UK State Pension: Payments to Rise to £12,548 in April Under Triple Lock Guarantee

The UK State Pension is set to receive a significant uplift in April 2026 under the much-talked-about triple-lock guarantee. For many retirees, this promises a welcome boost in income, but it also raises important questions about taxation, eligibility, and retirement planning.

What is the Triple Lock and How Does It Work?

The triple lock is a commitment introduced by the UK Government in 2011 to protect the value of the State Pension by ensuring it rises each April by whichever is highest of three figures: inflation (measured by the Consumer Prices Index for September of the previous year), average earnings growth (over the May-July period), or a minimum of 2.5 %.

For example:

- Inflation (CPI) might be 3.8%. Pensions Age

- Average earnings growth might be 4.7%.

- The baseline is 2.5%.

In this scenario, the highest figure (4.7%) would determine the increase. Importantly, the triple lock applies to the “basic” or “new” State Pension for those who reached pension age on or after April 2016.

How Much Will Payments Rise to in April 2026?

Based on official forecasts, the full new State Pension is expected to rise from about £11,973 per year (£230.25 per week) for the 2025/26 tax year to approximately £12,547 per year (£241.30 per week) from April 2026, if the earnings figure of 4.8% is used.

That amounts to an annual increase of roughly £574 for a pensioner on the full new State Pension. This figure edges the total pension payment very close to the UK tax-free personal allowance threshold of £12,570, meaning some pensioners could soon start paying income tax on their pension alone.

In simpler terms:

- Full new State Pension (current): ~ £230.25/week → ~ £11,973/year.

- Forecast increase: +4.7% – 4.8% → ~ £241/week → ~ £12,547/year.

- The basic (pre-2016) State Pension also sees a similar percentage rise.

Why This Increase Matters

1. Protecting Pensioner Income

The triple lock is designed to ensure that pensioners don’t suffer a decline in living standards just because inflation or wage growth outpaces their income. Using the highest of the three measures gives retirees better protection.

2. Hovering Over the Tax Threshold

With the full new State Pension approaching the income tax personal allowance, more pensioners will face tax liabilities even if the State Pension is their only income. For many, this is a new development. Financial commentators are alert that the rise could force pensioners into the tax net for the first time.

3. Fiscal and Policy Implications

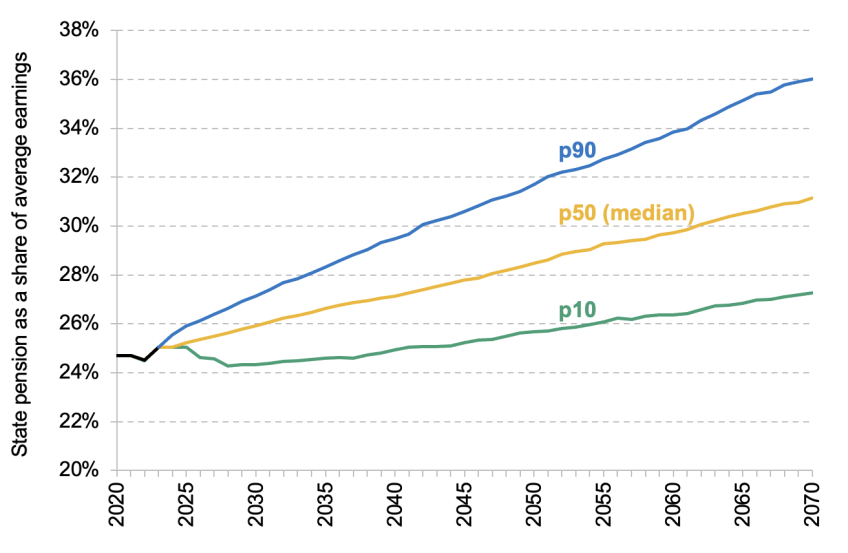

While welcome for pensioners, the rising cost of the State Pension under the triple lock raises concerns about its long-term sustainability, especially with a growing number of retirees and pressures on public finances.

Who Qualifies for the Full Increase?

To receive the full amount of the new State Pension, you’ll generally need:

- 35 qualifying years of National Insurance contributions or credits for someone who reached State Pension age after 6 April 2016.

- For the old basic State Pension (for those reaching pension age before 6 April 2016), full National Insurance records or credits apply.

- If you have fewer than the required years, you’ll receive a reduced pension.

Notably, some elements, such as Additional State Pension or amounts for deferral, do not benefit from the triple lock; they increase only in line with inflation.

For a personal estimate, you can use the official Government tool on the Department for Work and Pensions (DWP) website to check your State Pension forecast and contributions record.

What Pensioners Should Be Aware Of

Check Your Contribution Record

Ensure you have the requisite qualifying years and that any gaps in National Insurance contributions or credits have been accounted for. If you’re short, you might consider making voluntary contributions, depending on your circumstances.

Plan for Tax Implications

Given that the State Pension may soon exceed the personal allowance, consider whether you’ll need to pay income tax. If you have other income (savings, pensions, investments), this is even more relevant. Speak to a financial adviser if needed.

Review Retirement Income Strategy

While the State Pension provides a base income, it may not be sufficient alone for a comfortable retirement. Consider other pension savings, workplace pensions, or individual retirement investments as part of your broader plan.

Keep an Eye on Policy Changes

The triple lock is a political commitment rather than a statutory guarantee. While current government policy is to maintain it, future changes (such as linking only to inflation) cannot be ruled out.

Monitor the State Pension Age

Under current plans, the State Pension age is scheduled to increase from 66 to 67 between April 2026 and April 2028. This may affect your timing for claiming your pension and your overall retirement planning.

Our Summary Statement

The UK State Pension is poised for a meaningful year-on-year increase in April 2026, thanks to the triple-lock mechanism. For those eligible for the full new State Pension, the annual amount looks set to rise to around £12,547. While this represents a positive outcome for pensioners, it carries along tax implications, eligibility issues, and the need for broader retirement planning.

The triple lock remains a vital safeguard, yet it also places the State Pension system at a crossroads: balancing adequacy for retirees with fiscal sustainability for the wider economy. As always, individual circumstances vary, so staying informed and proactive in planning is paramount.

FAQs

The uplift to the State Pension takes effect from 6 April 2026 for most recipients, which is the start of the new tax year.

Not exactly. Those receiving the full new State Pension for which they have 35 qualifying years will benefit from the full increase. If you have fewer years, or you are receiving parts of the old Additional State Pension, your rise may differ.

Yes, possibly. As the full new State Pension approaches and may exceed the personal allowance threshold (£12,570 for 2025/26), pensioners relying solely on this income could find themselves paying income tax. www.gov.uk provides full tax rules.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.