Telkom Indonesia Plans $2.16B Fibre Spin-off to Boost Network Efficiency

On 21 October 2025, Telkom Indonesia announced a bold move: it plans to slash off around US$2.16 billion worth of its fibre-optic business into a separate entity. The idea? To sharpen its focus on network assets and let a dedicated arm handle fibre rollout and maintenance.

This is more than an accounting trick it’s about making the infrastructure leaner, more agile and better able to serve Indonesia’s exploding demand for high-speed internet. With households, startups and enterprises all chasing faster, more reliable connections, this spin-off aims to position Telkom for the digital future.

Let’s explore why this change matters, how it will work, and what it could mean for consumers, competitors and the wider telecom landscape.

Background: Telkom Indonesia’s Current Structure and Why Change Matters

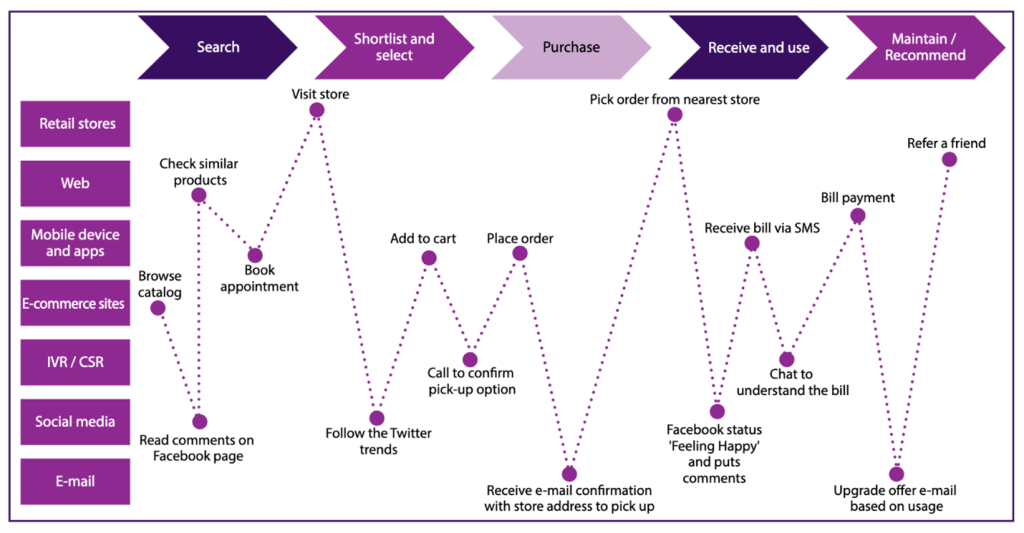

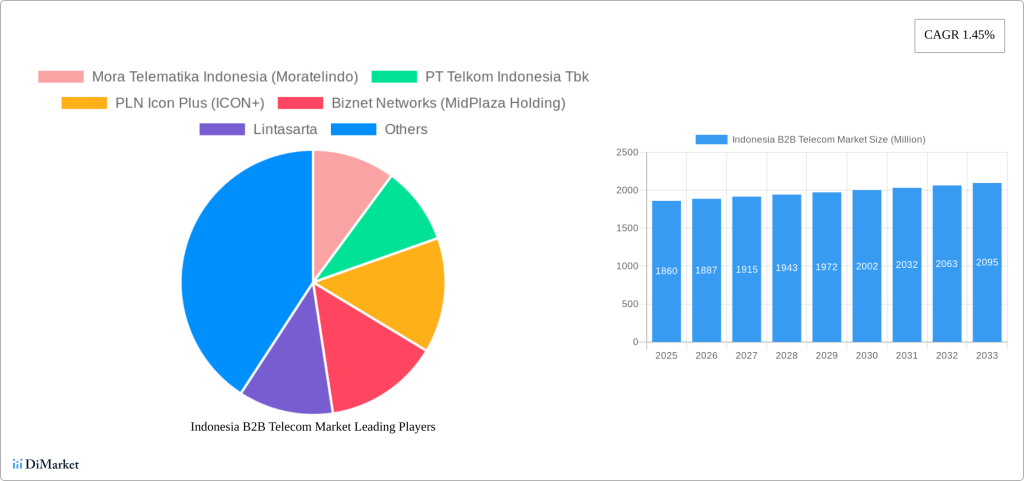

Telkom Indonesia runs a wide range of services. It owns Indihome, the country’s largest fixed-broadband brand. It also holds large stakes in mobile and infrastructure units. Managing retail services and heavy network assets together makes operations complex.

The company must balance consumer marketing with long-term infrastructure investment. That tension can slow decisions on upgrades and new rollout. Telkom’s fibre network also faces rising demand from homes, businesses and cloud providers. Many of the fibre lines are under-utilised. Spinning off the fibre arm aims to create sharper focus on network build, monetisation and capacity expansion.

Details of the Fibre Spin-off Plan

On 20-21 October 2025, Telkom signed a conditional deal to move its wholesale fibre connectivity assets to its infrastructure arm, Telkom Infrastruktur Indonesia (TIF). The transaction value is about IDR 35.787 trillion (US$2.16 billion). The transfer will happen in stages. More than half of fibre assets will move in the initial phase.

The plan covers backbone fibre, aggregation access and supporting infrastructure. Shareholder and regulator approvals are required before completion. The move is structured as a partial spin-off and asset transfer to TIF, with further steps expected into late 2025 and early 2026.

Strategic Goals behind the Move

The spin-off targets four core goals. First, increase operational focus: the new unit will specialise in fibre deployment and maintenance. Second, attract capital: a separate asset company becomes easier for infrastructure funds and strategic partners to value and invest in. Third, speed up upgrades: a dedicated manager can execute network expansion faster.

Fourth, unlock new revenue: wholesale leasing and dark-fibre products can be monetised more aggressively. Telkom’s leadership has framed the deal as a way to make fibre assets “leaner and more investible,” not merely to rearrange accounting lines.

Financial Impact and Market Reaction

Markets reacted cautiously but with interest. Early press coverage noted the sizeable IDR valuation and the strategic rationale behind it. Analysts say the spin-off could raise Telkom’s asset returns over time. Short-term costs are likely. Those include transaction fees, asset revaluation and legal work.

Long term, a clearer separation could lift valuation multiples if investors view the fibre unit as a stable, cash-generating infrastructure asset. Some broker notes referenced the potential for foreign infrastructure funds to join as minority partners after regulatory clearance. The company’s formal filings and conditional agreement signal that management sees investor appetite for infrastructure plays in Indonesia.

Industry Context: Why Telecoms Spin Off Networks?

Telkom’s move fits a global trend. Major operators have separated networks from retail services. The model appears in Japan, Europe and parts of Asia. The logic is consistent: infrastructure attracts long-term investors seeking steady returns. Service units stay nimble and customer-facing. For network owners, scale and stable cash flow create value for infrastructure funds and pension investors.

The switch also helps governments and regulators monitor critical national infrastructure more transparently. In many markets, this separation has led to faster fibre rollout and improved wholesale pricing. Telkom’s timing reflects similar strategic thinking in the region.

Benefits for Consumers and Businesses

The spin-off could deliver practical gains. Expect faster upgrades to urban and peri-urban links. Wholesale focus may reduce bottlenecks for enterprises that need high-capacity circuits. Improved maintenance plans can lift reliability for home broadband users.

For startups and cloud firms, denser fibre routes reduce latency and cost. The structure also opens possibility for new partnerships with content and cloud providers that require strict service-level commitments. In short, the change aims to lower friction in the network layer so service innovation can follow.

Challenges and risks

The plan carries real risks. Regulatory clearances can delay timelines. Asset transfers often trigger complex employee, contractual and creditor negotiations. Service disruption risk exists during cutover phases. There is also execution risk: the new unit must prove it can run fibre more efficiently and find outside investors under acceptable terms.

Finally, competition from private fibre builders and alternative technologies could pressure returns if demand growth slows. Transparency and governance will be critical to win investor trust. Telkom’s past disclosures on spin-off processes show awareness of these hurdles.

What this means for Investors and Partners?

Investors should watch several indicators. First, the scope of assets transferred in each stage. Second, any announced minority investors or strategic partners. Third, regulatory milestones and shareholder votes. Broker commentary suggests that infrastructure funds may be keen, but valuations and governance terms will determine interest.

For institutional buyers, an independent fibre owner with stable contracts is appealing. Market participants may also use an AI stock research analysis tool to model long-term cash yields and simulate scenarios tied to utilisation rates. Transparent reporting from Telkom will shape how quickly partners move.

Telkom’s Future Outlook

If executed well, the spin-off could reshape Indonesia’s broadband market. A specialised fibre owner can drive wider coverage and faster quality improvements. Telkom itself can focus on customer experience and new services. The move may also spur similar restructurings across Southeast Asia as operators chase capital for high-cost infrastructure.

Yet success depends on swift approvals, careful asset transfer and competent governance at the new entity. Stakeholders should track developments through late 2025 and into 2026 to measure real impact.

Bottom Line

The partial spin-off announced on 20-21 October 2025 marks a major tactical shift for Telkom Indonesia. The deal aims to unlock fibre value, attract investors and speed network expansion. The plan offers clear benefits. It also brings notable risks. Scrutiny of regulatory steps and investor commitments will show whether this becomes a blueprint for telecoms across the region.

Frequently Asked Questions (FAQs)

On October 21, 2025, Telkom Indonesia announced the spin-off to make its network faster, improve management, attract investors, and expand fibre coverage across the country.

The fibre spin-off deal is worth US $2.16 billion. It includes moving fibre assets to a new unit, Telkom Infrastruktur Indonesia, to manage networks more efficiently.

After the spin-off, users can expect faster internet, wider network reach, and fewer service delays as the new unit focuses only on fibre development and maintenance.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.