Trump Gold Card Launches: How the $1 Million Visa Works

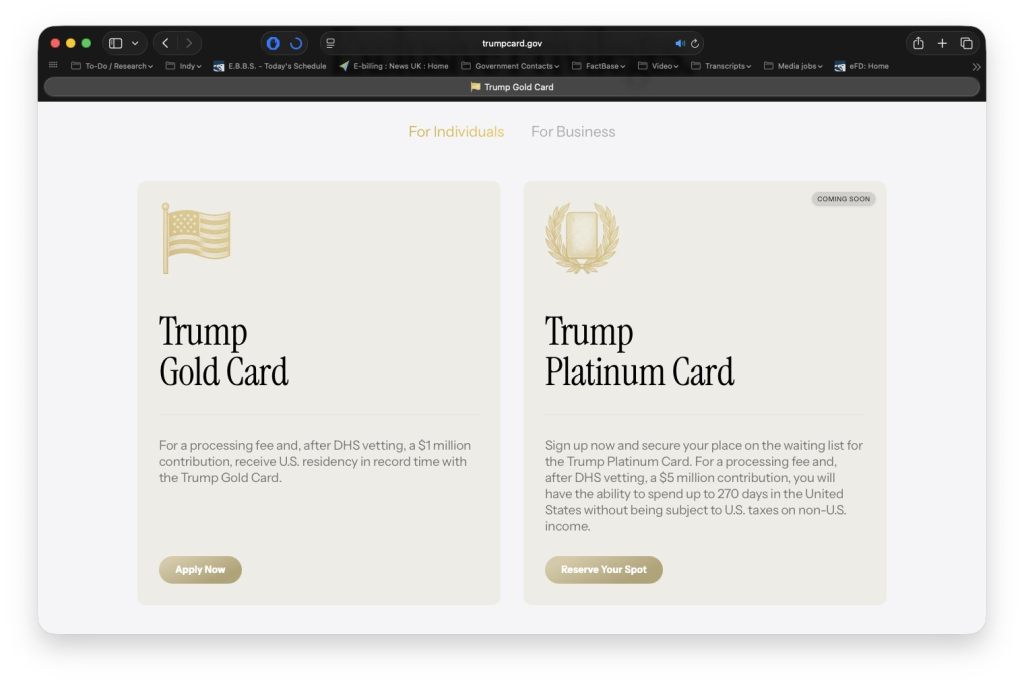

On December 10, 2025, the United States government officially launched the Trump Gold Card program. Under the new rules, foreigners who contribute US$1 million can gain a fast-track visa, a “golden ticket” to U.S. residency. They must also pay a $15,000 processing fee and pass security checks.

The idea is bold. It promises to turn wealth directly into immigration privileges. Some see it as a new chance for global talent and investors. Others wonder if it turns American residency into a luxury good.

Let’s explore how the Trump Gold Card works. We ask what it offers and what it really means.

What exactly is the Trump Gold Card?

The Trump Gold Card is a premium visa program rolled out by the administration in December 2025. Applicants must pay a $15,000 Department of Homeland Security processing fee and then make a $1,000,000 contribution described on the government site as a “gift” to secure expedited residency.

The official site and public statements say the card grants fast-tracked permanent residency with special benefits and priority adjudication. The White House presentation also advertised a corporate path: companies can sponsor foreign employees for $2 million per worker.

Why a $1 Million Visa? Strategic Breakdown

This program aims to attract very wealthy foreign talent and large corporate sponsors. Officials argue it will bring capital, elite skills, and tax revenue. The administration frames the card as a way to compete with investor programs in other countries and to replace or supplement older investor visas.

Critics say the price tag signals a shift: residency becomes a purchasable privilege rather than a merit or family-based benefit. The launch also ties into a broader political message about privileging business-friendly immigration while tightening other entry paths. Reuters and AP reported these official and critical angles on December 11, 2025.

The Benefits Package: What Million-Dollar Cardholders Actually Get?

Public materials promise fast processing and priority status in immigration queues. The site lists access to all 50 states and says cardholders will receive premium treatment in adjudication and interview scheduling. The administration also hints at exclusive events tied to the Trump brand and enhanced travel and consular services.

Families may be covered, but recent guidance suggests each dependent may face equivalent contribution and fee requirements. This point raises cost and fairness questions. Legal briefings from immigration firms confirm the DHS fee and outline derivative-beneficiary implications.

How the Visa Function Works: Technical & Financial Angle

The Gold Card is structured as a two-step process. First, applicants pay a nonrefundable $15,000 fee for vetting and background checks. After clearing vetting, applicants must pay the $1 million contribution. The government calls the payment a “gift” rather than an investment tied to job creation, which marks a shift from the EB-5 model. That means the program may lack explicit job-creation metrics.

Officials claim the program will be legally administered via new forms and OMB clearance, but experts note that creating a new visa category typically requires Congress. Fragomen and other immigration law firms published guidance after the launch about fees, derivative applicants, and procedural steps.

Who is the Card Targeting?

The program targets very wealthy individuals. Likely profiles include high-net-worth entrepreneurs, large-company executives, and foreign investors seeking U.S. base access. Corporations in technology, real estate, energy, and finance are obvious sponsors for the $2 million corporate route.

The government markets the card to graduates of U.S. universities who cannot easily transition off student visas. International applicants from regions with high capital mobility are the primary market. Several outlets noted a large number of pre-registrations and a waitlist, which suggests real demand among affluent foreigners.

Controversies and Legal Questions

The plan faces major legal and ethical questions. First, immigration law experts say the executive branch cannot unilaterally create a new permanent-residence category without Congress. Several legal analyses and opinion pieces warn of court challenges.

Second, critics call the program elitist. They argue it turns residency into a commodity and undermines the image of the United States as a haven for refugees and the middle class. Third, watchdogs warn about money-laundering and transparency risks in high-value investor programs, especially when job-creation rules are absent. Media coverage since the launch has pressed these legal and ethical points hard.

Economic Impact: What it means for Political Fundraising and Immigration Markets

If the program scales, it could generate large immediate cash inflows. Officials estimate billions in revenue from contributions. Commerce leaders also pitched the card as a way to retain top technical talent. However, economists caution that the long-run gains depend on whether cardholders actually invest in productive activity in the U.S. without job-creation requirements.

The move may spur other wealthy donors to seek comparable premium access, reshaping how campaigns and governments monetize elite support. Investment and policy analysts are already modeling scenarios. One market note even referenced an AI stock research analysis tool that flagged certain banking and real-estate companies as likely beneficiaries of wealthy inflows linked to new resident investors.

Is the Trump $1 million Gold Card worth it?

Value depends on the buyer’s goals. For a wealthy investor who mainly wants fast residency, the convenience may justify the cost. For families, the price multiplies. The absence of required job creation may reduce measurable economic returns. For countries and competitors, the U.S. offering is now among the priciest global investor programs.

Comparisons to the EB-5 program show one key difference: EB-5 ties funds to job creation and local projects, while the Gold Card frames the payment as a contribution with fewer direct economic strings attached. Legal uncertainty further reduces the program’s near-term value.

The Bigger Picture and Likely Next Steps

Expect legal pushback and legislative scrutiny. Immigration lawyers and professional groups will file briefs and likely ask courts to test the program’s legality. Congress may hold hearings on the scope and oversight of the Gold Card. The administration may respond by publishing implementing regulations and seeking statutory cover.

If litigation slows rollout, early applicants could face delays. If courts allow the program, expect a new market in high-net-worth migration options and industry actors facilitating applications. Reuters, AP, and major legal firms outlined these likely pathways after the December 11, 2025 announcement.

Conclusion: What to Watch

Watch these items closely: formal OMB clearance and new DHS forms, congressional hearings, court challenges, and the first wave of approved applicants. Also track whether the program spurs rival offers from other countries or prompts reforms to older investor visas like EB-5.

Finally, monitor transparency safeguards. Without clear job-creation rules or tight oversight, the Gold Card risks becoming a headline for inequality rather than a driver of broad economic growth. Official statements and coverage on December 11, 2025, mark the start of what will likely be a long legal and political story.

Frequently Asked Questions (FAQs)

The Trump Gold Card visa costs $1 million, plus a $15,000 processing fee. This price was confirmed in official updates released on December 11, 2025.

The program is open to wealthy foreign applicants who can pass security checks and pay the required fees. Rules were shared by officials on December 11, 2025.

The card offers fast processing, but it does not promise automatic approval. Applicants must meet all immigration rules set by the U.S. government as of December 2025.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.