TSMC Profit Report: Q3 Earnings Jump 39% on Soaring AI Chip Demand

The TSMC Profit surge stunned markets this week. Taiwan Semiconductor Manufacturing Company reported a 39.1% jump in third-quarter net income, pushing record quarterly profit as demand for AI chips climbs.

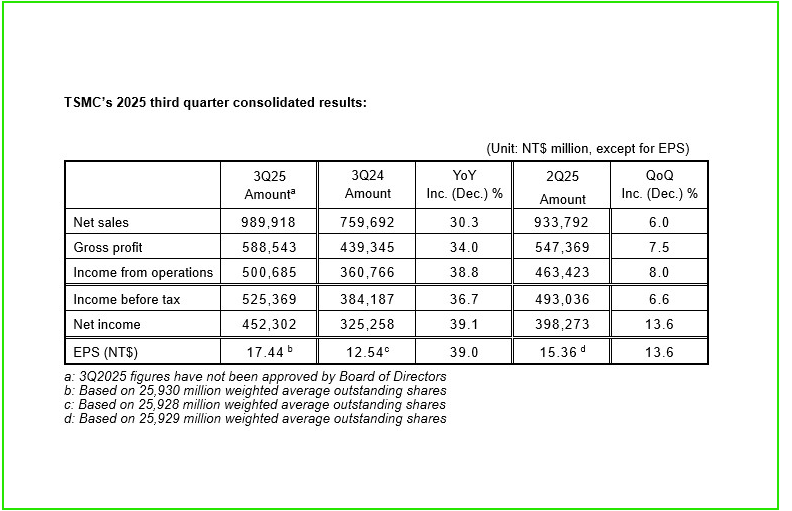

Consolidated revenue hit NT$989.92 billion and net income reached NT$452.30 billion, handily beating forecasts. The earnings beat underlines how AI data centers and cloud computing are reshaping the chip industry and TSMC’s role inside it.

TSMC Profit Soars as AI Demand Reshapes the Semiconductor Industry

TSMC’s Q3 results reflect a big shift in where chip dollars flow. The company said revenue rose about 30.3% year-on-year, and margins remained strong; gross margin was 59.5%. Management attributed the gains to surging orders for chips that power AI workloads, especially advanced nodes used in data center accelerators.

Why did TSMC profit jump so much? Because cloud providers and AI companies rushed to secure advanced capacity. That lifted shipments of 3-nanometer and 5-nanometer wafers, which now make up a big share of wafer revenue.

TSMC said 3nm was 23% and 5nm was 37% of wafer revenue for the quarter, while advanced technologies (7nm and below) accounted for 74% of wafer revenue. These are the most profitable product lines.

“TSMC’s 3rd quarter revenue rose 30.3% year-on-year to a fresh record high NT$989.9 billion, beating guidance.”

Record AI Chip Demand Powers TSMC’s Growth

Data-center demand is the story. Industry reports and management comments point to heavy orders for AI accelerators and high-bandwidth memory. These products use the most advanced process nodes and carry higher margins.

Analysts say that as AI workloads scale, foundry demand will remain strong for several quarters.

Is AI demand likely to continue? Most analysts expect AI spending to remain elevated. TSMC itself projects solid near-term demand and guided fourth-quarter revenue in a strong range, signaling management’s confidence.

AI Stock research now flags TSMC as a core holding in portfolios seeking AI-exposed hardware names, given its central role in producing chips for Nvidia, Apple, and other major customers.

TSMC’s Position in the Global Market

TSMC’s scale (TSM) matters. The company remains the leading contract chipmaker and controls a dominant share of advanced-node foundry capacity. Coverage notes that TSMC’s market position widened versus peers as demand for leading-edge chips accelerated. This dominance gives the firm pricing power and priority with equipment suppliers.

“TSMC revenue 5 yr CAGR through ’29: Total revenue 20%, AI: 45%, the scale advantage is clear.”

Global Expansion, Capex, and Supply Strategy

TSMC is investing heavily to meet AI demand. Management has flagged large capital spending to expand capacity at advanced nodes, including fabs outside Taiwan. These investments aim to diversify supply and shorten delivery times for big customers.

Public filings and market reports place multi-year capex in the tens of billions, supporting long-term capacity growth.

Will more plants solve capacity tightness? Yes, over time. New fabs help, but capacity ramps take years. In the near term, tightness at the most advanced nodes can persist, keeping pricing power high for TSMC.

AI Stock Analysis tools used by institutional desks show improving forward earnings revisions for foundry peers when TSMC signals stronger AI-related demand. That data supports the view of sustained sector flows.

Market Reaction and Stock Performance

Markets reacted positively. TSMC shares climbed as investors priced in brighter earnings and a stronger 4Q outlook.

Foreign and institutional inflows were reported across Asian tech pockets after the results. The stock move reflected not just one quarter but a larger re-rating tied to AI-driven profit potential

“What a company $TSM, record quarter, AI orders everywhere.”

AI Stock trackers also flagged TSMC among the top-performing semiconductor equities after the release, which helped push more funds toward the sector.

Analysts: Is the TSMC Profit Rally Sustainable?

Analysts are largely upbeat, but cautious. They praise TSMC’s execution and the durable nature of AI demand. Yet they also warn about cyclical risks: memory and other segments can turn, and macro shocks or policy shifts could cool demand.

Most broker notes raised near-term targets after the beat, but they stress that execution and margin preservation will determine the sustainability of the rally.

What are the main risks? Export controls, rising energy costs, and intense competition remain the top three risks. TSMC’s scale helps, but it is not immune to macro or policy shocks.

Challenges Ahead: Competition, Policy, and Costs

The company faces competitive pressure from other foundries and longer-run challenges such as rising operational costs tied to expansion.

Export rules and geopolitics also add uncertainty. TSMC’s management has shown prudence, but investors will watch guidance and capex discipline closely.

Conclusion: TSMC Profit Signals a New Era in Chipmaking

The TSMC Profit jump in Q3 2025 is more than a single good quarter. It reflects a structural shift driven by AI. With record revenue, strong margins, and prioritized capacity at cutting-edge nodes, TSMC is positioned as a backbone of the AI infrastructure wave.

Challenges remain, but for now, the market rewards scale, technology leadership, and execution. If AI demand continues as forecast, TSMC’s (TSM) strong quarter may mark the start of a sustained upcycle for the foundry industry.

FAQ’S

TSMC profit increased due to strong demand for AI chips, advanced 3-nanometer production, and higher orders from major clients like Apple and Nvidia.

Investors see TSMC’s rising profit as a positive signal of market strength, with many expecting continued gains from the global AI and semiconductor boom.

According to Google search trends and AI-driven insights, interest in “TSMC profit” has sharply risen, showing global curiosity about Taiwan’s leading chipmaker and its key role in powering AI innovation.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.