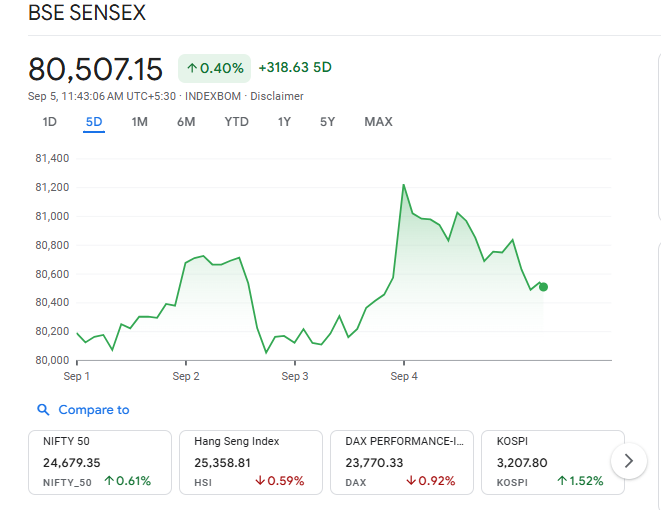

Today Share Market Open: Sensex, Nifty Poised for Another Day of Gains

The Indian share market opened today on a strong note, with both Sensex and Nifty showing signs of another winning session. This rise comes after a week of steady gains, which reflects how investors are feeling more confident about the economy. Global cues also played their part. Asian markets traded higher, while Wall Street closed positively overnight. Together, these signals gave our markets a strong push at the opening bell.

We can see the optimism building from several directions. Foreign investors are showing renewed interest. Domestic buyers are also supporting the market. Stable oil prices and hopes of steady inflation add to the positive mood. At the same time, corporate earnings are keeping many stocks in focus. This mix of global and local factors is shaping today’s upbeat start.

Investors or market watchers have a big question is whether this momentum will hold through the day. Let’s find out the early trends, key sectors, and stocks driving today’s move, along with expert insights on what to expect next in the share market.

Global & Domestic Market Sentiments

Today’s market strength comes from both global and domestic triggers. Asian indices opened higher, reflecting solid confidence overseas. Wall Street also closed in green, supported by soft labor data and the Federal Reserve’s dovish tone. These signals raised expectations of a potential interest-rate cut, which improves risk sentiment worldwide.

For India, the outlook turned brighter with supportive policy steps. The GST Council announced major tax reductions and introduced a simpler two-slab system. This reform is expected to lift consumer demand and ease compliance. Together, these factors created optimism among investors and added momentum to the share market at the opening bell.

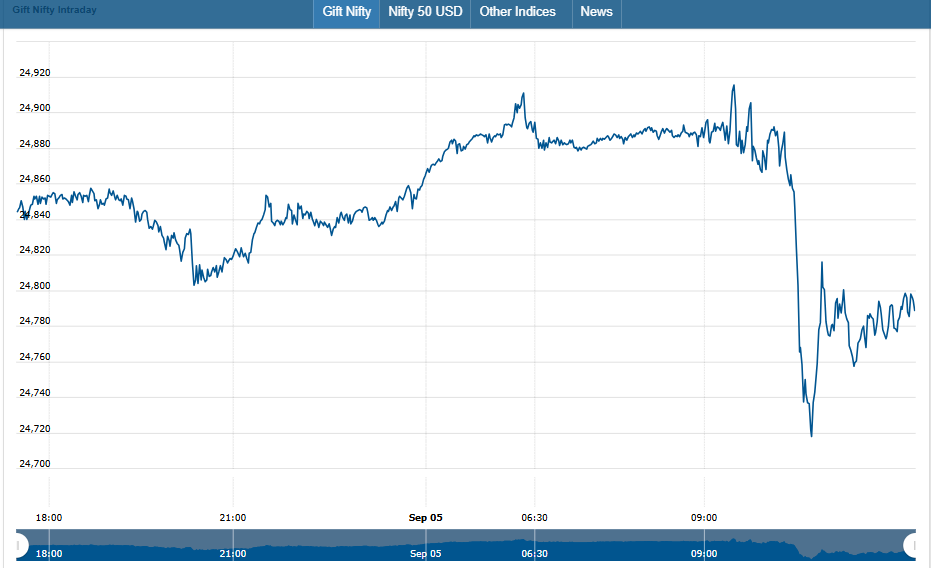

Pre-Market Trends & Opening Highlights

The GIFT Nifty futures provided a clear signal of a strong open. It was nearly 60 points above the previous close, pointing to solid momentum at the open. Markets began strongly. Sensex crossed the 81,000 mark, while Nifty rose past 24,800, registering nearly 0.36-0.37 % gains. Sensex reached around 81,012 and Nifty hovered near 24,820.

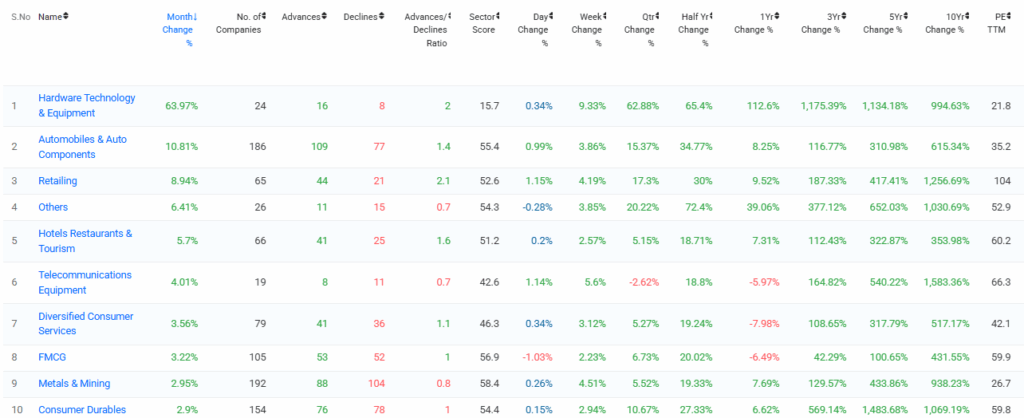

Sectoral Performance

Auto and consumer sectors stood out. They enjoyed a rally on the back of GST rate cuts. Auto stocks led, rising sharply, along with footwear stocks that also saw strong buying. In midday trades, auto and FMCG indices were among the top sector winners, up almost 2 %.In contrast, oil & gas names like GAIL and ONGC slipped, weighed down by higher levies.

Key Stocks in Focus Today

Some heavyweight stocks drove today’s gains. Reliance Industries and HDFC Bank helped push the broader index higher. Many auto names jumped thanks to the GST relief expected to boost consumption. While specific small-cap or mid-cap names weren’t singled out, ongoing themes like tax reforms and festive season demand could lift them further.

Economic & Policy Drivers

The main policy driver today was the GST revamp. The tax cuts and simplified rate slabs are meant to boost consumption and ease compliance. This has raised hopes for faster economic growth. Additionally, expectations of a U.S. interest-rate cut supported global risk appetite, adding buoyancy to Indian markets.

Expert Opinions, Market Outlook & Risks

Analysts see this rally as a response to the GST optimism and global cues. Money markets are pricing in a near-certain Fed rate cut, and that could mean more foreign flows into India. But some caution remains. Market watchers note that the GST expectations may be baked into prices already.

Profit booking could temper the rally. Past behavior shows that once major events approach, markets often see a “buy-on-expectations, sell-on-news” pattern. Some sectors, like energy, are lagging and may drag further if global oil price dynamics worsen.

Wrap Up

Today’s market open reflects widespread optimism, fueled by planned GST reforms and a hopeful glance at U.S. Fed policy. Gains came fast and strong, led by auto, consumer, and select heavyweight names. The weight of expectation is high, though profit booking could appear soon. Still, India’s long-term outlook holds promise if consumption revives and reforms continue to support growth.

Frequently Asked Questions (FAQs)

On September 5, 2025, the Sensex and Nifty opened higher due to hopes of a GST tax cut, stronger global markets, and rising investor confidence following possible U.S. Federal Reserve rate cuts.

On September 5, 2025, the auto and FMCG sectors benefited the most from the GST reforms, while energy stocks, such as GAIL and ONGC, faced selling pressure due to higher levies.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.