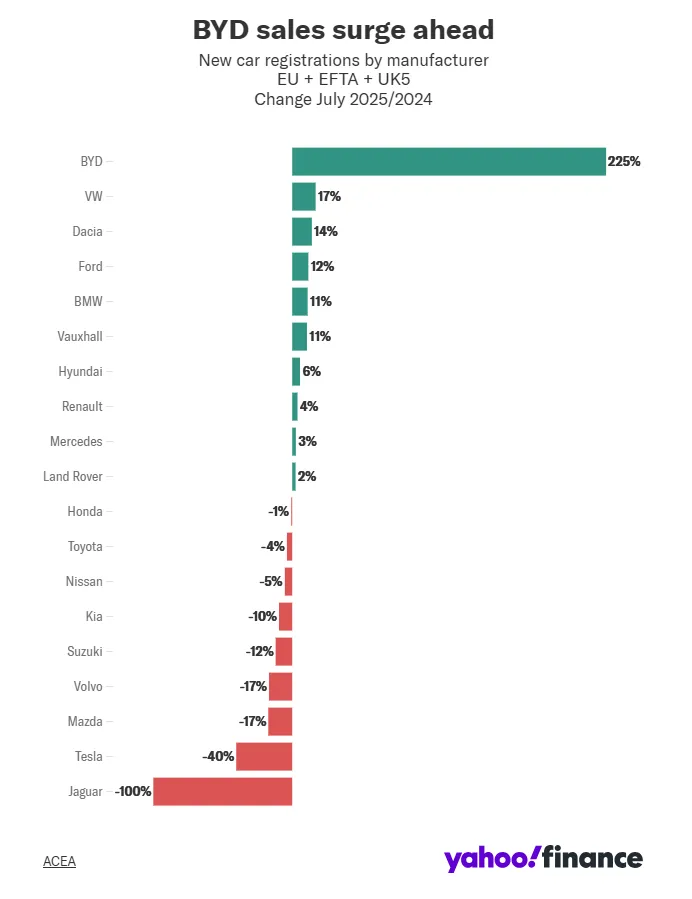

Tesla Sales Plunge 40% in Europe as BYD Gains Ground in July

Tesla faces tough times in Europe. In July, Tesla registrations dropped 40% from last year. They hit just 8,837 units.

This marks seven straight months of falls for Tesla. Their market share fell to 0.8% from 1.4%. Meanwhile, BYD surged ahead.

BYD saw 13,503 new registrations in July. That’s a 225% jump year-on-year. They grabbed 1.2% market share.

Why Tesla Struggles in Europe

Tesla deals with fierce rivals. Chinese brands like BYD grow fast. They offer fresh models.

Tesla’s lineup feels old. No big updates came lately. This hurts sales.

Elon Musk’s words cause harm. His politics turn off buyers. Reputation matters in Europe.

BYD’s Rise and Market Shifts

BYD thrives in Europe. Their sales boomed in July. They lead Chinese brands.

Overall EV sales rose 33.6% in July. Chinese firms hit over 5% share in half the year. This shows change.

Tesla must adapt. Competition grows. New players take ground.

Key Factors Behind BYD’s Success

BYD builds affordable cars. They appeal to buyers. Prices draw crowds.

They expand fast in Europe. More models launch. Variety helps.

Tech advances aid them. Better batteries last longer. Users like that.

Tesla’s Plans to Fight Back

Tesla eyes a cheap EV. It comes in late 2025. Volume production starts then.

This could boost sales. Fresh options attract buyers. Tesla needs this win.

They focus on tech. Autopilot improves. Features draw fans.

Upcoming Tesla Models

- Model 2: Affordable entry-level car.

- Cybertruck: Rugged truck for adventure.

- Updated Model Y: Better range and speed.

These aim to refresh the brand.

Impact on Tesla Stock Market

Tesla stock feels the pain. Shares fell over 13% this year. Investors watch Europe.

Q2 revenue dropped 12% to $22.5bn. Sales dips hurt profits. Stock market reacts.

We track these trends. Tesla’s moves affect shares. Europe plays a big role.

Tesla Stock Performance

- Q2 Performance

- Revenue Change: -12%

- Share Drop: -13% YTD

- Market Share: 0.8% (Europe)

- July Performance

- Sales Decline: -40%

- Share Drop: N/A

- Market Share: 1.2% (BYD)

Broader EV Market Trends

EV sales grow in Europe. Battery cars lead the way. Green policies help.

Chinese brands surge. They offer value. Europe welcomes them.

Tesla pioneered EVs. Now others catch up. Innovation is key.

Challenges for Established Brands

Legacy firms lag. They switch slow. Tesla feels this too.

Supply chains shift. Batteries from Asia dominate. Costs drop.

Regulations push EVs. Bans on gas cars loom. All must adapt.

How Tesla Can Regain Ground

Tesla invests in factories. Europe gets more plants. Local builds cut costs.

They improve service. Faster fixes build trust. Happy owners spread word.

Partnerships help. Team with locals. Expand reach.

Strategies for Growth

- Cut prices on current models.

- Launch ad campaigns in Europe.

- Boost charging networks.

These steps could turn tides.

Stock Market Reactions to EV Shifts

Stock market eyes EV wars. Tesla’s dips worry holders. BYD’s rise lifts rivals.

Investors seek growth. Europe data sways picks. We watch close.

Volatility marks this space. News drives swings. Tesla news hits hard.

Investor Tips Without Advice

Track sales reports. Monthly data reveals trends. Europe matters a lot.

Watch competitors. BYD’s moves signal shifts. Stock market follows.

Diversify if possible. EVs are just one sector. Balance helps.

Global Context for Tesla

Tesla sells worldwide. Europe is one piece. US and China dominate.

But Europe grows EVs fast. Policies favor them. Tesla must compete.

Aging models hurt everywhere. Refresh is vital. Stock market agrees.

Regional Sales Comparison

- Europe: Down 40% in July.

- China: Stable but competitive.

- US: Mixed with incentives.

This shows varied markets.

Future Outlook for Tesla in Europe

Tesla plans big in 2025. New car could change game. Sales may rebound.

BYD keeps pushing. They won’t slow. Tesla needs speed.

We see potential. Innovation wins. Stock market bets on it.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.