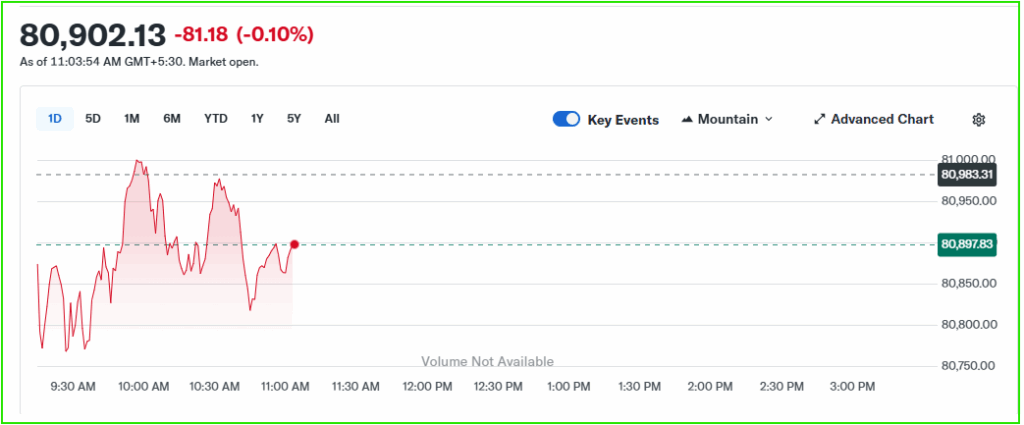

Stock Market Update: Sensex, Nifty Struggle for Direction Amid Volatile Trade

The Sensex and Nifty struggled for direction in a volatile session as global cues mixed with domestic policy talk. Traders moved between risk-on and risk-off flows. Early gains faded, and indexes traded in a narrow band for much of the day.

The cautious mood came after mixed global signals and domestic headlines that left investors undecided. Volatility hit both large caps and midcaps, and intraday ranges widened on breaking headlines. Longer-term investors stayed patient, while traders looked for clear catalysts.

Sensex and Nifty Market Overview

Early Trade Movements and Opening Trends

Early trade showed modest moves, with the BSE Sensex barely changed and the Nifty50 holding around intraday levels. Some heavyweight stocks led the choppiness as markets reacted to company news and global headlines.

Profit taking in select pockets trimmed gains. Volume patterns suggested low conviction among traders.

Why is the Sensex struggling today?

Mixed global cues, earnings, and policy talk have kept buyers and sellers split.

Key Sectors Dragging and Supporting Indices

Financials and IT stocks showed mixed performance. Energy and materials faced pressure, while consumer names offered support. Sector rotation kept volatility high, as investors favored safety in certain segments and risk in others. Midcap action was uneven, reflecting selective buying.

Global Cues Influencing the Sensex

US Market Performance and Federal Reserve Signals

Wall Street moves set an early tone, with US indices showing caution after data and Fed comments. Traders watched for rate signals and tariff talk that could hit trade flows. Global risk appetite wavered, and that fed into Indian markets. Economic surprises abroad can quickly change flows into emerging markets.

Will US data sway Indian markets further? Yes, strong US data or hawkish Fed talk can tighten risk appetite and weigh on the Sensex.

Asian Markets and Global Risk Sentiment

Asian bourses traded mixed, reflecting uncertainty about economic growth and trade. Regional sentiment matters because flows between Asia and India can change fast on headlines. That volatility translated into choppy trading for Indian indices. Emerging Asia moves often set the tone for Mumbai.

Domestic Factors Shaping Sensex Mood

RBI Monetary Policy and Interest Rate Speculation

Investors watched comments around RBI policy and the repo rate. Any hint of hawkish bias or liquidity tightening can pressure markets, while a dovish tone can lift risk assets. The RBI conversation is a near-term focus for traders. Statements around liquidity management are also being read closely.

Will the RBI decision affect Sensex further? Yes, changes in policy outlook can shift sector leadership and market direction quickly.

Political and Economic Triggers in India

Domestic headlines, corporate actions, and economic data all played a role. Election talk and trade policy were in the background. These triggers can accelerate moves when global sentiment is fragile. Keep an eye on fiscal signals and major corporate announcements for sudden shifts.

Investor Reactions and Sensex Sentiment

Institutional Investors and FII Flows

Foreign institutional investor flows were cautious, with mixed inflows and outflows across the session. Institutions scanned global cues and domestic signals before adjusting positions. Their moves influenced liquidity and price action. Large block trades reflected repositioning ahead of policy cues.

Retail Investors’ Cautious Moves

Retail traders showed hesitance, trimming exposure after intraday swings. Many are waiting for clearer catalysts before committing larger positions. This caution added to the low conviction in either direction. Some retail traders monitored AI Stock for sentiment signals.

Social Media Buzz

Traders posted live reads and technical calls on social platforms. See these trader tweets for quick market sentiment updates:

Media Coverage and Sensex Analysis

Reports from Times of India, MyFXBook, and Finimize

Major outlets noted the lack of a clear trend, with some highlighting a late-day recovery on select sessions. The Times of India reported a rally in the Nifty50 to end above intraday levels after volatility, while MyFXBook flagged early choppiness.

Finimize framed the session in the context of a souring global mood. Journalists stressed the link between global headlines and local flows.

Market Experts’ Take on Short-Term Outlook

Analysts said markets may remain range-bound unless a clear macro cue emerges. They advised watching global rates, RBI statements, and quarterly results for direction. Some teams used AI Stock research to scan reams of data for leading indicators. Others ran AI Stock Analysis to stress test portfolios.

Broader Outlook for Sensex and Nifty

Near-Term Predictions and Volatility Risks

Short term, analysts expect choppy sessions with a bias to follow global headlines. Volatility may persist until major data or policy clarity arrives. Traders should manage risk and use tight stops when momentum fades. Technical levels remain important for day traders.

What Traders Should Watch Next

Key triggers include US economic releases, RBI commentary, corporate earnings, and any trade policy updates. Also watch liquidity, FII flows, and sector leadership for early signals. The YouTube market brief offers a visual recap of today’s moves:

Also monitor the global macro calendar, commodity moves, and currency swings, as rupee shifts can sway exporters and importers and tilt the Sensex direction.

What should investors watch for tomorrow? Look for global cues and any RBI-related updates, plus corporate news that can swing sector performance.

Conclusion

The Sensex and Nifty are taking cues from both global markets and domestic headlines, which have left them struggling for a clear direction. Investors should expect more volatility and watch key policy and earnings triggers closely.

Use risk management and monitor flows for clearer trend signals. Stay alert, and let confirmed data guide positions. Expect quick moves around major data.

FAQ’S

The stock market is volatile due to global economic uncertainty, interest rate hikes, geopolitical risks, and fluctuating foreign investor flows.

Nifty and Sensex are benchmark indices that reflect overall market sentiment. Their movement influences investor confidence and trading patterns.

The Indian market may crash due to weak global cues, heavy foreign outflows, poor earnings, or concerns about inflation and growth.

The 10 am rule suggests that the first hour of trading sets the market tone. Many traders wait until after 10 am to avoid early volatility.

The 7% rule means cutting losses if a stock falls 7% below the purchase price. It helps traders manage risk and protect capital.

Emerging markets like India, Brazil, and Turkey are often more volatile compared to developed markets due to global and local uncertainties.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.