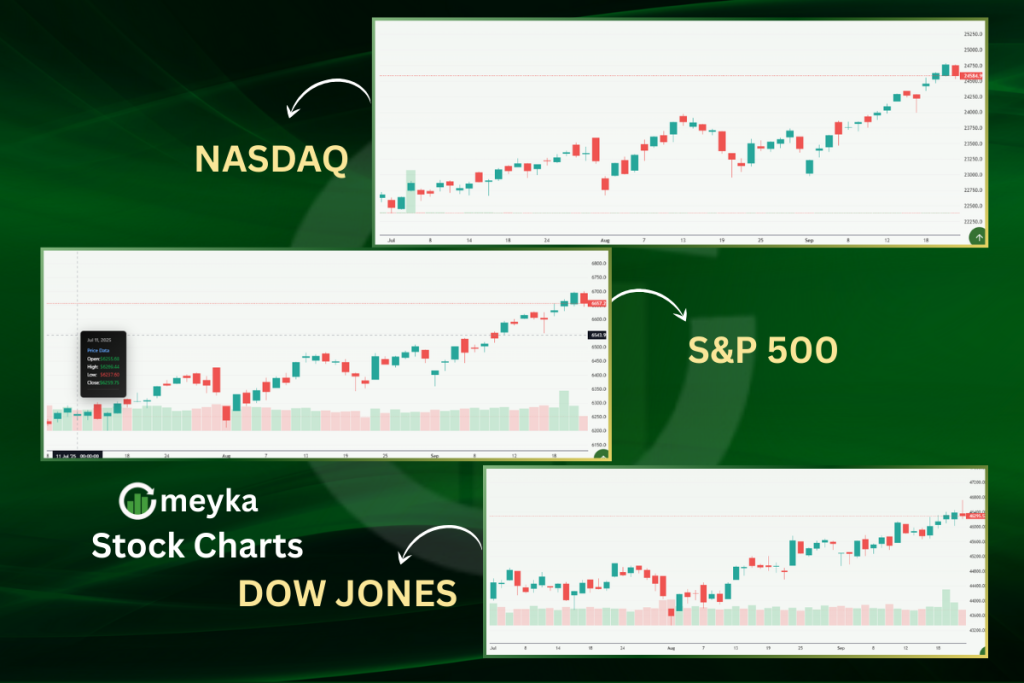

This day’s moves reflect a tug of war between optimism about rate cuts and worries about global political risks. Stock Market Update 8 Oct captures early gains in Dow, S&P, and Nasdaq futures, the dramatic gold rally, and how markets in Asia and Europe are reacting.

Stock Market Update 8 Oct: Futures and Stock Indices Overview

Global stocks edge higher as investors weigh inflation data

U.S. futures ticked up modestly in the pre-market, pointing to a cautious open for the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite.

Tech names showed mixed strength, while cyclical sectors paused for breath. Markets are pricing in the possibility of Fed rate cuts later in the cycle, but investors remain wary about near-term shocks.

U.S. market futures gain amid cautious optimism

Early futures gains were led by selective buying in large-cap names. Traders cited ongoing optimism that the Federal Reserve will move to ease policy later; however, the path remains uncertain because of inflation prints and global political headlines. Short-term trading looks cautious, long-term positioning remains tilted to risk on if rate cuts materialize.

What should traders watch today? Watch headline inflation data, key earnings, and any Fed commentary; those will move the S&P and Nasdaq more than overnight chatter.

Stock Market Update 8 Oct: Gold Price Hits $4,000 Record

Gold price surge, what’s driving the $4,000 record

Gold surged past $4,000 per ounce as investors sought safety amid political tensions and uncertainty about fiscal outlooks.

The move reflects demand for safe-haven assets as bond yields soften and risk premiums rise. Commodities desks noted increased flows into futures and ETFs that track bullion.

Why is gold rising so fast? Because of a mix of geopolitical risk, expectations for lower real yields, and flows into safe-haven stores of value. Markets often bid gold when central bank policy is expected to ease and when geopolitics creates uncertainty.

Notable market voice: a timely post from GoldSeek highlighted the historic moment as traders watched bullion climb toward psychological and technical resistance.

Stock Market Update 8 Oct: Global Market Reactions

Asian and European markets reflect mixed sentiment

Asia opened with mixed returns, as investors digested U.S. futures, local earnings, and regional politics. The Nikkei and Shanghai Composite showed selective gains while the Hang Seng was more tentative.

In Europe, stock indices were subdued as investors reacted to political headlines and the strong gold rally. Bond markets moved too, with benchmark yields pulling back in some regions.

Oil, bonds and broader commodities

Oil prices were relatively steady, with traders noting supply signals from producers and demand data from major economies.

Lower bond yields helped the gold case, as real yields fell and made non-yielding bullion more appealing. Commodities are acting as a barometer for risk, with gold signaling caution.

Does a big move in gold mean stocks will fall? Not always; sometimes gold and stocks can rise together if inflation fears ease. In this case, rising gold reflects fear, which can pressure risk assets if uncertainty persists.

Stock Market Update 8 Oct: Investor Sentiment and Economic Outlook

Economic outlook and investor confidence going forward

Investors are balancing hopes for Fed easing against short-term risks. Softening yields and a resilient jobs market create an ambiguous mix. Many strategists say the market needs clear signs on inflation to confirm a sustainable rate cut path. That uncertainty helps explain why safe-haven flows into gold accelerated today.

Analysts from commodities desks and macro teams flagged political events and central bank windows as the dominant forces shaping risk appetite this week.

Stock Market Update 8 Oct: Tweets and Market Voices

Market commentary surfaced across social media and analyst feeds as the day progressed. A note from a market commentator captured the split view between tech optimism and safe-haven flows: see

Another analyst highlighted broader market calm, even as gold screamed higher, pointing to localized pockets of volatility:

Regional voices added context, noting that local currency moves and sovereign news are feeding the global narrative:

Stock Market Update 8 Oct: Outlook for the Week

What traders should watch next?

Keep an eye on inflation prints, Fed speaker calendars, and several corporate earnings reports. Geopolitical developments will also matter; further escalation could reinforce flows to gold and weigh on equity confidence. For traders, the combination of macro data and risk headlines will set near-term volatility.

What does this mean for long-term investors? Long term, fundamentals and earnings performance will matter most. Use this period to review exposure to safe-haven assets and consider rebalancing if allocations feel overweight to high beta positions.

Stock Market Update 8 Oct: Conclusion

Today’s action shows a market that is not yet fully committed. Futures edged higher, signaling cautious optimism about growth and rate policy. At the same time, gold’s record near $4,000 signals a strong hedge demand and real concern about global risks.

Short-term traders should monitor data and headlines closely, while longer-term investors should weigh portfolio diversification, inflation hedges, and earnings momentum. This Stock Market Update 8 Oct matters to traders and investors because it highlights how fragile optimism can meet powerful safety-seeking flows.

FAQ’S

The Stock Market Update 8 Oct showed gains driven by strong tech earnings and easing inflation concerns. Investors reacted positively to signs of stable U.S. bond yields and resilient consumer demand.

During the Stock Market Update 8 Oct, shares of major tech firms like Nvidia, Apple, and Microsoft led the gains, while energy and healthcare sectors also saw moderate growth across global indices.

In the Stock Market Update 8 Oct, Asian markets remained mixed as investors tracked Wall Street’s overnight performance. Japan’s Nikkei advanced slightly, while Chinese and Hong Kong stocks faced mild pressure.

Key factors highlighted in the Stock Market Update 8 Oct include upcoming inflation data, corporate earnings, and central bank policy signals that could shape short-term investor sentiment.

The Stock Market Update 8 Oct suggests early signs of stabilization, supported by cautious optimism over U.S. economic resilience and hopes of a soft landing for major economies.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.