TEMU Doubles EU Profits to $120M with Lean Team of 8 Employees

In 2024, Temu, a Chinese e-commerce platform, achieved a remarkable feat: it doubled its pre-tax profits in the European Union to nearly $120 million. What makes this achievement even more striking is that the company accomplished this with just eight employees at its Ireland-based headquarters, Whaleco Technology. Despite the minimal workforce, Temu’s revenue soared to $1.7 billion, up from $758 million the previous year, driven by strong demand for its low-cost products promoted on social media.

This success story raises questions about the efficiency of Temu’s operations and the strategies it employs to manage such significant growth with a lean team. How does a company manage to scale rapidly and achieve substantial profits with such a small workforce? What innovative approaches and technologies are enabling Temu to operate efficiently? These are the questions we will explore in this article, and check the factors that have contributed to Temu’s impressive performance in the European market.

Background of TEMU

The company was started in 2022 by PDD Holdings. It is an online marketplace that connects buyers directly with manufacturers in China. This helps it sell many products at low prices. It avoids extra retail costs. TEMU grew fast because it focuses on saving costs and uses online marketing to reach people worldwide.

In the European Union, TEMU runs through its Ireland office, Whaleco Technology. The company grew a lot, with EU revenue rising from $758 million in 2023 to $1.7 billion in 2024. This is a 124% increase. The growth shows TEMU is popular with European customers who want affordable products.

EU Market Strategy

TEMU’s success in the European market can be attributed to several key strategies:

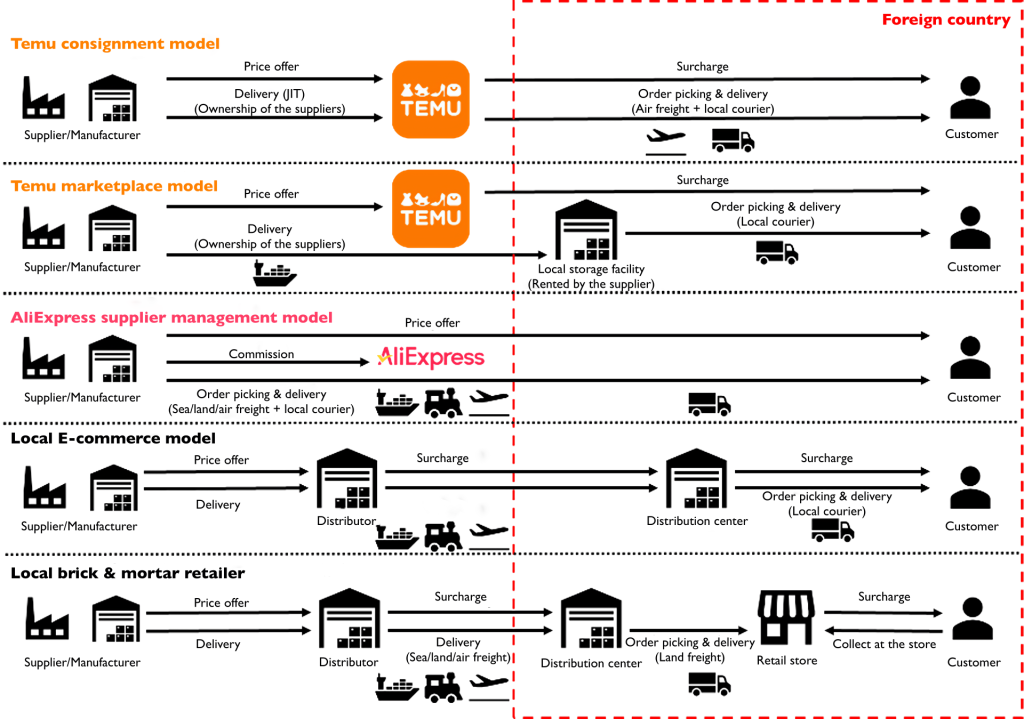

- Direct-to-Consumer Model: By eliminating intermediaries, TEMU offers products at lower prices, appealing to budget-conscious consumers.

- Social Media Marketing: The platform utilizes targeted advertising on platforms like TikTok and Instagram, effectively reaching younger demographics and driving traffic to its site.

- Localized Offerings: TEMU tailors its product selection to meet the specific preferences and needs of European consumers, enhancing customer satisfaction.

- Efficient Logistics: Through partnerships with global logistics providers, TEMU ensures the timely delivery of products, maintaining customer trust and satisfaction.

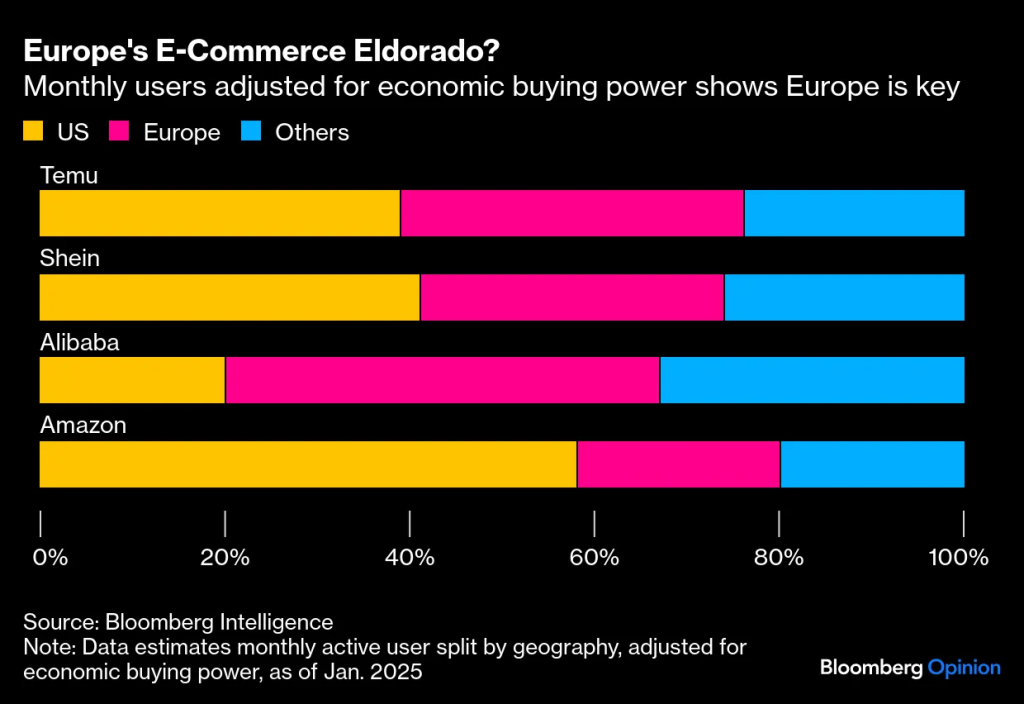

These strategies have enabled TEMU to build a substantial presence in Europe, with over 115 million active users by early 2025.

Lean Team Model

Despite its extensive operations, TEMU maintains a lean workforce. The company’s EU division, Whaleco Technology, operates with just eight employees, a testament to its efficient organizational structure. This minimal staffing is supported by advanced automation and AI-driven tools that handle various functions, including customer service, inventory management, and order processing.

The use of technology allows TEMU to streamline operations, reduce overhead costs, and scale rapidly without the need for a large workforce. This approach not only enhances profitability but also positions TEMU as a competitive player in the e-commerce sector.

Financial Performance

TEMU’s financial performance in the EU has been impressive. In 2024, the company reported pre-tax profits of nearly $120 million, more than double the previous year’s figures. The substantial revenue growth is indicative of the platform’s effective business model and market acceptance.

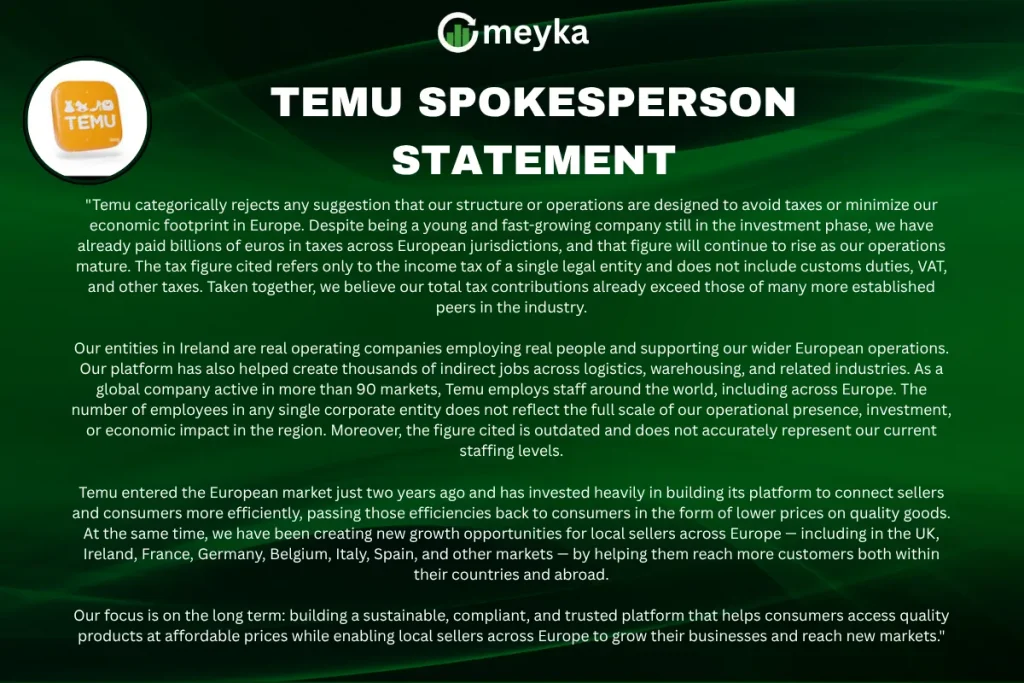

However, the company’s tax contributions have been a point of contention. The company paid $18 million in corporation tax, including a $3 million top-up due to the EU’s adoption of a global minimum tax rate. Critics argue that TEMU’s tax payments are disproportionately low compared to its earnings. This raises concerns about tax avoidance strategies employed by the company.

Challenges and Risks

Despite its success, TEMU faces several challenges in the European market:

- The European Commission has raised concerns about the safety and legality of products sold on TEMU, citing instances of counterfeit and non-compliant items. As a result, TEMU is under investigation for potential violations of EU regulations.

- TEMU has been accused of exploiting customs loopholes by undervaluing shipments to avoid duties. Although the EU plans to close these loopholes by 2028, the current system allows TEMU to benefit from reduced import costs.

- Established e-commerce giants like Amazon and local retailers pose significant competition to TEMU. The company’s ability to maintain its market share will depend on its continued innovation and customer service excellence.

Also, a recent statement from Temu’s Spokesperson elaborating on the company’s current employment structure and finance:

Future Outlook

Looking ahead, TEMU aims to expand its footprint in the European market. The company plans to enhance its product offerings, improve customer service, and invest in localized marketing campaigns to attract a broader audience.

Additionally, TEMU is exploring opportunities to diversify its revenue streams by introducing new services and partnerships. The company’s focus on technological innovation and operational efficiency will be crucial in sustaining its growth trajectory.

Wrap Up

TEMU’s fast growth in Europe shows that selling directly to customers works well. It’s a smart use of online marketing that helped boost sales. Even with strong profits, TEMU faces rules about product safety and taxes. Following these rules is important for long-term success. How TEMU adapts to changes in the European market will decide its future growth and stability.

Frequently Asked Questions (FAQs)

The company made $120M in EU profits by using smart automation and AI tools. Its small team managed operations, marketing, and logistics efficiently in 2024.

It faces EU scrutiny for selling some illegal or non-compliant products. Regulators check that the platform follows safety rules and the Digital Services Act as of 2025.

TEMU paid $18M in corporation tax in 2024, using current customs rules. The EU plans to tighten rules by 2028, which may change tax responsibilities.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.