Tata Motors Share Gains Spotlight After NCLT Restructuring Nod

Tata Motors has once again come into the spotlight, this time with a major push from the National Company Law Tribunal (NCLT). The tribunal recently gave its nod to the company’s restructuring plan, a move that has caught the attention of both investors and the wider auto industry. Shares of Tata Motors reacted quickly, gaining momentum in the market as optimism around its future grew stronger.

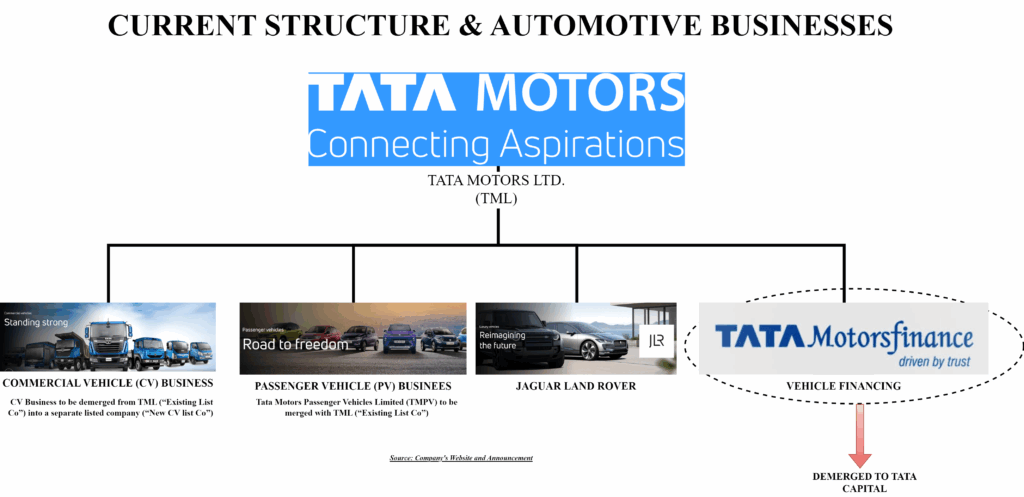

We know Tata Motors is not just another automaker. It has been a leader in India’s automobile industry for decades and also owns the iconic Jaguar Land Rover brand overseas. The restructuring nod signals a turning point. It shows that the company is serious about strengthening its financial base, simplifying operations, and creating more value for shareholders.

For investors, this decision comes at the right time. The auto sector is changing fast with electric vehicles, new regulations, and global competition shaping the road ahead. With this approval, Tata Motors seems better prepared to face challenges while also unlocking fresh opportunities. The market has taken notice, and so should we.

About the NCLT restructuring nod

The National Company Law Tribunal (NCLT), Mumbai Bench, has cleared Tata Motors’ Composite Scheme of Arrangement. The order was passed on August 25, 2025. The scheme reorganizes the core auto businesses. The commercial vehicle arm will be demerged into TML Commercial Vehicles (TMCLV). The passenger vehicle arm, including EVs, will be merged into Tata Motors Passenger Vehicles (TMPV).

Earlier board and shareholder approvals are now backed by the tribunal, which moves the plan to execution. The company has also guided that the demerger becomes effective from October 1, 2025, with separate listings expected in the October–December quarter of FY26. This is a big structural change aimed at clarity, focus, and value discovery for each franchise.

Impact on Tata Motors’ share price

The stock drew quick attention after the order. Intraday updates on August 26 showed heightened tracking even as the price hovered near ₹680-₹682. Short-term prints were mixed, including a dip below the 100-day SMA, but the news flow kept interest high.

Market blogs and live trackers highlighted the NCLT sanction as the key trigger for the day’s focus. In the two weeks heading into the event, momentum had improved modestly from prior declines. Price action after big restructurings can stay choppy, yet the core driver here is the pathway to two focused entities.

Strategic importance of the restructuring

The split lets each business run with its own goals and capital needs. CV cycles, margins, and regulations are different from PV and EV dynamics. A cleaner structure also reduces complexity, speeds decisions, and makes partnerships easier. Management’s timelines suggest execution discipline, with an effective date targeted for October 1, 2025, and separate listings in Q3 FY26.

For investors, that means clearer valuation lenses for CV on one side and PV/EV/JLR exposure on the other. The sanction from NCLT is the crucial legal milestone that unlocks this shift.

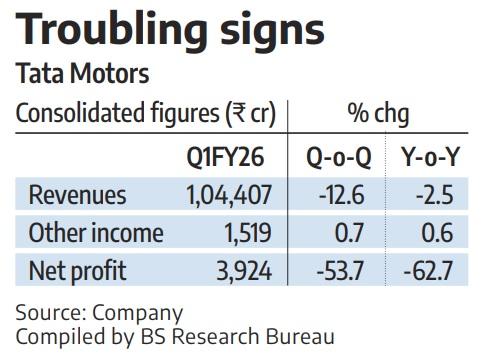

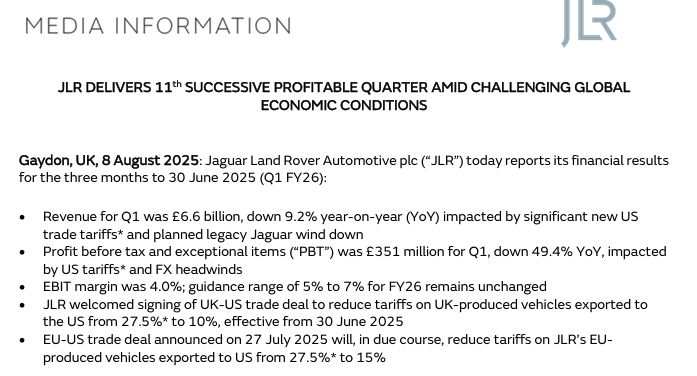

Tata Motors’ Current Market Position

Recent numbers frame the starting line. Consolidated Q1 FY26 revenue slipped 2.5% to ₹1.04 lakh crore. Net profit fell to about ₹3,924 crore. JLR revenue was down 9.2%, with margins hit by U.S. tariffs and model transitions. CV revenue fell 4.7%, though CV margins improved on better realizations and cost control. The passenger vehicle business has been moderating as models transition and demand remains cautious. These trends explain why management is doubling down on focus, cost, and product cycles as the demerger approaches.

Investor Sentiment and Analyst Views

Brokerages and market desks see the sanction as value-accretive over the medium term. Live coverage flagged the stock as “in focus” post-order. Earlier in the quarter, analysts maintained constructive stances despite earnings pressure, with some targets clustered in the ₹745-₹815 zone depending on assumptions for JLR recovery and India EV traction.

Consensus dashboards still showed upside versus spot, though target dispersion remains wide due to global risks. The headline: structure improves, execution and demand need to follow.

Broader impact on the auto industry and market

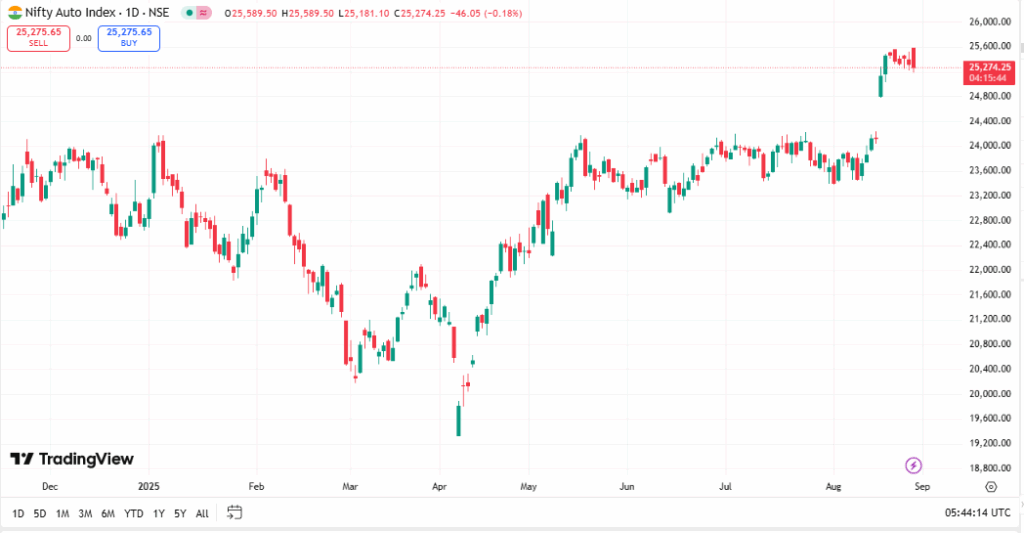

India’s auto index has been active in August, reflecting shifting views on demand, tariffs, and product launches. A successful separation at Tata Motors may nudge peers to revisit structures for EVs, software, and exports. Cleaner listed entities also help global funds pick exposure by risk bucket, CV cyclicals versus PV/EV growth.

If the two Tata platforms deliver sharper ROCE and steadier cash flows, the read-through for capital allocation in the sector could be meaningful. Recent index moves show how fast sentiment can rotate when catalysts appear.

Challenges ahead for Tata Motors

Execution risk sits front and center. The market will watch how quickly carved-out teams run independent P&Ls and capital plans. JLR faces pricing, tariff, and model-cycle pressures. U.S. tariffs dented profitability in Q1, and model phase-outs added drag.

Domestic PV demand has cooled in places, and competition in EVs is intense. CV cycles depend on rates, freight, and capex trends. Any supply hiccups or policy changes can add bumps to the road. The split does not remove these pressures, but it can make them easier to manage.

Future outlook

Key dates are set. The effective date is targeted for October 1, 2025, and separate listings are planned for Q3 FY26. Management commentary points to a stronger second half if festive demand and tariff clarity improve. The CV unit aims to defend margins through mix and costs. PV and EV aim to refresh line-ups and scale software and charging ecosystems. JLR targets margin rebuild as new models ramp and trade frictions ease. If the plan holds, the market will have two simpler stories to value, each with clearer levers.

Bottom Line

The tribunal’s green light gives Tata Motors a clear lane to restructure. The scheme separates CV and PV/EV under focused umbrellas and aligns the business with how the industry now competes. Earnings still face global and local headwinds, yet structure, timelines, and execution plans are in place. Investors finally have dates to track and milestones to verify. The spotlight is on delivery through FY26.

Frequently Asked Questions (FAQs)

It allows Tata Motors to separate its commercial vehicle and passenger vehicle businesses. This creates a clearer focus and better value discovery for investors.

The demerger is set to take effect on October 1, 2025, with separate listings expected in the October-December quarter of FY26.

Tata Motors shares gained after the NCLT restructuring approval. Analysts see growth potential, but risks remain from global slowdown and EV competition. Investors should decide based on risk tolerance.

The board fixed June 7, 2025, as the record date for Tata Motors’ final dividend for FY25. Shareholders holding stock on that date will qualify for payment.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.