Tata Steel Share Price Journey: Stock History and Market Performance

Tata Steel is one of the oldest and strongest names in India’s industrial story. Founded in 1907, it became the first steel company in Asia to start an integrated steel plant at Jamshedpur. Over the years, the company has grown into a global player, with operations in more than 20 countries and commercial presence in over 50.

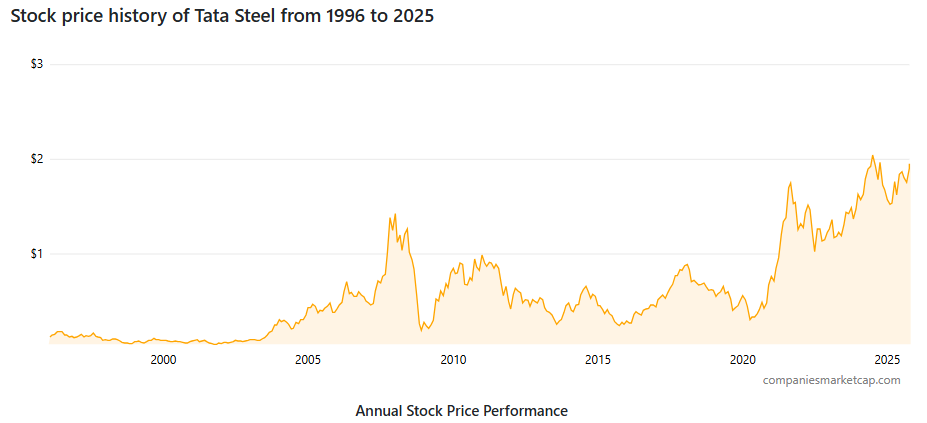

The journey of Tata Steel’s share price tells a fascinating story. It reflects India’s growth, global steel cycles, and the company’s bold moves in expansion. From the 2007 Corus acquisition to the 2008 financial crisis, and from the COVID-19 shock in 2020 to the steel boom of 2021, we see sharp ups and downs. Each event left a mark on the stock’s history and investor sentiment.

Investors look for patterns in such stories. They want to know why prices moved, what decisions shaped the future, and how external factors influenced the market. Tata Steel’s stock is not just about numbers; it is about resilience, risk, and renewal.

Let’s look through Tata Steel’s share price journey, its key milestones, and what lessons we can take as investors today.

Company Background

Tata Steel began operations in 1907 with an integrated plant at Jamshedpur. Over the decades, it grew from a national champion to a global steel maker. The company expanded through organic growth and big buys abroad. The most notable was the Corus takeover in 2007.

Today, Tata Steel has manufacturing and commercial reach across Asia and Europe. Annual reports for FY2024-25 show it still runs both Indian and overseas operations. These moves shaped its cost base, markets, and the stock’s long run.

Tata Steel Share Price History

Early Years (Pre-2000s)

Share price growth matched India’s industrial rise. The stock was seen as a blue-chip play on heavy industry. Volatility was low in calmer commodity cycles. Long-term investors treated it as a legacy industrial name.

2000-2010: Global Expansion Phase

The 2007 purchase of Corus for about $12.1 billion was a landmark. The deal boosted global scale. It also added large debt and integration work. Markets reacted strongly as investors weighed growth and risks. The global financial crisis hit in 2008. Steel demand fell and prices plunged. Tata Steel’s shares tumbled along with many industrial stocks.

2010-2020: Consolidation & Challenges

The next decade focused on fixing the balance sheet. Debt from acquisitions stayed a concern. Management sold non-core assets and cut costs. Indian demand had slow stretches. Global overcapacity and low prices kept margins tight. The company worked on operational efficiency and local market share. Analysts often flagged debt as the main risk during these years.

2020-Present: Recovery & Growth

COVID-19 caused a sharp drop in early 2020 as factories paused. Prices recovered in 2021 with a strong steel cycle. The stock rose as demand for construction and exports jumped. By mid-2024-25, the company pushed hard on debt reduction and liquidity.

The FY2024-25 integrated report (published June 6, 2025) shows measures to cut net debt and improve cash. On October 3, 2025, shares traded near ₹173-174, close to a recent 52-week high reached in late September 2025. This showed renewed investor interest.

Factors Which Influence Tata Steel’s Share Price

Global steel prices drive profit margins. When prices rise, margins widen fast. When prices fall, profits vanish. Raw material costs matter next. Iron ore and coking coal swings hit operating costs. Import dependence and contract terms affect results. Debt levels are a big price driver. High leverage scares investors during slow markets. Debt cuts and better liquidity raise confidence.

Government policy shapes domestic demand. Infrastructure spending and housing boosts steel consumption. Currency moves also change export profits. Mergers and large buys change investor views quickly. The Corus deal in 2007 is a classic example. Market sentiment and macro events add volatility. Traders and long-term holders both react to quarterly numbers. Analysts use tools and models to track these drivers. Some use advanced screeners and even an AI stock research analysis tool to test scenarios.

Tata Steel vs Competitors

Tata Steel competes with JSW Steel, SAIL, and global players like ArcelorMittal. JSW often posts stronger margins from integrated and efficient mills. SAIL has government backing as a public sector player.

ArcelorMittal runs big global volumes and different cost structures. Tata’s edge lies in its mix of Indian scale and some European assets. The Corus buy gave access to high-end markets but raised costs. In recent years, Tata has focused on reducing debt and improving cash flow to match its private peers. Market cap and P/E ratios vary with cycles, so comparisons change fast.

Key Milestones in Stock Performance

- 2007 – Corus acquisition completed (Feb 2007). This marked a global scale expansion.

- 2008-09 – Global financial crisis. Steel demand fell sharply. Shares dropped with the market.

- 2020 – COVID-19 shock hit production and demand in March 2020.

- 2021 – Steel supercycle boosted prices and earnings. Stock rose with margins.

- 2024-25 – Focus on deleveraging. FY2024-25 report (issued June 6, 2025) highlights net debt reduction and liquidity actions. Recent trading in Sept-Oct 2025 shows strong volumes and levels near a 52-week high.

Investor Outlook & Analyst Opinions

Analysts point to two main themes. First, demand recovery in India and exports. Second, the a need for continued debt cuts. Some see a fair upside if steel prices stay steady and debt falls. Others warn that price swings can erase gains quickly. Valuation metrics in late 2025 showed a premium P/E versus some peers, reflecting expected recovery. Investors should watch quarterly cash flow, net debt trends, and global steel demand. Use clear risk checks and scenario plans before buying. Analyst coverage and ratings update often, so check recent notes before acting.

Wrap Up

Tata Steel’s stock tells a story of scale, risk, and repair. Big deals boosted reach but raised leverage. Cyclical steel prices caused sharp moves up and down. Recent years have focused on fixing the balance sheet and restoring profits. The FY2024-25 filings show progress on debt and liquidity. Short-term swings will remain linked to global commodity cycles. Long-term prospects will hinge on demand growth in India, success in cost control, and how quickly debt falls. Watch company reports and market data for clear signs of durable improvement.

Frequently Asked Questions (FAQs)

On October 3, 2025, Tata Steel traded near ₹173.80. The 52-week high was ₹174.35, while the lowest point during this period was ₹122.60.

Tata Steel stayed profitable. In Q4 FY2025, profit reached ₹1,301 crore. In Q1 FY2026, reported on July 30, 2025, net profit more than doubled.

In 2025, Tata Steel began a ₹27,000 crore expansion at its Kalinganagar plant, Odisha. Capacity will rise to 8 million tonnes. Green steel projects also continue.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.