Trump Tariff: U.S. to Cut China Import Duties from 57% to 47% After Fentanyl Talks with Xi

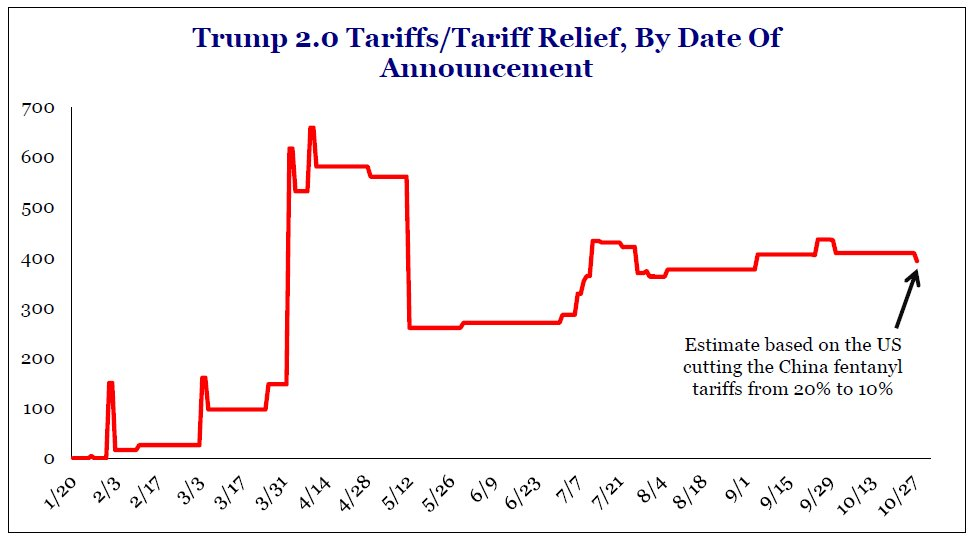

The United States has announced a major shift in its trade policy with China. On October 29, 2025, President Donald Trump confirmed plans to cut import duties on Chinese goods from 57% to 47%. This change comes right after high-level talks with Chinese President Xi Jinping about stopping the flow of fentanyl and its chemical ingredients into the U.S. The meeting marked a rare moment of cooperation between the two powerful nations on tariffs.

For years, Trump’s tariffs on Chinese imports have been at the center of global trade tension. Now, this tariff cut signals a possible reset in the relationship. Economists say it could help lower costs for U.S. consumers and ease inflation. But critics warn it might weaken American manufacturing and reward Beijing too soon. As trade barriers fall and diplomacy rises, the world is watching to see if this deal marks a true turning point in U.S.-China relations.

The Trump Tariff: Full Analysis

Background: The History of Trump’s China Tariffs

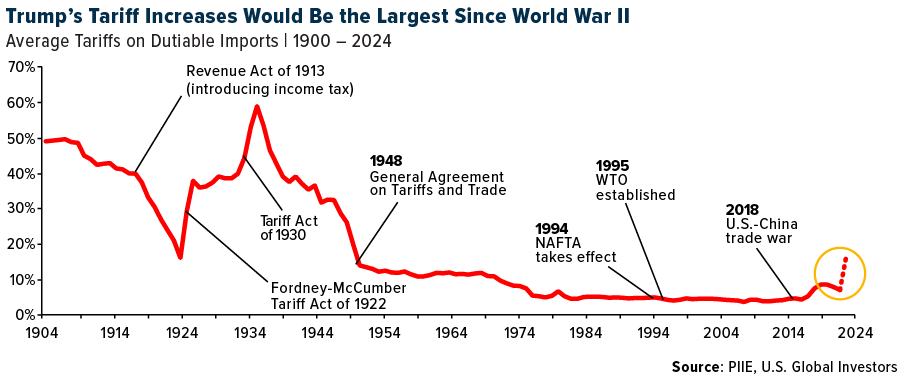

The tariffs trace back to the U.S.-China trade war that began in 2018. The original goal was to pressure China on trade deficits, intellectual-property theft, and forced technology transfer. The approach layered tariffs on hundreds of billions of dollars of Chinese goods. Over time, those duties multiplied into a complex tariff structure that many U.S. importers and global firms still navigate.

The tariffs raised costs for some American companies. They also reshaped supply chains and pushed firms to diversify sourcing. Policymakers have argued about their effectiveness for years. Some say the tariffs forced China to negotiate. Others say they mostly raised prices for U.S. consumers and businesses.

The Fentanyl Connection: Why it Mattered in these Talks?

Fentanyl is a highly potent synthetic opioid. The United States has faced a steep rise in overdose deaths in recent years. A key focus of U.S.-China discussions has been the flow of precursor chemicals used to make fentanyl and fentanyl analogues. U.S. officials have accused certain Chinese chemical suppliers and sometimes Chinese territory-based manufacturers of enabling illicit trade.

Curbing that flow became a political and humanitarian priority. In the recent summit, fentanyl controls were central to the bargaining chip: tariff relief in exchange for tougher Chinese action on the chemicals linked to U.S. overdoses.

Details of the Tariff-Reduction Deal

On October 30, 2025, President Donald Trump announced a reduction in the combined tariff burden on Chinese imports from about 57% to 47%. The move came after a face-to-face meeting with President Xi Jinping in Busan, South Korea, on the sidelines of regional summits. The specific change halved a 20-percentage-point levy aimed at goods tied to fentanyl precursor chemicals down to roughly 10 percentage points, producing the headline drop in the overall rate.

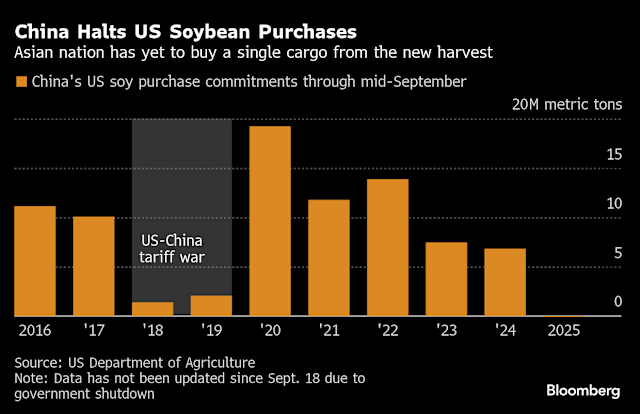

The deal also included related trade elements: Beijing agreed to resume purchases of U.S. soybeans and to pause or adjust restrictions on rare-earth exports that threatened critical supply chains. Both sides framed the package as a targeted, limited reset rather than a full rollback of broader trade measures.

Economic Impact on U.S. Businesses and Consumers

Lower tariffs will reduce landed costs for many importers. Retailers that depend on Chinese-made goods could see narrower margins and lower consumer prices. Tech manufacturers that source components in China may feel relief on the bill-of-materials costs. That could modestly ease inflationary pressure in certain sectors, although overall inflation depends on many factors beyond tariffs.

At the same time, domestic manufacturers that compete with cheaper Chinese imports may face renewed price pressure. Labor groups and some industry advocates in the U.S. warned that the tariff easing might weaken the leverage used to protect high-value manufacturing jobs. Financial analysts offered mixed projections: some expect short-term gains for consumers and corporate profits, while others expect limited medium-term gains if supply chains and investment patterns remain cautious.

China’s Gains and Global Market Reaction

For China, the Trump tariff cut restores competitiveness for exporters. That will likely support Chinese manufacturing output and help firms that had been squeezed by high U.S. duties. Global markets reacted quickly to the announcement. Equity markets showed pockets of gains in sectors tied to trade and commodities, while other assets moved modestly as investors digested the geopolitical implications. Commodity markets, especially soybeans, moved on news that Beijing would resume purchases from U.S. farmers.

The yuan’s reaction was muted but showed signs of stabilizing as trade tensions eased, at least temporarily. International observers noted that even a partial thaw between Washington and Beijing can trigger predictable ripple effects across supply chains and regional trade dynamics.

Political and Diplomatic Implications

The deal signals a pragmatic turn in a contentious relationship. For the Trump administration, the tariff cut is framed as a strategic tradeoff: barter tariff relief for concrete action on a severe public-health threat. This sets a precedent for tying trade concessions to non-trade security outcomes. Domestically, reactions split along partisan and sectoral lines. Supporters praised the arrangement as a win for U.S. farmers and consumers.

Critics, including some members of Trump’s political base and labor advocates, called it a risky concession that risks emboldening Beijing without guaranteeing sustained enforcement. Internationally, allies watched closely. A U.S.-China truce on key trade items may recalibrate alliances that had benefited from U.S. pressure on China’s trade practices. Yet core strategic issues, including Taiwan and advanced chip controls, remain unresolved.

Expert Opinions and Criticism

Economists and trade experts offered fast, divergent takes. Some economists called the targeted tariff rollbacks sensible if they produce measurable reductions in fentanyl precursors entering the illicit market. Others questioned whether customs enforcement can track and prevent diversion once duties change.

Trade analysts flagged the risk of short-term optics overshadowing long-term enforcement mechanisms. Security scholars warned that trading away tariff leverage might constrain future U.S. policy responses. Market strategists used scenario models to estimate modest GDP and inflation effects, but cautioned that such models hinge on whether China’s commitments are verifiable and durable.

Using an AI stock research analysis tool, a few analysts ran sensitivity checks showing small positive earnings effects for import-heavy retail chains under the revised tariffs.

Future Outlook of Trump Tariff: What Comes Next?

This agreement is a test of trust and verification. The United States will likely seek monitoring mechanisms to confirm China’s controls on precursors. If enforcement proves effective, further tariff recalibrations or a broader trade understanding could follow. Alternatively, if fentanyl flows persist or enforcement lapses, the U.S. could re-tighten duties or pursue secondary measures.

The one-year pause on some rare-earth tensions suggests room for negotiation, but it is fragile. Global firms will continue to hedge risk by diversifying suppliers and reworking supply chains. Policymakers must balance immediate relief to households and firms with long-term strategies that protect industrial capability and national security.

Closing Note

The October 30, 2025, agreement marks a pragmatic, if cautious, detente between two rival powers. It links trade relief to a pressing health and security problem. The move offers tangible short-term benefits for consumers and exporters. It also poses hard questions about leverage, verification, and long-term strategy. Markets and policymakers will now watch whether China’s commitments translate into fewer illicit fentanyl flows and whether the tariff shift endures as part of a broader reset or proves to be a temporary pause in a longer rivalry.

Frequently Asked Questions (FAQs)

On October 30, 2025, Donald Trump cut tariffs after talks with Xi Jinping to control fentanyl chemicals and improve trade relations between the U.S. and China.

The tariff cut may lower prices on imported goods, reduce inflation, and make electronics, clothing, and daily products cheaper for American consumers in late 2025.

The 2025 Trump-Xi deal shows a small step toward calmer trade relations, giving markets hope for better cooperation and more stable global trade flows.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.