Trending Stocks Today (Dec 15, 2025): Tesla, iRobot, HSBC, Canopy Growth & STMicroelectronics in Focus

Stock markets opened the week with sharp moves and mixed signals on December 15, 2025. Investors are reacting fast. Headlines, analyst notes, and sector news are shaping decisions within minutes. This is why certain trending stocks are standing out today.

Tesla is back in focus as valuation concerns clash with its long-term growth story. iRobot is making waves for a very different reason. Its bankruptcy news has sparked questions about the future of consumer robotics. HSBC is trending after fresh analyst actions that reflect shifting institutional sentiment. At the same time, Canopy Growth is gaining attention as policy hopes lift the cannabis space once again. STMicroelectronics is also on investors’ radar, supported by renewed confidence in the semiconductor cycle.

These stocks are not trending by chance. Each reflects a deeper market theme. From risk appetite to sector rotation, today’s movers offer clues about where money is flowing next. Understanding these signals matters, especially in a volatile year like 2025.

Trending Stocks December 2025

Tesla (TSLA): Valuation Pressure Meets Long-Term Bets

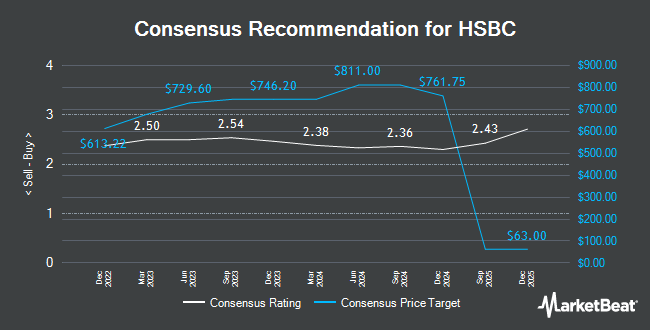

Tesla faces fresh scrutiny on December 15, 2025. Analysts point to a gap between price and profits. HSBC has kept a Reduce rating in recent weeks. That call highlights lower profit forecasts and rising competition. Investors worry if growth is already priced in. Yet Tesla still leads in EV scale and software ambitions. Upcoming product timelines and margins will matter most. Watch for updates on vehicle deliveries and energy unit growth. Traders should weigh valuation risk against the firm’s execution path.

iRobot (IRBT): Bankruptcy and a Quick Buyout

On December 15, 2025, iRobot filed for Chapter 11 and agreed to be bought by its manufacturer. The move came after a steep revenue decline and heavy cost pressures. The buyer will assume key debt and keep operations running.

Common shareholders face severe losses. The deal may calm suppliers and customers. Still, this signals a shakeout in consumer robotics. The sector could see tighter margins and more consolidation ahead. Privacy and supply chain questions may resurface under new ownership.

Canopy Growth (CGC): Policy Hopes Fuel a Sharp Rally

Canopy soared after reports of possible federal cannabis reclassification. Investors reacted to policy talk on December 12-13, 2025, which extended into trades on December 15. The market expects easier banking, tax, and licensing rules if rescheduling happens. That could unlock U.S. demand and lift profits for major growers.

Still, regulatory shifts take time. Companies must prove they can scale and control costs. The rally reflects speculative flows as much as fundamentals. Keep an eye on concrete regulatory actions before assuming lasting gains.

STMicroelectronics (STM): Chip Demand and a Strategic Win

STMicroelectronics reported a notable production milestone in early trade on December 15, 2025. The firm highlighted large shipments tied to space and communications partners. That news adds confidence about order flow for advanced chips.

Semiconductors are seeing renewed appetite from AI and automotive markets. STM’s broad product mix helps it ride both trends. Still, the sector can swing fast on inventory cycles. Monitor forward bookings and margin trends to judge sustainability.

HSBC’s Moves: More than a Single Rating

HSBC’s analyst actions are shaping headlines. The bank’s Tesla rating and price-target commentary highlight deeper worries about margins and product cycles. Institutional calls like this can shift short-term flows. They also guide other analysts and funds. That said, ratings change with new data. Investors should track fresh reports and not react solely to a single note. Look for corroborating signals from earnings and sector trends.

Trading Signals and What to Watch Next

Volume spikes and big price gaps tell the short-term story. For Tesla, watch delivery updates and software milestones. Monitor iRobot court filings and supplier notices. For Canopy Growth, follow any formal action on federal scheduling. For STMicroelectronics, check order books and partner announcements. Use an AI tool for fast scans of filings and headlines if processing many tickers. Keep trades small when news drives moves. Volatility can flip quickly in late-year markets.

Final Words: Key Takeaways for December 15, 2025

These five trending stocks reveal larger market themes on December 15, 2025. Tesla shows valuation stress amid growth promises. iRobot marks consolidation in consumer robotics. Canopy Growth reflects policy-driven speculation. STMicroelectronics benefits from renewed chip demand. HSBC’s analyst signals remind investors to check fundamentals before acting. Follow confirmed regulatory steps and official filings. That will separate short swings from lasting trends.

Frequently Asked Questions (FAQs)

Tesla stock is trending on December 15, 2025, due to fresh analyst ratings, valuation concerns, and investor focus on delivery outlook, margins, and long-term growth expectations.

iRobot stock crashed on December 15, 2025, after the company filed for Chapter 11 bankruptcy and announced a buyout deal that leaves existing shareholders with limited value.

Canopy Growth stock is rising on December 15, 2025, as investors react to renewed optimism around possible U.S. cannabis policy changes and improved regulatory support for the sector.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.