Strong NVDA Earnings 2nd Quarter FY26 Clouded by Export Curbs, Valuation

Nvidia has become the heartbeat of the global AI race. In the earnings of the 2nd Quarter of fiscal year 2026, the chipmaker once again posted strong results. Revenue and profits rose sharply, fueled by massive demand for advanced AI and data center chips. Wall Street had high expectations, and Nvidia still managed to deliver.

Yet, the story is not as simple as numbers on a chart. We see a company at the top of innovation, but caught in the middle of global politics. U.S. restrictions on chip exports to China now create real risks. Investors also debate whether Nvidia’s sky-high valuation can keep pace with growth.

As we look closer, we find a mix of strength and uncertainty. The company’s data center business leads the charge, while gaming and automotive add steady support.

At the same time, export curbs and competition raise questions. Let’s find out how Nvidia’s Q2 earnings highlight both opportunity and challenge, and what this means for the road ahead.

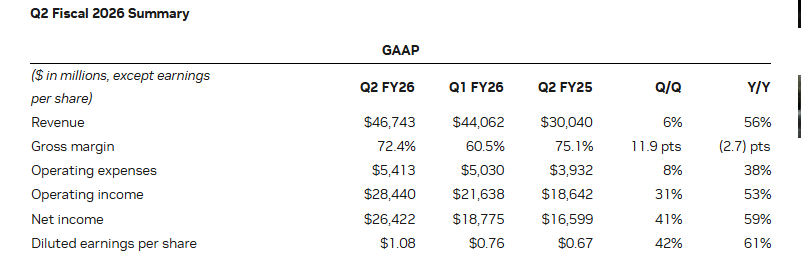

Nvidia’s Earnings 2nd Quarter: FY26 Highlights

Nvidia reported revenue of $46.7 billion for the 2nd Quarter ended July 27, 2025. That was up 56% year-over-year and slightly above most analyst estimates. Earnings per share also beat expectations. Gross margins expanded as sales of high-end data center chips rose. The company noted sequential growth in its Blackwell data center line. Still, some key figures fell short of the extreme market hopes that had been priced into the stock.

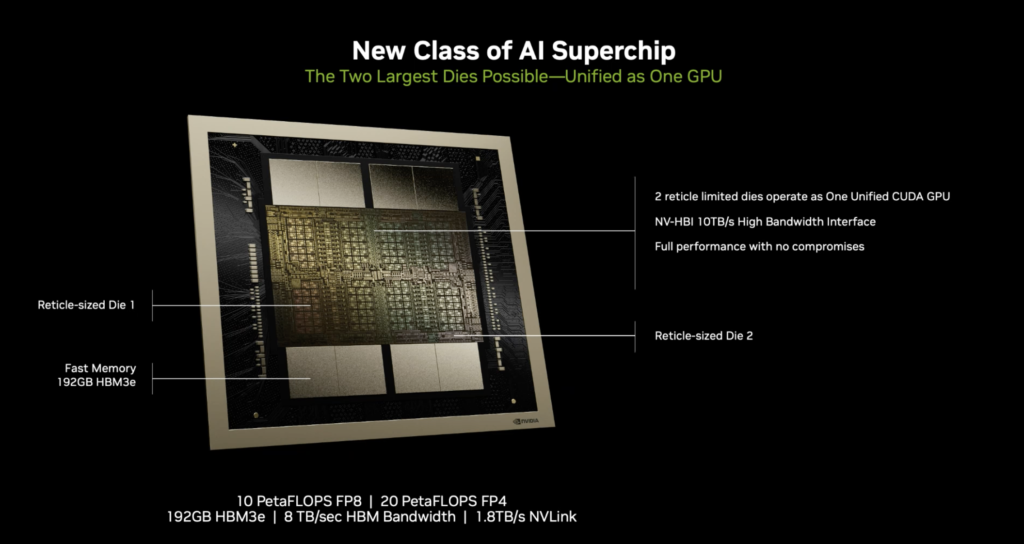

Data Center and AI Demand – The Growth Engine

Data center chips remain the single largest revenue driver. Demand for AI training and inference pushed customers to buy newer Blackwell GPUs. Hyperscalers and cloud providers kept placing big orders. Enterprise adoption of on-premise AI systems also added to the demand.

However, China-related limits trimmed some expected sales of H20 class chips. Nvidia said some H20 inventory was released to non-China customers, which helped the results this quarter.

Gaming, Automotive, and Other Segments

The gaming business showed a steady recovery. GeForce RTX lineups continued to sell, supporting revenue outside data centers. Automotive revenue grew slowly as AI cockpit and autonomous projects advanced. Enterprise tools like Omniverse and software licensing added smaller, but steady, contributions. These segments helped diversify revenue while the data center remained dominant.

Export Restrictions to China – A Major Headwind

U.S. export curbs on advanced AI chips remain a big risk. The rules have limited sales of H100 and initially H20 class chips to China. China is a large market and was responsible for a meaningful share of past sales. The recent moves by U.S. regulators and Chinese responses created a period of uncertainty. Nvidia has tried to comply by designing China-specific chips that are less capable. Even so, political friction means revenue from China could be lower or slower to recover.

How Much Do the Curbs Hurt the Numbers?

Analysts estimated that restricted H20 sales could shave several billion dollars off potential revenue in a quarter. Nvidia disclosed no H20 sales to China this quarter and noted a release of around $180 million in previously reserved H20 inventory to non-China buyers. The absence of expected China demand pressured the data center growth figure and weighed on investor sentiment. Estimates of the hit vary, but the effect was clearly visible in the company’s data center sequencing and guidance.

Valuation Concerns Amid Strong Growth

Nvidia trades at high multiples compared to traditional chipmakers. Investors priced in fast, sustained growth from AI adoption. After the earnings, valuation worries surfaced again. Some analysts argue that current multiples still reflect a large margin for error. Others say the growth runway justifies the price. The debate centers on how much China’s access, competition, and long-term demand will change future cash flows.

Earnings 2nd Quarter: Market and Investor Reaction

The immediate market response was mixed. Shares fell about 2-3% in after-hours trading despite the beat. European trading also showed a drop, with Frankfurt seeing a roughly 2.9% slide. Traders focused on softer data center sequencing and China uncertainty rather than the headline numbers. ETFs and indexes with heavy Nvidia weightings saw ripple effects as investors rebalanced.

Strategic Outlook and Company Guidance

Nvidia issued guidance for the next quarter with revenue centered around $54 billion, plus or minus 2% at the midpoint. That implies continued strong demand but a slightly slower growth rate than some models expected. The company plans to keep investing in next-gen GPUs and software. R&D and partnerships with foundries like TSMC remain central to the roadmap. Nvidia also explained efforts to design compliant chips for restricted markets while maintaining product leadership for global customers.

Competitive and Operational Risks

Competition is intensifying. AMD and Intel are pressing into AI accelerators. Cloud providers and new startups are also building custom silicon. Supply chain risks persist due to reliance on advanced foundries. Geopolitical tension adds another layer of risk, especially where export rules can change quickly. Finally, the semiconductor industry has cycles; a demand slowdown could hit even a market leader.

What does this mean for Investors?

Strong earnings confirm Nvidia’s central role in AI compute. Yet, political and valuation risks make timing important. Short-term price swings are likely as news about China access, product shipments, or guidance arrives. Long-term outcomes will depend on whether AI demand stays robust and whether Nvidia can navigate export rules and growing competition.

Wrap Up

Nvidia delivered another quarter of powerful revenue and profit. Data center demand and AI adoption remain the core growth engines. Export curbs and lofty valuation now shape the story. Investors must weigh the company’s technical edge against political risks and stretched market expectations. The path ahead looks promising, but it is no longer just a pure tech growth story; it is a geopolitical and valuation story as well.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.