Tesla Sales Boom Fails to Lift Shares as Investors Sell Off

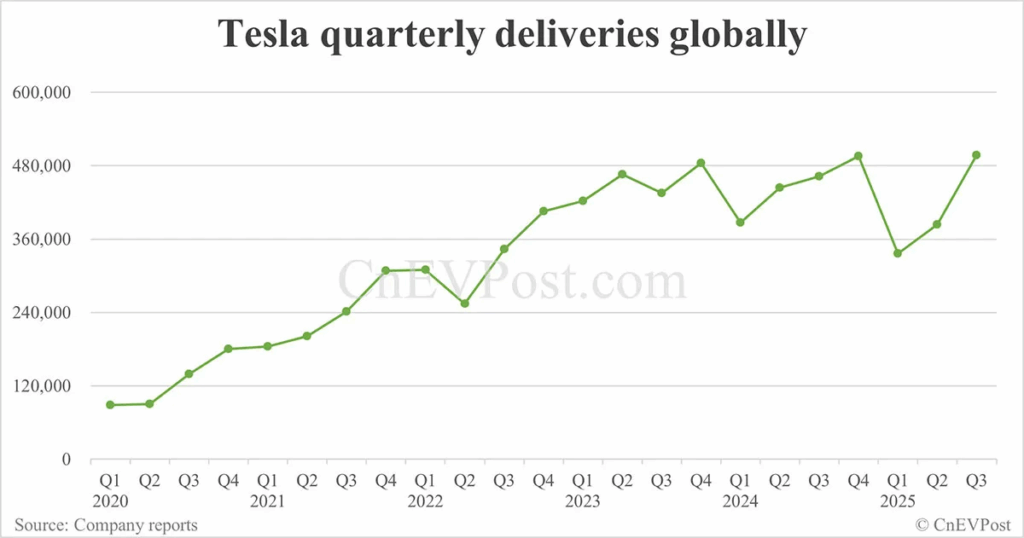

In the third quarter of 2025, Tesla reached a major milestone. The company delivered 497,099 electric vehicles worldwide. This was a 7.4% increase from the same period in 2024. It also beat Wall Street’s forecast of about 439,600 units.

The rise in sales was mainly due to customers rushing to use the $7,500 U.S. federal EV tax credit. This credit ended on September 30, 2025. Even with strong sales, Tesla’s stock fell. On October 2, 2025, shares dropped 5.1%. This happened even though Tesla reported its best quarter ever. The situation shows a gap between sales growth and stock price.

Investors and analysts are asking why this happened. Factors include the expired tax credit, challenges in global markets, and concerns over Tesla’s long-term growth plan.

This article explores why Tesla had record sales but saw a falling stock price. It also looks at how investors judge the company’s performance and future prospects.

Tesla’s Sales Performance

In the third quarter of 2025, Tesla reached a major milestone. The company delivered 497,099 electric vehicles worldwide. This was a 7.4% increase from the same period in 2024. It also beat Wall Street’s estimate of around 443,600 units.

Most of the sales came from the Model 3 and Model Y, Tesla’s mass-market cars. This helped reduce extra inventory, which had been a problem in past quarters. Even so, Tesla’s year-to-date sales are still down 5.9% compared to 2024. This shows that overall demand for electric vehicles may be slowing.

Tesla’s performance varied across the world. In Europe, deliveries fell by 37% because of strong competition from local car makers. In China, Tesla also struggled to keep its market share due to growing domestic electric vehicle brands.

Looking ahead, the end of the federal EV tax credit is a big challenge for Tesla. To help, the company introduced a $6,500 lease credit for customers. Tesla is also focusing on long-term AI projects. This includes a robo-taxi service and a humanoid robot, both expected in 2026. These projects aim to add new income and make Tesla less dependent on car sales.

Stock Market Reaction

Despite the record deliveries, Tesla’s stock experienced a notable decline. On October 2, 2025, the company’s shares fell by 5.1%, closing at $436. This marked its worst session in over two months.

The initial investor optimism following the delivery announcement was short-lived. The market’s reaction underscores the complexity of predicting investor behavior, as strong sales figures did not translate into sustained stock price gains.

Analysts suggest that the expiration of the EV tax credit and Tesla’s reliance on U.S. demand may have contributed to the stock’s downturn. With the incentive now gone, future sales may decline, impacting the company’s revenue projections.

Reasons for the Sell-Off

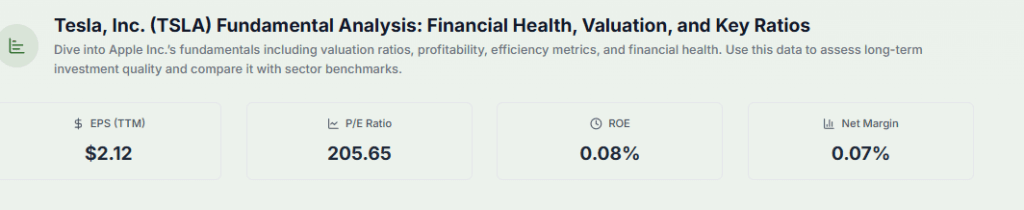

Valuation Concerns

Tesla’s stock has been trading at high multiples, leading to concerns about its valuation. The company’s price-to-earnings ratio remains elevated compared to industry peers, prompting investors to question whether the stock is overvalued.

Profit-Taking

Following a significant rally earlier in the year, some investors may have decided to lock in profits, leading to increased selling pressure on Tesla’s stock.

Macroeconomic Factors

Rising interest rates and inflation concerns have affected growth stocks like Tesla. Higher borrowing costs can impact consumer spending and investment in electric vehicles, potentially slowing Tesla’s growth.

Competition & Market Pressure

Tesla faces increasing competition from both established automakers and new entrants in the electric vehicle market. This heightened competition may pressure Tesla’s market share and profit margins.

Regulatory/Policy Concerns

Changes in government policies and incentives can significantly impact Tesla’s sales. The expiration of the federal EV tax credit has already affected demand, and future policy changes could pose additional challenges.

Tesla’s Strategic Moves and Outlook

To deal with the end of the EV tax credit, Tesla introduced a $6,500 lease credit. This is meant to keep demand high and support vehicle sales without federal incentives.

Tesla is also focusing on long-term AI projects. The company plans a robo-taxi service and a humanoid robot, both expected to launch in 2026. These projects aim to add new income and reduce reliance on car sales.

Analysts believe Tesla’s market value could reach $3 trillion by the end of 2026. Growth is expected from AI and robotics. Still, Tesla faces challenges like rising competition and possible government rules that could affect its plans.

Expert Opinions and Market Insights

Financial analysts have expressed mixed views on Tesla’s future prospects. While some remain optimistic about the company’s long-term growth potential, others caution that challenges such as high valuation and increased competition could impact performance.

Investor sentiment is increasingly shifting toward Tesla’s long-term artificial intelligence prospects, including the development of a robo-taxi service and a humanoid robot. These initiatives have spurred multiple price target increases, with analysts projecting significant growth if Tesla successfully executes its plans.

Wrap Up

Tesla’s record-breaking third-quarter deliveries highlight the company’s ability to capitalize on favorable market conditions. However, the expiration of the federal EV tax credit and increasing competition present significant challenges. The company’s strategic focus on artificial intelligence and robotics may provide new revenue streams, but successful execution is crucial. Investors must weigh these factors when evaluating Tesla’s future prospects.

Frequently Asked Questions (FAQs)

Tesla delivered a record 497,099 cars in Q3 2025. On October 2, 2025, its stock fell 5.1% due to the tax credit ending, high valuation, and market competition.

The $7,500 U.S. EV tax credit ended on September 30, 2025. Q3 sales surged as customers rushed to buy. Future demand may fall without incentives; Tesla offers lease credits.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.