TSMC Shares Surge as ADR Premium Hits 20-Year High Amid Global Investor Rush

TSMC, the world’s largest contract chipmaker, is back in the spotlight as its shares surge to new highs. In October 2025, its U.S.-listed ADRs (American Depositary Receipts) began trading at a premium not seen in 20 years, signaling massive foreign investor demand. This sharp rise is not just a market jump; it reflects how TSMC has become the backbone of the global tech and AI revolution.

Investors are rushing in because TSMC makes the most advanced chips used in iPhones, data centers, and AI systems like NVIDIA GPUs. As AI adoption accelerates in every industry, the world needs TSMC more than ever. The company is also expanding its factories in the United States, Japan, and Europe to secure supply chains and reduce geopolitical risk.

This surge raises big questions: Why are investors paying such a high premium? What does this mean for the semiconductor industry? And can TSMC maintain its lead as competition grows?

Let’s look into the reasons behind the rally, the risks ahead, and what this historic premium means for global markets.

What is an ADR Premium and Why does it Matters?

An ADR (American Depositary Receipt) lets U.S. investors buy shares of a foreign firm without trading on the local exchange. ADRs can trade at a different price than the stock at home. That difference is the ADR premium. A high premium shows strong foreign demand. On October 15, 2025, TSMC’s ADRs hit a premium not seen in two decades. That jump signals intense global buying interest and shifts how traders value the company across markets.

Key Factors Driving the Surge in TSMC Shares

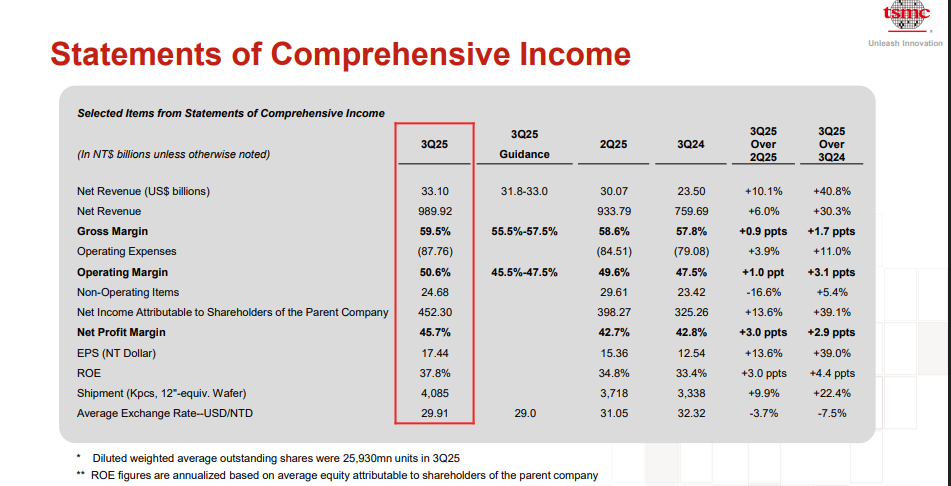

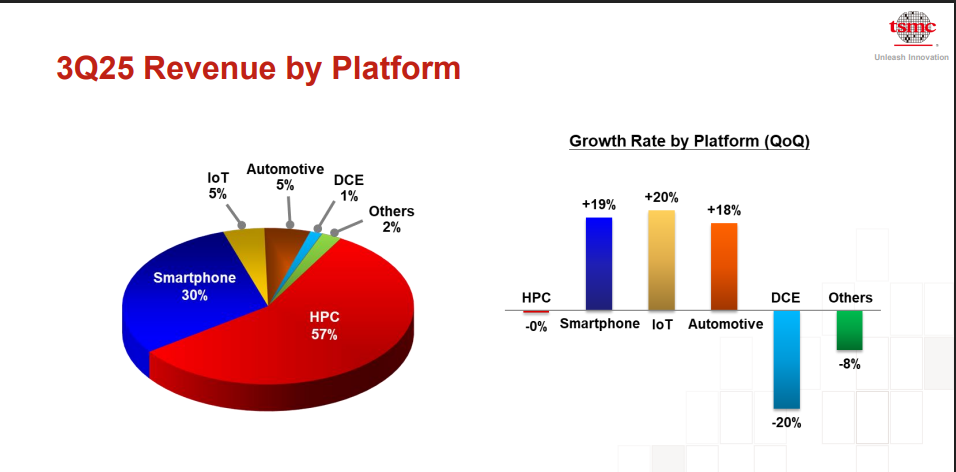

The biggest force is AI. Data centers and AI servers need the latest chips. TSMC makes those chips at scale. Demand for advanced nodes, like N3 and the coming N2, has risen sharply. This fuels revenue and profit growth. Analysts expect record Q3 profit tied to AI spending, with Q3 results and guidance closely watched on October 16, 2025.

Manufacturing strength is another factor. TSMC keeps a large lead in process tech. Firms such as NVIDIA, Apple, and AMD rely heavily on TSMC. That client mix gives steady, high-margin work. The firm also sells capacity to many high-growth segments. Markets reward that predictability.

Capital spending and global fabs matter too. TSMC is building multiple fabs in Taiwan and abroad. Investment in Arizona, along with projects in Japan and plans in Europe, aims to secure supply and meet demand. The Arizona program reached new milestones in 2025 with multiple fabs in various stages of construction. These moves reassure international buyers and support the ADR premium.

Why are global Investors Rushing In?

Investors see TSMC as a core play on AI infrastructure. Buying TSMC is a proxy for gains in chips and data centers. Foreign funds and ETFs ramped up ADR positions this year. ADR trading volumes jumped relative to the Taiwan listing. That flow widened the ADR premium. Market narratives about supply tightness and long product cycles added urgency.

Another driver is perceived safety. TSMC is a supplier, not a consumer brand. This status makes it less volatile than some end-product tech names. Long contracts and deep client ties lower the risk of abrupt demand swings. As a result, many institutional investors treat TSMC as a long-term hold rather than a trade.

Impact of the ADR Premium on Markets

The price gap between the ADR and local Taiwan shares can create short windows for arbitrage. Yet such windows are narrow. Liquidity and trading hours often block simple arbitrage. Retail investors see the ADR as easier access. That has helped retail flows into U.S. markets. ETFs and large asset managers also added positions through ADRs, which pushed the premium higher.

The premium also affects valuation measures. A higher ADR price raises market cap on U.S. listings, which influences index weights and institutional mandates. Fund managers must then decide which listing better matches their mandate and trading rules.

Analyst Opinions and Market Sentiment

Wall Street sentiment turned more positive in October 2025. Several banks raised targets or maintained buy ratings ahead of the Q3 report. Analysts cited stronger fab utilization and the AI demand pipeline as reasons for optimism. Some forecasts expect full-year revenue to exceed prior guidance. Those views helped push ADR demand just before earnings.

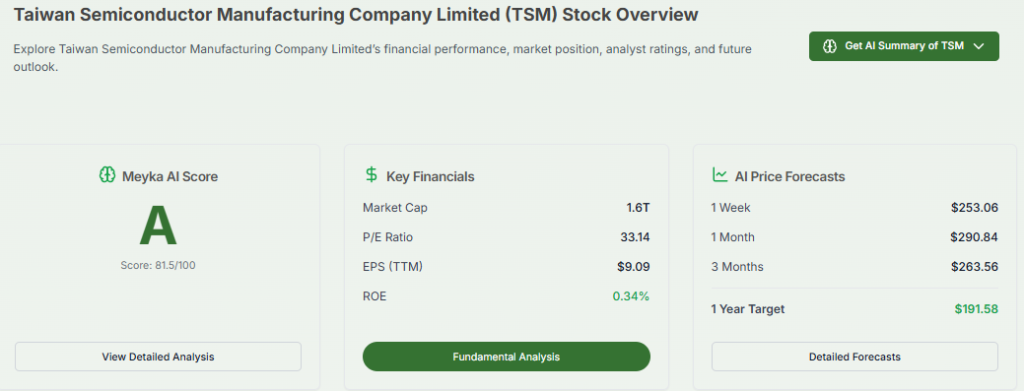

Third-party tools also showed strong interest. An AI stock research analysis tool flagged TSMC as a top AI-infrastructure beneficiary. That kind of automated signal likely amplified momentum among quant and discretionary investors.

TSMC Shares: Potential Risks and Challenges

Geopolitics is the top risk. Taiwan sits at the center of U.S.-China tensions. Any escalation could disrupt supply or prompt policy actions. U.S. efforts to onshore chipmaking add complexity. Onshoring helps supply diversity but may reduce Taiwan’s “silicon shield” over time. Policymakers and markets must balance security with commercial realities.

Competition is real. Samsung and Intel are investing heavily in advanced nodes. They aim to close the gap. TSMC’s lead is strong now, but continued investment is required to hold that position. That spending can pressure margins.

Macro conditions matter too. A global slowdown or softer tech capex would lower chip demand. Inventory cycles in customers could cause a temporary pullback. That would test valuations and the sustainability of the ADR premium.

What does this mean for the Semiconductor Industry?

TSMC’s surge highlights how capital and supply are shifting. The company’s scale gives fast access to advanced nodes. That creates a two-tier industry: those who can access bleeding-edge nodes and those who cannot. The gap affects product roadmaps and corporate strategy across tech firms. Regional fab expansion also raises the cost of building supply resilience but it may reduce single-point concentration risk over time.

Future Outlook: Can the Rally Continue?

Sustainability depends on demand and execution. If AI spending stays strong, TSMC should keep high utilization and pricing power. Upcoming product launches and fab ramp timelines will be critical. TSMC’s Q3 earnings on October 16, 2025, and the Q4 outlook will set the near-term tone. Investors will watch revenue growth, margin trends, and capex plans closely. Any hint of demand cooling could narrow the ADR premium. Conversely, stronger guidance could push the premium even higher.

Wrap Up

The ADR premium shows how global money values TSMC. It also reflects the broader rush into AI and data-center chips. The October 2025 surge has clear roots: strong demand, tight capacity, and big expansion plans. The path ahead carries risks. Geopolitics and competition could alter the story. Still, the company sits at the heart of modern chipmaking. The October 16, 2025 earnings report will offer the next big signal for markets.

Frequently Asked Questions (FAQs)

TSMC’s ADR trades at a premium because foreign investors buy more shares in the U.S. market. Strong demand in October 2025 pushed ADR prices higher than Taiwan listings.

TSMC remains attractive in 2025 because AI demand keeps rising. The company makes advanced chips for top tech firms, but investors should still consider market risks.

TSMC benefits because AI needs powerful chips that it can produce. Its new factories in the U.S., Japan, and Europe help secure supply and attract more customers.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.