Titan Stock Rises 4% After Strong Q2 Growth in Consumer Segment

On October 8, 2025, Titan Company’s stock surged over 4% following the announcement of its Q2 FY26 results. The July-September quarter saw a robust 20% year-on-year growth in its consumer businesses, signaling strong market demand and strategic execution. This performance underscores Titan’s resilience and adaptability in a competitive market.

The company’s consumer segments, jewelry, watches, eyewear, and emerging lifestyle categories contributed significantly to this growth. Despite challenges such as rising gold prices, Titan’s diversified portfolio and strategic initiatives have positioned it well to capitalize on market opportunities.

Let’s check the key factors driving Titan’s recent success, analyze the performance of its various business segments, and explore the implications for investors and the broader market.

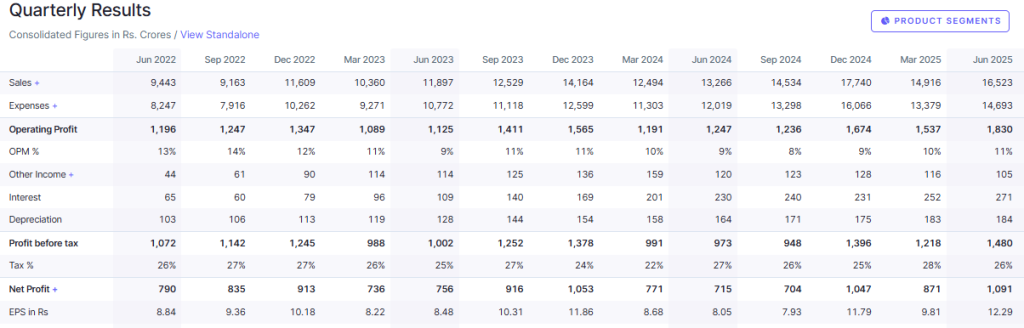

Titan Overview of Q2 Performance

Titan Company Ltd reported a robust 20% year-on-year (YoY) growth in its consumer businesses for the July-September quarter of FY26. This performance was driven by strong domestic demand, festive season spending, and strategic retail expansion.

Despite challenges such as rising gold prices, Titan’s diversified portfolio and operational efficiencies helped mitigate potential impacts on profitability. The company’s consolidated net profit for the quarter reached ₹1,091 crore, reflecting a 52.5% increase compared to the same period last year.

Consumer Segment Growth

Titan’s consumer segment, including jewellery, watches, eyewear, and lifestyle products, grew strongly in Q2 FY26. The jewellery division, making up almost 90% of revenue, rose 19% year-on-year. Brands like Tanishq, Mia, Zoya, and CaratLane helped this growth. CaratLane added 10 new stores during the quarter.

The watches segment grew 12%, led by a 17% rise in analog watch sales. Smart wearables fell about 23%. Eyewear sales rose 9%, supported by high demand for international brands and sunglasses, especially online.

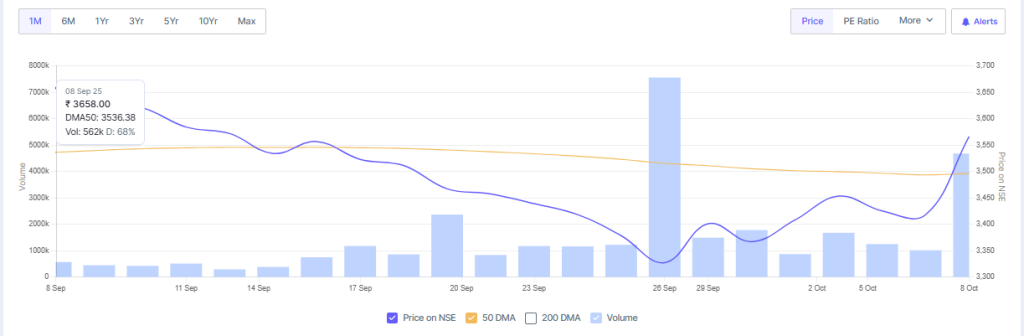

Factors Driving Stock Increase

Titan’s stock price surged by over 4% on October 8, 2025, following the announcement of its Q2 FY26 results. The market responded positively to the company’s strong performance across its consumer segments and its ability to navigate challenges such as rising gold prices.

Analysts noted that Titan’s strategic retail expansion, with the addition of 55 new stores during the quarter, enhanced its market presence and accessibility to consumers.

Competitive and Industry Context

Titan is a top player in India’s jewellery and lifestyle market. It competes with Kalyan Jewellers and Malabar Gold & Diamonds. The company’s focus on organized stores, strong brand, and customer trust helps it take a large market share. The industry is moving toward premium products, as more consumers choose high-quality items. This trend benefits Titan, which offers many premium options.

Expert Opinions and Analyst Recommendations

Analysts are positive about Titan’s future. The company has a strong brand and a wide range of products. It has shown steady growth over time. Titan quickly adapts to changing customer needs and keeps expanding its stores. Many analysts have raised their ratings, expecting Titan to perform well in the consumer market.

Risks and Considerations

Despite its strong performance, Titan faces potential risks, including fluctuations in gold prices, which can impact consumer purchasing behavior. Additionally, the decline in the smart wearables segment indicates the need for innovation and adaptation to technological trends. The company must also navigate the competitive landscape and maintain its brand appeal to sustain growth.

Final Words

Titan’s Q2 FY26 results show its strength and smart strategies in growing its consumer businesses. Strong performance, store expansion, and brand power put Titan in a good position. Investors and market watchers will watch how Titan keeps its growth and adapts to changing market conditions in the next quarter.

Frequently Asked Questions (FAQs)

Titan stock rose 4% on October 8, 2025, because its Q2 FY26 results showed strong growth in consumer businesses. Investors were confident about its sales and profits increasing.

Titan’s 20% growth in Q2 FY26 came from strong demand for jewelry, watches, and eyewear. New stores opened and festive-season sales helped the company earn more revenue.

Titan’s international business grew by 86% in Q2 FY26. New stores in West Asia and Southeast Asia, and higher exports, boosted global sales for the company.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.