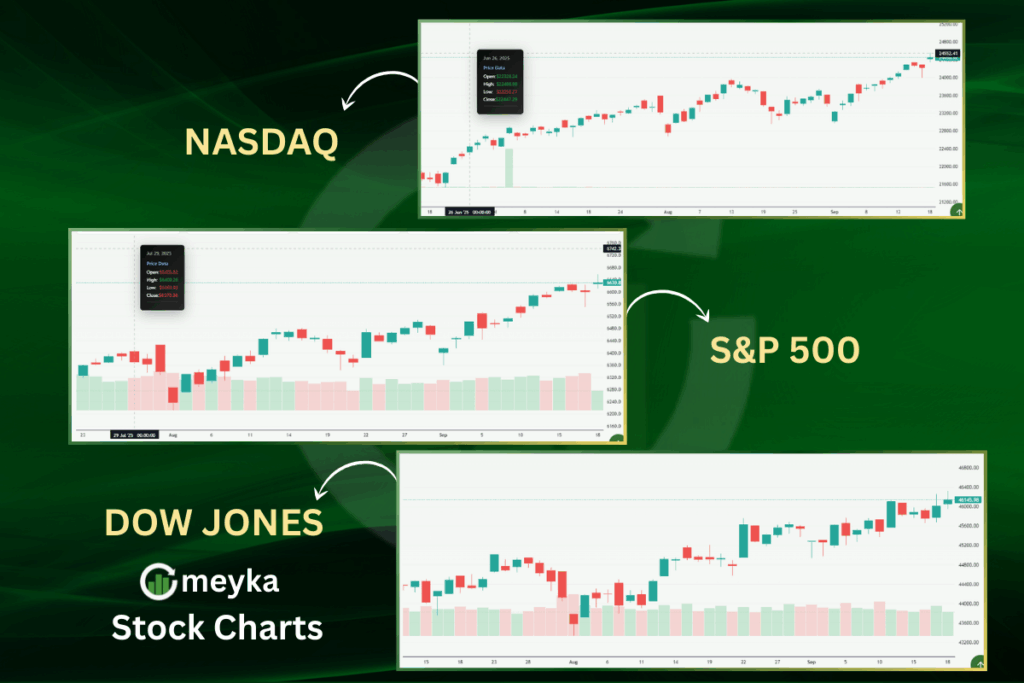

Trump-Xi Call Anticipated as Dow, S&P 500, Nasdaq Futures Climb

The U.S. stock market is waking up with energy. Futures for the Dow, S&P 500, and Nasdaq are climbing as traders wait for an expected call between Donald Trump and Xi Jinping. This is not just a routine chat. When the leaders of the world’s two biggest economies talk, global markets listen.

We know why. Every shift in U.S.-China relations touches trade, tech, and supply chains. A promise of cooperation can push markets up. A sharp remark can pull them down. Right now, investors are leaning toward hope. The call may signal progress, or at least reduce tension.

But we should not rush to conclusions. Futures often react to headlines, not outcomes. Traders may see short-term gains, while long-term growth depends on real policy change. As we watch the market’s next move, the Trump-Xi call shows how politics and money are tied closer than ever.

Market Snapshot

On September 19, 2025, U.S. index futures moved higher as traders awaited a call between President Trump and China’s Xi Jinping. Dow, S&P 500, and Nasdaq futures showed gains in premarket trade. Tech names led early interest. Oil and some commodity prices ticked lower, while the dollar eased. Volatility measures slipped, which pointed to calmer trading ahead.

Background on U.S.-China Relations

The United States and China have argued for years over trade and technology. Tariffs, chip bans, and supply chains are often at the center. Top-level talks between leaders can quickly move markets.

In September 2025, the U.S. and China reached a framework deal on TikTok. The plan shifts control to an American-led company. Data security and algorithms remain key issues.

China also opened probes into U.S. chip firms. These focus on analog and driver chips used in many electronics. Beijing said it was checking for unfair trade and discrimination.

Rare earth minerals are another flashpoint. The U.S. depends on China for critical supplies. New export curbs from Beijing raised alarms. In reply, a U.S. lawmaker suggested limiting Chinese flight rights unless access is restored.

Tariffs still hang over the trade relationship. Both countries added new duties in recent years. Washington linked some tariffs to fentanyl chemical concerns, while Beijing answered with its own measures.

Firms are also reshaping supply chains. Many now follow a “China+1” model, moving production to other countries. U.S. companies like MP Materials are investing in rare earth processing at home.

Investor Sentiment and Expectations

Investors hoped the call would soften trade tensions. Some traders expected clearer rules on tech exports. Others looked for hints of tariff rollbacks or new trade deals. Short-term traders bought riskier stocks. Long-term investors stayed cautious. Headlines can move prices quickly. It often takes real policy changes to keep gains.

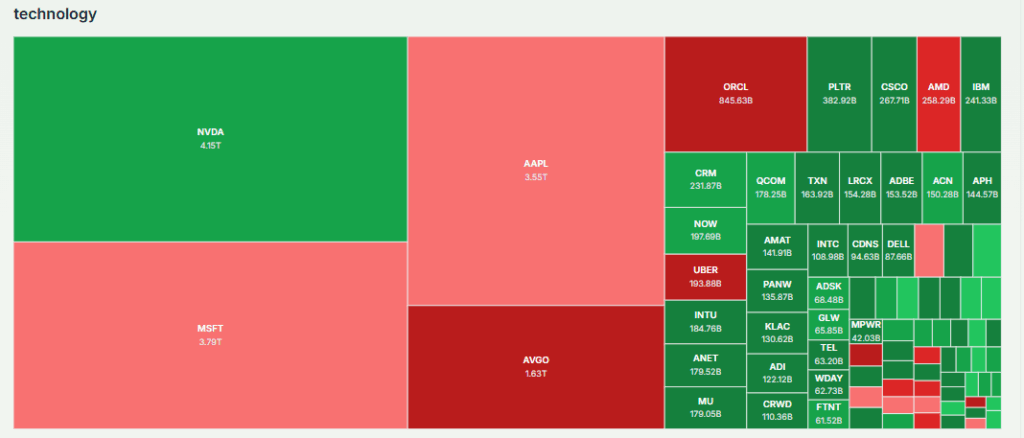

Impact on Key Sectors

Technology stocks saw the biggest lift. Chips, cloud firms, and AI-related firms rallied on optimism about supply and sales. Financial stocks picked up, too, as bond yields fell. Industrials and exporters reacted to the chance of easier trade. Agriculture markets moved on to possible new purchases by China. Soybean futures slipped ahead of the call as traders priced in potential Chinese purchases. Commodities tied to rare earths stayed in focus, given past trade talks.

Analyst Views and Caution

Analysts praised the tone of the talks but warned against overconfidence. Some said markets were pricing in a best-case outcome. Others noted that policy change takes time and paperwork. A few strategists flagged that futures often overshoot on news. Calls between leaders can calm nerves. But real progress needs follow-up steps, such as signed agreements or implementation plans.

Political and Geopolitical Angle

The call had political weight for both leaders. For Trump, easing trade frictions can boost markets before key domestic events. For Xi, trade stability helps the export sector and growth targets. Diplomacy also shapes alliances and supply-chain choices. Any deal or truce in tech rules could shift where companies invest and who supplies critical parts. That has a global impact.

What to Watch Next?

Look for the official readout after the call. Watch for clear details on tariffs, export controls, and sector deals. Follow-up meetings between trade teams and regulators will matter.

Earnings reports and trade data will also guide sentiment. Fed policy updates are key since rate changes affect risk appetite. Traders often mix technical tools with AI stock analysis to track such shifts. If the language in the call is vague, futures may swing, and volatility could rise. If concrete steps are announced, sector gains could last longer.

Wrap Up

Markets rose on the hope that diplomacy could ease key frictions. Short-term gains are real but fragile. Lasting improvement needs clear policy moves. Traders should balance the upbeat headlines with caution. The Trump-Xi call can tilt markets. The next steps will decide how big that tilt becomes.

Frequently Asked Questions (FAQs)

In August 2019, Donald Trump called Federal Reserve Chair Jerome Powell an “enemy” on Twitter after the Fed’s policy move. He also used tough words for China’s Xi.

Trump’s issue with China was about unfair trade. He said China took U.S. jobs, forced tech transfer, and sold more goods than it bought. Tensions grew.

In 2018-2019, Trump placed tariffs of 10% to 25% on billions of Chinese goods. The goal was to pressure China for fairer trade and rules.

As of September 2025, analysts see mixed signals. Some expect gains if inflation cools and rates drop, but risks from global politics and earnings stay.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.