Sudeep Pharma IPO Subscription Hits 5.09x on Day 3: GMP & Review Explained

Sudeep Pharma’s IPO gained strong attention as the issue hit a subscription level of 5.09x on 24 November 2025, the third day of bidding. This fast rise shows clear interest from retail and institutional investors. Many traders were watching this IPO because the company works in a steady and essential sector. Sudeep Pharma makes key ingredients that help medicines stay stable, safe, and effective. That makes the business important for global drug makers.

The IPO opened with a steady start, but the demand grew fast over the next two days. Investors liked the company’s growth record, its long list of clients, and its steady earnings. The grey market premium also moved up during the same period, which added more talk about possible listing gains.

But interest alone is not enough. Many investors still want to know if the company is fairly valued and if the GMP can really guide their decisions. This article breaks down the IPO, the subscription trend, the GMP signals, and what the numbers truly mean.

Company Overview: Who is Sudeep Pharma?

Sudeep Pharma is an Indian specialty chemicals and pharmaceutical-grade ingredients maker. The firm supplies excipients and mineral-based products to drug and nutrition manufacturers. Exports form a large part of revenue. The company serves clients in many countries and across multiple sectors. These details appear in its prospectus and recent reports.

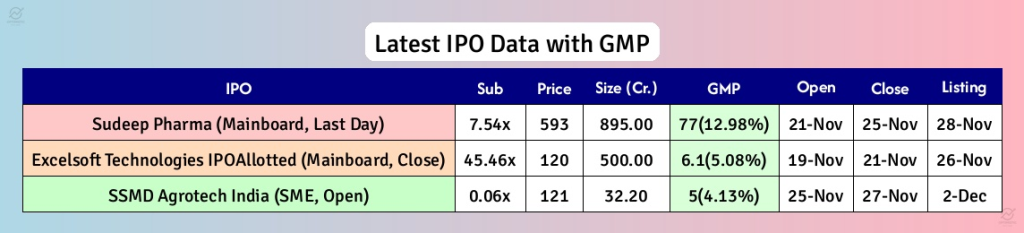

IPO Details at a Glance

The IPO opened on 21 November 2025 and closed on 25 November 2025. The price band was set at ₹563-₹593 per share. The total offer size is about ₹895 crore, which includes a fresh issue of ₹95 crore and an offer-for-sale (OFS) of roughly ₹800 crore. The lot size is 25 shares. Key dates such as allotment and tentative listing were announced in the RHP and by market outlets.

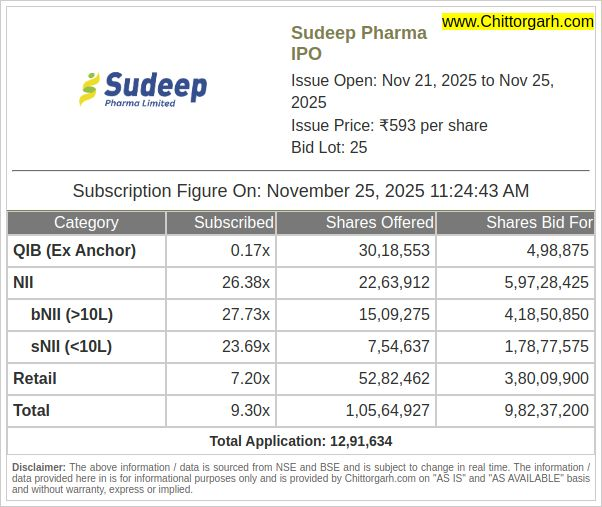

Subscription Status: 5.09x on Day 3

By the close on 24-25 November 2025, the issue was reported as 5.09 times subscribed. The surge happened by Day 3 of bidding. Retail and institutional interest pushed the tally higher after a steady start. Early data showed full subscription on Day 1, then faster inflows on Days 2 and 3. These subscription figures indicate strong demand during the offer period.

Breakdown of Bids

Reports show that demand came from all categories. Institutions, non-institutional investors, and retail bidders all participated. Public filings and market trackers list category-wise bids during the final hours. Strong participation across categories reduces the chance that demand was driven only by short-term traders. However, detailed final splits are published after allotment.

Grey Market Premium (GMP) Update

The grey market reacted quickly before and during the issue. GMP jumped before the IPO opened. On 21 November 2025, some trackers showed GMP up over 15-20%. By the last day, GMP had moderated but remained positive, indicating expected listing gains. GMP is a sentiment gauge only. It is not an official price and can swing widely before listing. Treat it as one signal among many.

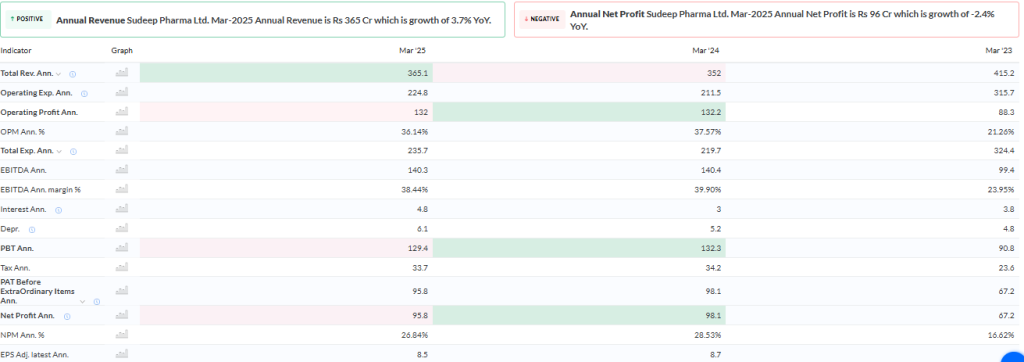

Financial Performance Snapshot

Sudeep Pharma reported steady top-line growth in recent years. Revenue rose year-on-year to about ₹459 crore in FY2024, up from around ₹429 crore in FY2023. Reported profit expanded markedly, with PAT jumping in the latest fiscal. The firm carries some debt, reported at about ₹110 crore as of April 2025. Profitability improved, but working capital needs increased. The prospectus and audited statements give full figures and quarter-wise trends.

Strengths of Sudeep Pharma

The company has focused product lines. These help maintain steady orders. Long-term client ties reduce revenue volatility. A plan to expand capacity is underway and funded partly by the fresh issue proceeds. Export markets offer growth potential. Vertical integration in certain inputs provides some margin stability. The firm’s track record of profit growth strengthens its listing pitch.

Risks and Concerns

Dependency on a few large customers is a risk. The top three clients account for a notable share of revenue. Raw material price swings can squeeze margins. Regulatory checks in the pharma and nutrition sectors can slow approvals or exports. The OFS makes the public float large, which may reduce promoter skin-in-the-game compared to pre-IPO levels. Monitor working capital trends and client concentration after listing.

Valuation Review

At the upper band, the post-issue market cap implies a relatively high P/E for FY25. Broker notes show valuations near 48x FY25 earnings at the top price band, which places the company at a premium to many peers. Such premiums can be justified by growth and margin expansion. Yet high P/E leaves less room for disappointment. Using an AI stock research analysis tool can speed peer comparisons and highlight valuation gaps. Investors should compare the IPO multiple to listed specialty chemical and excipient makers before deciding.

Expected Listing Scenarios

Given the GMP and subscription, an above-issue listing seems likely. Market outlets suggested potential listing price ranges between ₹688 and ₹723 per share before the listing day chatter. Conservative scenarios still imply modest listing gains if GMP holds around mid-teens percent. Over the medium term, listing performance will depend on how markets view the company’s growth plan and whether the expanded capacity drives margins. Remember, pre-listing chatter can change quickly.

Should an Investor Apply?

If the goal is a short-term listing gain, the strong GMP and heavy subscription make applying tempting. For long-term investors, focus should be on fundamentals. Revenue growth, margin sustainability, client concentration, debt levels, and capex execution matter most. If comfort exists on these points, participation at the lower part of the band may suit a long-term buyer. For risk-averse investors, waiting for post-listing financial clarity could be wiser.

Final Thoughts

The Sudeep Pharma IPO attracted clear interest during 21-25 November 2025. The subscription at 5.09x and a positive GMP show market appetite. The company presents a mix of promise and risks. Valuation at the top band appears rich versus peers. Decision-making must weigh short-term listing prospects against long-term fundamentals. Read the RHP, check final allotment details on 26-27 November 2025, and review audited reports before committing capital.

Frequently Asked Questions (FAQs)

The GMP shows the expected listing gain based on market demand. It changes often, so investors check it daily before allotment and listing.

Investors consider subscription numbers, GMP trends, and market sentiment. Strong demand usually hints at listing gains, but results depend on market mood.

The allotment date usually falls 1-2 days after the issue closes. Listing happens soon after, based on the schedule shared by stock exchanges.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.