UK Inflation: Price Growth Stuck at 3.8% for Third Straight Month, Surprising Economists

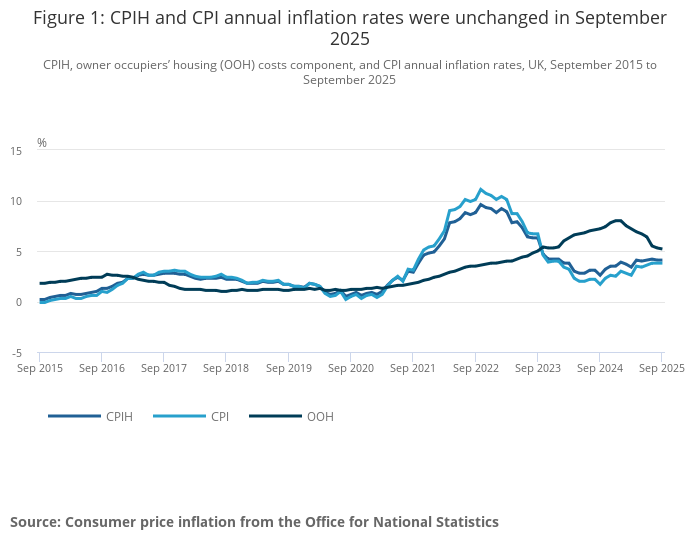

We are watching closely the latest numbers on UK inflation, which remained stuck at 3.8% for a third month in a row in September 2025. According to the Office for National Statistics (ONS), the headline Consumer Prices Index (CPI) rose by 3.8% over the 12 months to September, unchanged from August and July.

This persistence of inflation at that level has surprised many economists who had expected an uptick or at least some downward momentum. It raises important questions for the economy, households, and the policy stance of the Bank of England (BoE)

Why Inflation Held at 3.8% – Key Drivers and Offsets

In understanding how UK inflation remained at 3.8%, we need to look at what pushed prices up and what worked to hold inflation in check.

Upward pressures

- Transport prices made a strong upward contribution. For the CPIH (CPI including owner-occupiers’ housing costs) measure, transport prices rose by 3.8% in the 12 months to September, up from 2.4% in August.

Concretely: motor fuels, airfares, and vehicle maintenance/repair were drivers. For example, air fares fell month-on-month but contributed upward to the annual rate because the baseline from last year was far lower. - Housing-related costs (in the CPIH) also remained elevated: owner-occupiers’ housing costs rose by 5.2% in the 12 months to September, slightly lower than 5.3% in August, but still high.

- Services inflation: For the CPI measure excluding volatile items, the services rate remained at about 4.7% in the 12 months to September.

Offsetting forces

- Food and non-alcoholic beverages: Interestingly, the annual rate for food fell from 5.1% in August to 4.5% in September (CPIH). Monthly food prices actually fell 0.2% in September year-on-year comparisons.

- Recreation and culture prices contributed to a downward effect. For example, live-music ticket prices fell by 8.6% month-on-month, which helped reduce the upward inflation pressure.

Thus, the combination of strong cost pressures (transport, housing, services) and easing in other areas (food culture) led to the headline inflation rate remaining flat at 3.8% rather than accelerating.

What This Means for the Economy and Households

Household purchasing power

For consumers, persistent inflation at 3.8% means that prices continue to rise significantly faster than the BoE’s target of 2%. Wages may be growing, but often not enough to maintain purchasing power after inflation. According to the ONS, regular pay growth (excluding bonuses) in the 3 months to August was about 4.7%. That means in real terms, wage growth above inflation is limited, and for many households, cost-of-living pressures remain very real.

Policy implications for the Bank of England

The BoE’s target inflation rate is “close to but not exceeding 2%” in the medium term. With inflation stuck at 3.8% for three consecutive months, the central bank faces a dilemma:

- If inflation shows no further decline, the BoE may delay any interest-rate cuts or even consider further tightening.

- On the other hand, if inflation begins to fall, the BoE may have room to reduce rates sooner than expected.

Markets are reacting: following this inflation release, the chances of an interest-rate cut in December rose, as the data slightly alleviated fears of a sharp deterioration.

Business planning and investment

Businesses also feel the impact of this inflation backdrop. Persistent inflation means cost pressures for inputs, especially in sectors heavily exposed to transport, energy, or housing. It may also affect consumer demand as households tighten budgets.

For firms researching stock market opportunities or AI stocks and broader stock research, inflation trends are critical because they influence interest-rate expectations, equity valuations, and future earnings. For example, if inflation stays high, earnings growth may be constrained, discount rates may be higher, and stock returns could be impacted.

How the 3.8% Rate Compares Historically and Internationally

- The current headline 3.8% inflation is the joint-highest since January 2024.

- It remains significantly above the long-term UK CPI average of around 2.8%.

- Internationally, among advanced economies, the UK is facing one of the highest inflation rates in the G7.

Thus, the UK inflation scenario stands out: the rate is high by historical standards for recent years and comparatively elevated internationally.

Outlook: What to Watch Next

Inflation forecasts

Analysts expect headline inflation to remain over 2% for the rest of 2025. The average forecast among economists surveyed by the Treasury in September 2025 was for inflation to be around 3.6% in Q4. The BoE itself projected inflation might peak at around 4% in September and then slow toward the target over the following years.

Key indicators to track

- Services inflation (a measure of underlying pressures), if this remains elevated, it suggests that inflation may be sticky.

- Food, energy, and transport price movements can cause significant swings in headline inflation.

- Wage growth in relation to inflation, to judge real incomes and household consumption.

- The BoE’s policy decisions, especially its interest-rate path and statements about inflation expectations.

- External shocks – supply disruptions, geopolitical events, or price spikes in commodities can derail inflation paths.

Implications for investors and stock market research

For those doing stock research, including AI stocks, inflation trends matter. Persistent inflation and higher interest rates often reduce equity valuations, increase discount rates, and create uncertainty for growth stocks (including many AI-sector companies). On the other hand, sectors with pricing power, inflation-hedge characteristics (e.g., commodities, real estate), or whose earnings rise with inflation may benefit.

Conclusion

The fact that UK inflation is stuck at 3.8% for three months in a row gives a somewhat mixed message. On one hand, the rate not rising further is modestly positive – it shows inflation hasn’t surged. On the other hand, remaining well above the 2% target means the economy still faces elevated cost pressures, and households remain under strain.

For policymakers, households, and investors alike, the path forward is uncertain. With inflation at 3.8%, the margin of safety is narrow. The next few months will be crucial to determine whether inflation begins to decline meaningfully or stalls, which would present a bigger challenge for the economy.

FAQs

The 3.8% rate refers to the annual increase in the Consumer Prices Index (CPI) in the UK over the 12 months to September 2025. In other words, on average, prices of goods and services were 3.8% higher than a year earlier.

The Bank of England has a target of 2% inflation (measured by CPI) because stable and low inflation helps with economic planning, investment, and wage growth. If inflation is too high or volatile, it introduces uncertainty and erodes purchasing power.

For homeowners, cost pressures may come via housing-services inflation, energy bills, or repairs. For renters, wage growth lagging behind inflation means real income may shrink, and many may face increasing rent, utilities, or other living costs. Persistent inflation can strain household budgets, especially for lower-income households.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.