Tata Motors Demerger: Record Date, Listing Details & Key Q2 Updates Explained

Tata Motors has taken a bold step that could reshape its future and create massive value for investors. On March 4, 2024, the company announced the demerger of its business into two separate listed entities, one focusing on passenger and electric vehicles, and the other on commercial vehicles. This move comes at a time when the automotive industry is rapidly shifting toward EVs, digital platforms, and global expansion. By splitting the business, Tata Motors aims to unlock hidden potential, improve focus, and attract the right kind of investors for each segment.

The demerger has created a buzz in the stock market, and investors are eagerly waiting for the official record date and listing details. At the same time, Tata Motors delivered a strong Q2 FY2025 performance, proving that both divisions are growing steadily. Higher sales, better margins, and rising demand in domestic and global markets show solid momentum.

Let’s break down everything about the demerger plan, record date, listing process, benefits, risks, and key Q2 updates.

What is the Demerger Actually?

The demerger splits Tata Motors into two listed companies. One will focus on passenger and electric vehicles. The other will house the commercial vehicle business. The move was first announced on March 4, 2024, and has moved through board and regulatory steps since then. The goal is a clearer focus for each business and a chance for each to earn its own market value.

Why does the Split make Sense?

Passenger vehicles and commercial vehicles have different growth paths. EVs need heavy R&D, software, and consumer marketing. Commercial vehicles need scale, fleet relationships, and logistics ties. Running both under one roof can hide the true value of each. The split aims to let investors value each business on its own merits. This can improve governance and speed decision-making.

Key Timeline and Approvals

After the March 4, 2024 announcement, the company moved the plan through the board and filed a composite scheme of arrangement. The board formally approved the composite scheme in August 2024. The scheme then went to shareholders, stock exchanges, and courts for clearance. The demerger requires SEBI, stock exchange listing permissions, and court approvals under the Companies Act.

Record Date and Ex-date: What Investors Need to Know?

The record date is the cut-off for who receives shares in the new commercial vehicle company. Tata Motors fixed October 14, 2025, as the record date. The stock will trade ex-demerger from that date. That means purchases after October 14 will not qualify for the allotment tied to the demerger. Retail investors who want entitlements need to buy before this ex-date. Financial news outlets and the company filings confirmed this date.

Share Allotment and Split Ratio

Regulatory filings and market reports show a 1:1 share entitlement for the demerger. Existing Tata Motors shareholders are expected to get one share in the new commercial vehicle company for each Tata Motors share held at the record date. This 1:1 split simplifies maths for individual holders and institutional books. Confirmations and market briefs issued on October 12-13, 2025, reported the ratio and explanatory notes from the company.

Listing Details

The new commercial vehicle company will list on both BSE and NSE. The company name announced in filings is TML Commercial Vehicles Limited for the resulting CV entity. The passenger vehicle business will carry the legacy Tata Motors passenger and EV assets and remain listed. Listing timelines depend on final regulatory clearances and exchange approvals. Markets expect listing shortly after formal allotment procedures following the record date.

Q2 FY2025: The Financial Picture

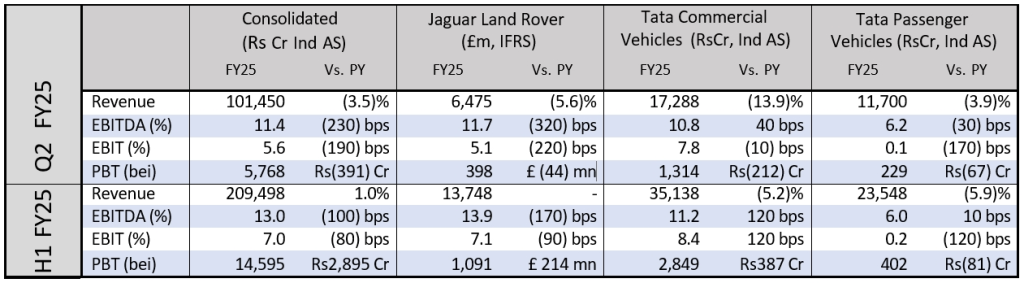

Tata Motors reported consolidated Q2 results for the quarter ended September 30, 2024, on November 8, 2024. Group revenue for Q2 FY25 stood at about ₹17,288 crore for Tata Commercial Vehicles and ₹11,700 crore for Tata Passenger Vehicles in the group presentation.

Consolidated revenue was around ₹101,450 crore reported on an Ind AS consolidated basis for Q2 FY25. EBITDA and margins showed mixed trends across businesses. The passenger vehicle segment registered margin pressures, while commercial vehicles and JLR showed differing trends. The official group press release and Q2 presentation contain full line items and segment splits.

Operational highlights from Q2 FY25

Electric vehicle sales rose in key months as new models reached showrooms. Commercial vehicle volumes were affected by fleet demand cycles and inventory adjustments. Jaguar Land Rover continued capital investment for future EV models and plant upgrades, including work to ready Halewood in the U.K. for EV production. The company flagged continued capex for electrification and software. The published Q2 deck lists specific capex lines and project updates.

Trending Update: JLR Cyberattack and Volume Hit

In late August 2025, Jaguar Land Rover suffered a severe cyberattack. The breach forced partial plant shutdowns and halted operations for several weeks. JLR reported a sharp fall in wholesale and retail volumes in the July-September 2025 period.

The disruption also widened production uncertainty and pressured short-term cash flow for the carmaker. Recovery actions and phased restarts began in early October 2025. This event is a material operational risk for the global part of the group and may affect near-term earnings and supply chains.

How is the Market Reacting?

Share price action around the record date showed volatility. Some investors sold into the run-up to lock profits or avoid short-term listing noise. Others bought before the ex-date to secure entitlement to the new CV shares. Broker notes and market commentaries offered mixed calls. Some analysts highlighted near-term uncertainty but a stronger long-term case for separate valuations. A number of investors also used AI stock research analysis tool outputs to model pro forma capital structures and expected multiples.

Benefits and the Likely Long-term Outcome

The separation should help each business tell a clearer story. The passenger EV arm may attract growth and tech investors. The commercial vehicle arm may trade at traditional industrial multiples tied to fleet cycles. Separate boards may speed decision-making and speed up capital allocation. Over time, investors may value each part on its own growth and margin prospects rather than an aggregated multiple.

Risks to Watch

Regulatory or court delays can push timelines. Market sentiment could remain fragile after the JLR incident. Execution risk exists in setting up two independent listed camps. Currency swings, commodity costs, and global trade rules remain additional pressures. Shareholders must watch formal filings, allotment notifications, and stock exchange announcements for final mechanics.

What Investors Should Track Next?

Watch the formal allotment circular and listing intimation from Tata Motors. Track official dates for allotment, listing, and the exact ticker names. Monitor quarterly updates and JLR production recovery progress. For active traders, the ex-date mechanics and settlement windows matter most. Long-term investors should focus on post-demerger standalone earnings and capex plans.

Bottom Line

The demerger is a big corporate reset for Tata Motors. The record date of October 14, 2025, is a key milestone. The split aims to create two clearer, sharper businesses. Q2 FY25 figures show the group already running complex, global operations with distinct dynamics. The recent JLR cyber incident adds a fresh layer of near-term risk. Careful tracking of company filings and exchange notices is essential for anyone holding or planning to buy Tata Motors stock.

Frequently Asked Questions (FAQs)

Tata Motors has set October 14, 2025, as the official record date. Only shareholders holding the stock before this date will receive shares of the new commercial vehicle company.

Shareholders are expected to receive 1 share of the new commercial vehicle entity for every 1 share of Tata Motors held on the record date, based on the proposed 1:1 ratio.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research