TotalEnergies Secures 21-Year Agreement to Supply Power to Google’s Malaysia Data Centres

On December 16, 2025, TotalEnergies signed a major 21-year power deal with Google to supply renewable electricity to the tech giant’s data centres in Malaysia. This long-term contract will deliver about 1 terawatt-hour of clean energy from the planned Citra Energies solar plant in Kedah, starting once construction finishes in early 2026.

This deal is unusual because of its length and scale. Most power purchase agreements (PPAs) run for 10-15 years, but this one locks in clean power for more than two decades. It shows how big tech companies like Google are changing the energy market by seeking stable, green electricity for huge power needs.

Malaysia’s growing role in cloud computing and renewable energy makes this agreement even more important. Google plans a major data centre expansion here, and long-term clean power gives the company reliable energy plus progress toward its sustainability goals.

Inside the TotalEnergies-Google Power Agreement

TotalEnergies and Google signed a 21-year power purchase agreement on December 16, 2025. The contract covers 1 terawatt-hour (1 TWh) of certified renewable power. The electricity will come from the Citra Energies solar plant in Kedah. Construction on the solar site is slated to begin in early 2026, and supply is expected to start in the first quarter after financial close.

The PPA is structured to deliver the equivalent of about 20 MW of continuous output. TotalEnergies retains responsibility for building and operating the solar facility. Google will receive certified renewable energy to match part of its Malaysian data-centre demand. Long tenors like 21 years are rare in the market. They offer price certainty for buyers and stable revenue for developers.

Why Malaysia Is Becoming a Data Centre Power Hub?

Malaysia offers several practical advantages. Land costs are lower than in Singapore. Grid access is improving. The government has also moved to encourage corporate green power through incentive schemes. These factors make Malaysia attractive for hyperscalers that need space and stable electricity. Google’s data-centre expansion in the country raises the bar for local energy projects.

Regional competition remains strong. Indonesia, Thailand, and Vietnam are all racing to host new cloud capacity. Malaysia’s edge is a mix of cost, policy clarity, and growing renewables capacity. The TotalEnergies deal signals that international buyers see the country as ready for large, long-term energy partnerships.

TotalEnergies’ Asia Strategy: Quiet Expansion, Big Impact

This agreement fits a larger pivot by oil majors into renewable power and grid services. TotalEnergies has been expanding its solar and wind projects across Asia. The company now pursues long PPAs with big corporate buyers. These contracts lock in cash flows and lower exposure to volatile oil and gas prices. The Malaysian PPA strengthens that strategy.

The deal also builds local partnerships. TotalEnergies holds a majority stake in the Citra Energies project with Malaysian partners. That joint approach helps navigate permits and local supply chains. It also reduces execution risk for a project that must operate reliably over two decades.

Google’s Energy Playbook: Locking Power Before Demand Explodes

Google is buying long-term clean power to match rising demand. AI workloads and cloud services raise energy needs fast. Long PPAs secure physical and financial supply. They also help meet corporate climate pledges. For Google, the Malaysia contract is one of several global deals aimed at stabilizing energy costs and greening operations.

Hyperscalers prefer bundled and certified renewable volumes. That approach ensures the company can claim emissions benefits while the grid transitions. A 21-year term hedges against future price shocks. It also signals to investors and regulators that energy planning is integral to digital infrastructure growth.

The Economics Behind a 21-Year Power Deal

Long durations shift risk. Price risk moves from the buyer to the seller. TotalEnergies bets on steady returns from a fixed-term revenue stream. Google secures supply and partly shields itself from spot price spikes. Both sides gain predictability. However, execution and regulatory risk remain over such a long period.

Inflation, currency moves, and evolving carbon rules are relevant. Contracts typically include price escalators or indexation clauses. Developers may lock financing with the PPA as collateral. That reduces the company’s cost of capital and enables faster project delivery. For investors, the stable cash flow is easier to value than commodity earnings.

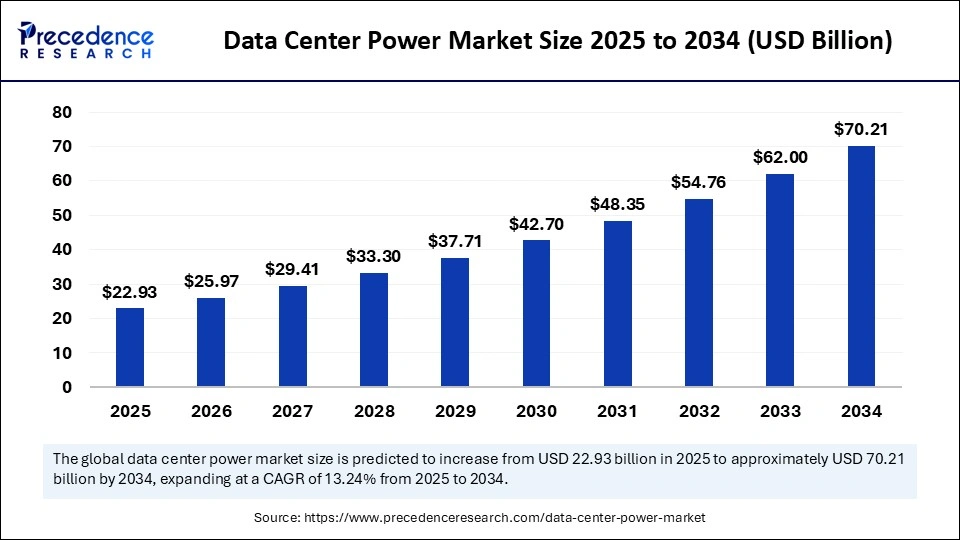

What does this mean for the Global Data Centre Energy Market?

Big tech firms are becoming dominant energy customers. Their demand shapes where and how new renewable capacity is built. This deal shows a trend: large corporate buyers will sign longer contracts to secure green power. Utilities and energy companies must adapt. They need more flexible offerings and grid upgrades to serve concentrated loads near data parks.

The result could be faster investment in regional renewables. It could also create a two-tier market where hyperscalers get priority access to green supply. Smaller firms might face higher costs or less direct access to long PPAs. Policymakers should watch these dynamics and consider frameworks that spread benefits broadly.

Investor Takeaways: TotalEnergies vs. Traditional Energy Peers

For investors, long PPAs translate into more predictable earnings streams. TotalEnergies can present the Malaysia contract as proof of its pivot to power-based revenues. That can improve forward-looking cash-flow visibility. Comparisons with peers show the same pattern: majors seek regulated-like assets to offset oil cycle exposure.

However, investors should track project execution, permit timelines, and the contracting counterparty’s credit profile. A PPA is only as strong as the underlying plant and the contractual protections in place. Monitoring the Citra Energies project through early 2026 will be key to assessing near-term risk. An AI stock research analysis tool can help model how this PPA changes projected free cash flow and valuation for TotalEnergies.

Risks and Challenges to Watch

Regulatory shifts in Malaysia could alter the economics. Grid congestion or transmission delays could slow delivery. Data-centre demand is great but not immune to market cycles. Finally, long tenors carry execution risk over decades. Stakeholders must track permits, construction milestones, and local supply-chain issues closely.

Big Picture: Energy, AI, and the Next Decade

This 21-year deal is more than a corporate contract. It highlights how digital demand will reshape power systems. Tech firms will increasingly act like utilities. Energy firms will act like infrastructure providers. Policymakers, investors, and local communities will all feel the impact. The Citra Energies project will be a test case. Its success or delay will offer lessons for future long-term PPAs across Asia.

Frequently Asked Questions (FAQs)

Google chose TotalEnergies for its long-term renewable supply experience. On December 16, 2025, the deal offered stable clean power, price certainty, and support for data centre growth.

The renewable power agreement runs for 21 years, starting from the signing date of December 16, 2025, making it one of Google’s longest clean energy contracts in Southeast Asia.

Google is expanding data centres in Malaysia due to lower costs, available land, and improved clean energy access. The country supports long-term digital growth and a stable power supply.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.