Tata Motors Passenger Vehicles (TMPV) debuts after demerger; commercial vehicle unit to list soon

On October 23, 2025, Tata Motors officially marked a major milestone with the debut of Tata Motors Passenger Vehicles (TMPV) after a long-awaited demerger. This move separates the company’s passenger and commercial vehicle businesses, creating two independent entities with sharper focus and strategy. The step isn’t just structural, it’s strategic. TMPV now carries the fast-growing passenger car and electric vehicle divisions, while the commercial vehicle unit will soon list as a separate company.

For Tata Motors, this transformation signals a new phase of growth and clarity. Investors have been watching closely, seeing this as a way to unlock value and improve performance across both segments. India’s auto industry is also eyeing this change as a sign of the evolving market, one moving rapidly toward electrification, innovation, and specialization.

The debut of TMPV reflects not only Tata’s confidence but also India’s growing role in shaping the future of global mobility.

Background: Tata Motors’ Journey to Restructuring

Tata Motors began as a unified player in both passenger vehicles (PV) and commercial vehicles (CV). Over time, it built strengths in electric vehicles (EVs) and the global premium brand Jaguar Land Rover (JLR). The decision to restructure was driven by the need for sharper focus and improved capital use. In August 2024, the board formally approved a scheme to split the company into two distinct listed entities.

The official effective date for the demerger was October 1, 2025. After the split, shareholders of Tata Motors receive one share in the newly-formed CV company for each share they held in the original company. This move sets the stage for a clearer strategic direction for each business and is expected to unlock value by allowing each unit to focus on its own growth path.

About the Demerger

Under the corporate re-organisation:

- The passenger vehicle division, which includes EVs and JLR, stays under the existing listed company, renamed Tata Motors Passenger Vehicles Ltd (TMPV).

- Tata Motors moved the commercial vehicle business, trucks, buses, and logistics into a new company called Tata Motors Commercial Vehicles Ltd (TMLCV).

- The demerger ratio is 1:1, meaning every Tata Motors shareholder gets one share of the new CV company for each share held.

- The record date for this entitlement was October 14, 2025.

This realignment allows each business to pursue strategies at differing paces: the PV/EV/JLR group can aim for consumer and global premium markets, while the CV unit focuses on infrastructure and commercial demand.

TMPV’s Strategic Focus and Vision

The newly-named TMPV now houses:

- Passenger cars such as models from the Tata brand.

- The electric vehicle business.

- JLR’s operations globally.

With this consolidation, TMPV aims to invest in technology, design, and sustainability. The company will focus on battery innovations, EV infrastructure, and global expansion of JLR.

The restructuring signals a shift to a sharper consumer-facing brand with a focus on mobility, electrification, and premium segments. It also aims to leverage global synergies while operating in a more agile structure.

Performance Snapshot: Financials and Market Impact

Before the split, the consolidated Tata Motors business had significant revenues from both PV and CV operations. Post-split, TMPV is expected to show improved profit margins, clearer brand positioning, and stronger investor appeal as a pure-play mobility business.

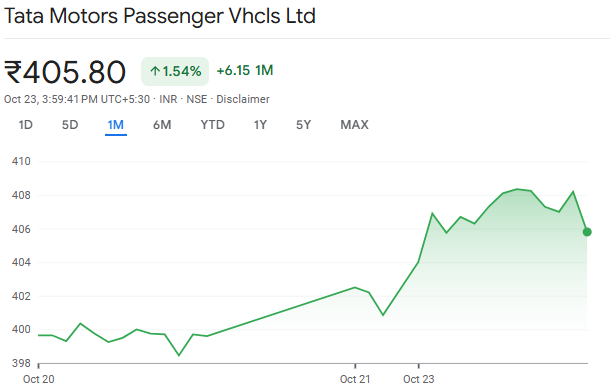

Market reaction has been mixed. On October 14, 2025, Tata Motors shares opened at around ₹399 on the BSE after the demerger. The price showed a notional drop of about 40% from the previous close of ₹660. Analysts emphasise that the drop reflects structural re-adjustment rather than an underlying business collapse. Brokerages like Nomura have set target prices post-split of ~₹367 for the PV entity and ~₹365 for the CV entity.

Upcoming Listing of the Commercial Vehicle Unit

Tata Motors plans to list the CV business (TMLCV) on the stock exchanges in early November 2025, after getting regulatory approval. Shareholders already have the shares in their demat accounts, but they can’t trade them yet. The exchanges usually complete permissions within 45-60 days after allotment.

This listing will allow investors to separately value the CV business, which is tied to infrastructure, logistics, and industrial demand, a different growth cycle compared to consumer-driven PV/EV markets.

Industry Implications: Reshaping India’s Auto Landscape

The demerger is symbolic of a larger trend in the Indian auto industry. By creating focused entities, Tata Motors is aligning with global peers who separate heavy commercial operations from consumer car and EV businesses. This clarity can attract different types of investors and help each business respond faster to market changes.

For India’s “Make in India” and EV push, TMPV consolidates the EV ambition under one roof, which could strengthen India’s role in global vehicle electrification. The CV unit’s strong base in trucks, buses, and logistics positions it to benefit from infrastructure growth and GST rate cuts in the CV segment.

Challenges and Risks Ahead

Despite the potential, several risks remain. The review of capital allocation is crucial executing EV scale-up is costly. Global supply-chain issues, commodity price volatility, and intense competition in the passenger EV segment pose threats. The commercial vehicle business is cyclical and depends heavily on infrastructure and economic growth. Execution will determine if the split translates into superior returns.

Investor Takeaways

For investors, the split offers a choice: exposure to a consumer/EV-growth business (TMPV) versus a commercial-infrastructure business (TMLCV). The separate listings allow more precise valuation. However, patience is needed; the benefits of the restructuring may show only over the medium to long term. Short-term volatility is expected as markets adjust to new structures.

Wrap Up

The restructuring of Tata Motors marks a bold step toward sharper focus and higher value. TMPV now handles the consumer, EV, and premium car segments. The commercial vehicle arm is preparing for its own listing soon. This move shows Tata Motors is ready for the next stage of growth. The real challenge will be execution and steady performance. Each new entity must adapt well to its own market to succeed.

Frequently Asked Questions (FAQs)

Tata Motors completed its demerger on October 1, 2025. The move created two independent companies, Tata Motors Passenger Vehicles (TMPV) and Tata Motors Commercial Vehicles (TMLCV).

After the demerger, every Tata Motors shareholder received one share of TMLCV for each Tata Motors share held, keeping the total investment value the same.

The Tata Motors Commercial Vehicles unit (TMLCV) is expected to list on Indian stock exchanges by November 2025, after getting all required approvals and clearances.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.