UK House Prices Show Flat Growth in November Ahead of Budget Decisions

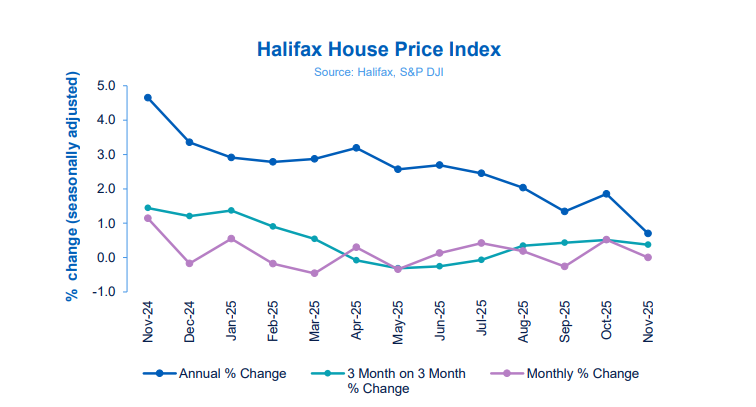

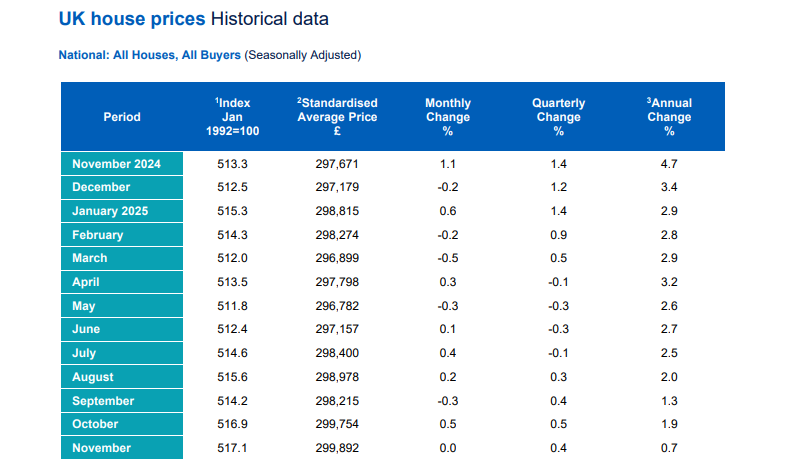

In November 2025, the UK housing market hit the brakes. According to recent data from Halifax, national house prices were virtually unchanged at a flat monthly reading, after rises in prior months.

That pause feels significant, because it comes at a delicate moment: the country is just days away from the Autumn Budget, a government statement widely expected to bring changes to property taxes, stamp duty rates, or mortgage rules. Many buyers and sellers are holding their breath.

This quiet in the market suggests more than normal seasonal calm. It hints at growing caution. By November, some homeowners are postponing sales. Some buyers are waiting to see if the Budget will shift the balance.

Let’s explore what this unexpected stall in prices really means and how the upcoming Budget could tip the scales.

What “Flat Growth” Actually Means in Today’s Market

Flat growth means prices changed very little from October to November 2025. Halifax recorded essentially no monthly movement. Annual growth fell to about 0.7%. That is the weakest yearly pace since March 2024. Flat does not mean collapse. It means market momentum slowed. Expectations and sentiment are driving this pause as much as fundamentals.

The Pre-Budget Freeze: Why Buyers and Sellers Hit Pause

The Autumn Budget landed on 26 November 2025. Many market participants paused ahead of that date. Sellers delayed listings. Buyers hesitated to make large offers. Lenders kept some mortgage products under review. The outcome: fewer firm moves and more conditional deals. Seasonal calm usually plays a part this time of year. But this pause had an extra political element. Uncertainty about tax or stamp duty changes amplified caution.

Data Breakdown: Regions That Defied the Flat Trend

Not every local market behaved the same. Nationwide showed a small monthly increase of 0.3% in November. Some northern regions outperformed. London and parts of the South East showed flat to falling values. The divergent patterns reflect job markets, local supply, and buyer mix. Tech and university towns kept demand firmer. Areas with high investor ownership felt more pressure. This patchwork view means national averages mask local shifts.

Mortgage Market Movements Behind the Stall

Lenders took a cautious stance in November. Product lists narrowed slightly. Approval numbers softened despite lower inflation. That suggests sentiment, not just rates, drives activity. Analysts expect the Bank of England to signal eventual rate cuts in early 2026. Lenders plan for that. Many borrowers looked to fix rates while options still existed. Broker chatter pointed to more conservative affordability checks. That tightened practical borrowing capacity even when headline rates were easing.

Seller Psychology: Pricing Power Is Not Where It Looks

Many sellers hoped for a spring rebound after a mid-year uptick. That hope underpinned stubborn asking prices. But buyers asked for concessions. Withdrawn listings rose. Some properties relisted after minor price trims. Incentives such as covering legal fees or including fixtures grew more common.

In short, pricing power shifted toward pragmatic negotiation. Advertising at an optimistic price no longer guarantees a quick sale. Market endurance now depends on realistic pricing and small seller concessions.

The Budget Wildcards That Could Move Prices

The Budget on 26 November 2025 contained a mix of revenue measures and targeted housing moves. Three levers stood out. First, stamp duty changes. Any targeted relief for first-time buyers would trigger a short-term uptick. Second, landlord taxation and regulation. Tougher rules can push some small landlords to sell. That would add supply and pressure prices in affected markets. Third, first-time buyer support schemes.

Renewed guarantees or equity help can concentrate demand in entry-level bands. Each lever can create local ripples or trigger broader sentiment shifts. The Treasury also showed caution about sweeping measures because of fiscal limits. This means changes could be modest but still market moving.

Short-Term Outlook: Analysts’ Near-Term Views

Most forecasters see muted activity for December and January. The Budget becomes the true pivot point for Q1 and Q2 2026. Some models predict a modest recovery if rates fall and targeted Buyer support appears. Others warn that any tax squeeze on landlords could prompt a mild price dip in pressured towns. Sentiment will matter.

Market psychology can amplify small policy shifts into larger price moves. Bloomberg and Reuters coverage in early December emphasised the delicate balance between policy signals and borrower appetite.

Practical Advice for Buyers, Sellers, and Investors

Buyers should monitor mortgage pipelines closely. A cheap fixed rate today can be worth securing. Sellers should focus on realistic pricing and small concessions to speed sales. Investors must assess rent yields against potential policy shifts. Diversification by region reduces exposure to landlord tax changes. Use of solid analytics helps. For deeper market screening, advanced platforms and even an AI research analysis tool can assist in scanning signals across regions and sectors.

Final Takeaway

November 2025’s flatline shows a market in wait. It is not broken. It is cautious. Policy decisions and subtle lender moves will shape the next quarter. Local markets will diverge more than national averages suggest. Buyers and sellers who act with clear data and prudent pricing will find opportunity. Investors who plan for policy risk will protect returns. For now, the market’s mood is patience, not panic.

Frequently Asked Questions (FAQs)

UK House prices stayed flat in November 2025. Some experts think small dips may happen if demand stays weak. Others expect steady prices if rates ease in early 2026.

The Autumn Budget on 26 November 2025 did not bring major stamp duty cuts. Small updates are possible in 2026, but no confirmed changes have been announced yet.

Many lenders expect lower rates in early 2026 if inflation keeps easing. Any cuts may be slow. Final decisions depend on Bank of England moves.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.