Trending Stocks Today: TSMC, Salesforce, Hims & Hers, and Nestlé Lead Market Buzz

On October 16, 2025, four major companies TSMC, Salesforce, Hims & Hers, and Nestlé made headlines in the stock market. Their recent developments are influencing investor sentiment and market trends.

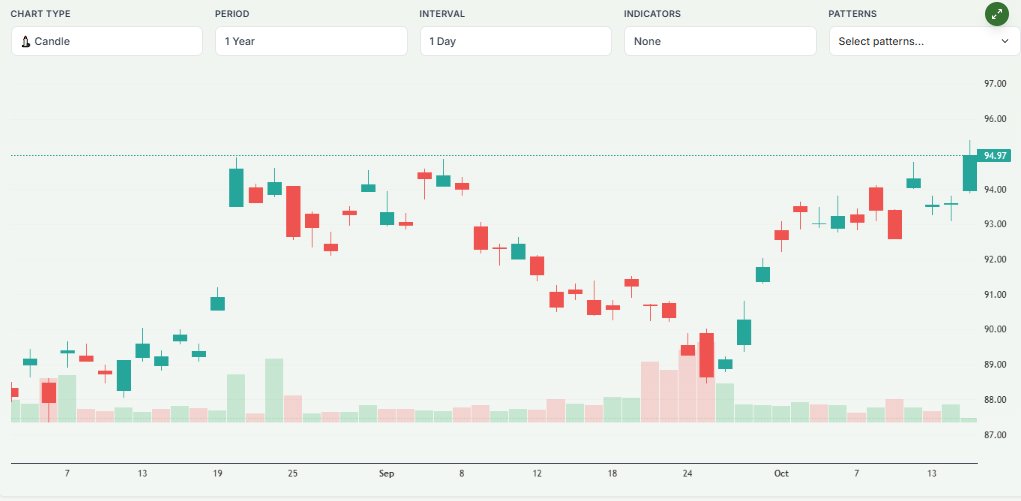

TSMC, a leader in semiconductor manufacturing, reported a record profit of $15.12 billion for Q3 2025. This performance is attributed to the growing demand for AI chips, boosting investor confidence.

Salesforce, a prominent CRM software provider, announced a new revenue target of over $60 billion by 2030. This ambitious goal, coupled with a $15 billion investment in AI initiatives, has positively impacted its stock price.

Hims & Hers, a telehealth company, saw its stock jump 9% following the launch of its menopause care services. This expansion into women’s health is expected to drive future growth.

Nestlé, a global food and beverage giant, reported stronger-than-expected Q3 sales, leading to an 8% surge in its stock price. The company also announced plans to cut 16,000 jobs as part of a restructuring effort.

These developments highlight the dynamic nature of the stock market and the factors influencing investor decisions.Let’s analyze in detail.

Market Overview with Trending Stocks

On October 16, 2025, the stock market showed mixed signals. While some sectors experienced growth, others faced challenges. The technology sector, particularly companies involved in artificial intelligence (AI), saw significant gains. Conversely, the consumer staples sector experienced volatility due to corporate restructuring efforts. Investors are closely monitoring these developments, as they could indicate broader economic trends.

TSMC: A Leader in Semiconductor Innovation

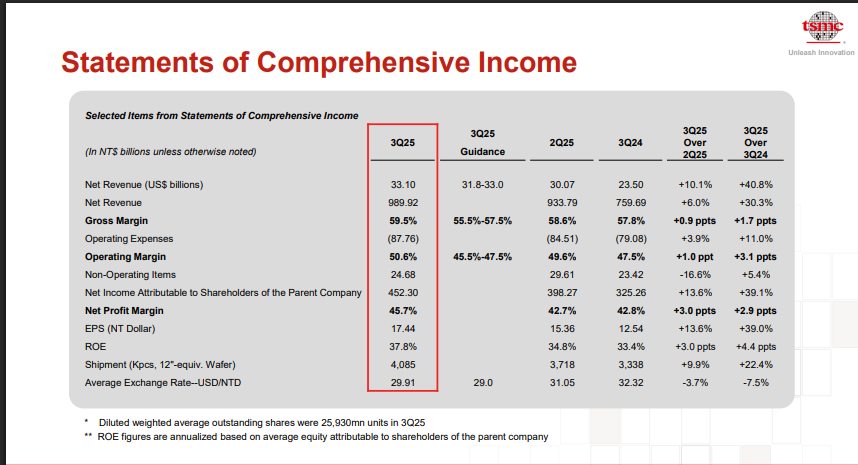

Taiwan Semiconductor Manufacturing Company (TSMC) reported a record-breaking third-quarter net profit of $15.12 billion, a 39.1% increase from the previous year. This surge is attributed to the growing demand for AI chips, with TSMC anticipating the AI chip market to double in 2025 and grow at an annual rate of around 45% over the next five years. The company also announced plans to expand its operations in the U.S. and Japan, investing a total of $165 billion to mitigate risks from geopolitical tensions and supply chain disruptions.

Salesforce: Projecting Future Growth

Salesforce announced a new revenue target of over $60 billion by 2030, surpassing Wall Street’s average forecast of $58.37 billion. This optimistic outlook is driven by the company’s rapid integration of AI features into its cloud offerings. The forecast does not include the effects of its pending $8 billion acquisition of software-maker Informatica, a move designed to bolster Salesforce’s AI capabilities through enhanced data management and integration tools.

Hims & Hers: Expanding Healthcare Services

Hims & Hers Health (HIMS) saw its stock jump 9% following the announcement of a new menopause care program. The launch builds on the company’s recent expansion into hormone replacement therapy (HRT), including testosterone treatments, and reflects a strategic extension of its Hers brand. The company plans to offer personalized treatments for perimenopause and menopause, including estradiol and progesterone in various forms like pills, patches, and creams.

Nestlé: Restructuring for Efficiency

Nestlé reported stronger-than-expected third-quarter sales, leading to an 8% surge in its stock price. The company also announced plans to cut 16,000 jobs as part of a restructuring effort aimed at improving efficiency and profitability. These job reductions represent about 6% of Nestlé’s global workforce and are expected to generate annual savings of CHF 1.0 billion by the end of 2027.

Trending Stocks: Analysis of Common Trends

The recent performance of these companies highlights several key trends:

- Companies like TSMC and Salesforce are leveraging AI to drive innovation and growth.

- Hims & Hers is diversifying its services to meet the evolving needs of consumers.

- Nestlé’s workforce reduction reflects a broader trend of companies seeking efficiency through restructuring.

Expert Opinions about Trending Stocks

Analysts view TSMC’s strong earnings as a positive indicator of the growing demand for AI technologies. Salesforce’s ambitious revenue target suggests confidence in its AI strategy, though some caution that execution will be key. Hims & Hers’ expansion into menopause care is seen as a strategic move to tap into a growing market. Nestlé’s restructuring efforts are viewed as necessary steps to maintain competitiveness in a challenging market.

Wrap Up

The developments at TSMC, Salesforce, Hims & Hers, and Nestlé underscore the dynamic nature of today’s markets. Investors should stay informed about these trends, as they could offer opportunities for growth and insight into broader economic shifts.

Frequently Asked Questions (FAQs)

TSMC’s stock is up due to a record Q3 profit of $14.8 billion, driven by strong demand for AI chips and a raised 2025 revenue forecast.

Salesforce is integrating AI into its cloud services, aiming for over $60 billion in revenue by 2030. The company also plans a $7 billion share buyback.

Nestlé’s stock rose after reporting strong Q3 sales and announcing plans to cut 16,000 jobs. Hims & Hers’ stock increased following the launch of a new menopause care program.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.