US Future Trade: Cautious Mood After Netflix Miss, Eyes on Tesla Next

US Future Trade opened in a cautious mood after Netflix’s latest results disappointed. Traders paused and digested the news. The miss weighed on Nasdaq futures and cooled risk appetite. Now all eyes move to Tesla’s Q3 report.

This week’s earnings calendar will shape the next market move.

US Future Trade Reacts to Netflix Earnings Miss

Netflix (NFLX) surprised the market with weaker numbers and softer guidance. That set off a pullback in tech names. Nasdaq futures were the first to show pressure. The move was not a panic sell-off. It was a measured pullback as traders reset expectations.

Markets often breathe after big rallies, and that is what happened here. For live coverage and details, see Yahoo Finance.

Tweet on market reaction:

Investor Sentiment and Tech Sector Focus

Investors now watch other big tech and consumer names. Tesla (TSLA), Coca-Cola (KO), and several chip makers are on the radar. The market is testing whether earnings can justify rich tech valuations. Sentiment is fragile.

Small misses now may trigger outsized moves. Some models also flag AI winners and losers in this backdrop, reflecting the broader interest in AI Stock themes.

Tesla in the Spotlight as Traders Assess Market Direction

Tesla’s Q3 report (TSLA) is the major event ahead. Traders want clarity on deliveries, margins, and cash flow. Analysts also watch management comments on pricing and production. A strong print would lift the Nasdaq, while a miss could deepen the pullback.

The market is sensitive because Tesla (TSLA) carries a large weight in tech indexes. That makes its results a litmus test for risk appetite.

Why is Tesla’s performance so important for US Future Trade? Tesla moves the index. Big beats lift sentiment. Big misses can force reassessments across the tech sector.

Tweet on Tesla focus:

Broader Market Moves and Economic Indicators

Beyond earnings, macro data will steer trading. Traders watch inflation readings closely. Fed rate cut odds are key too. If inflation stays sticky, investors may lower hopes for earlier cuts. That would hurt growth stocks. Also, global issues like US-China trade tensions add risk.

The mix of corporate news and macro signals keeps markets in a cautious mood.

Analyst Outlook and AI Stock Research Insights

Analysts are parsing Netflix (NFLX) and setting new targets. They also model scenarios for Tesla (TSLA) under different demand and margin outcomes. Many firms use machine models to scan filings and social sentiment. These tools help spot trading flows and surprise risks.

In short, AI-driven research is part of modern coverage, and AI Stock Research is helping some analysts refine short-term outlooks.

Technical Trends and AI Stock Analysis

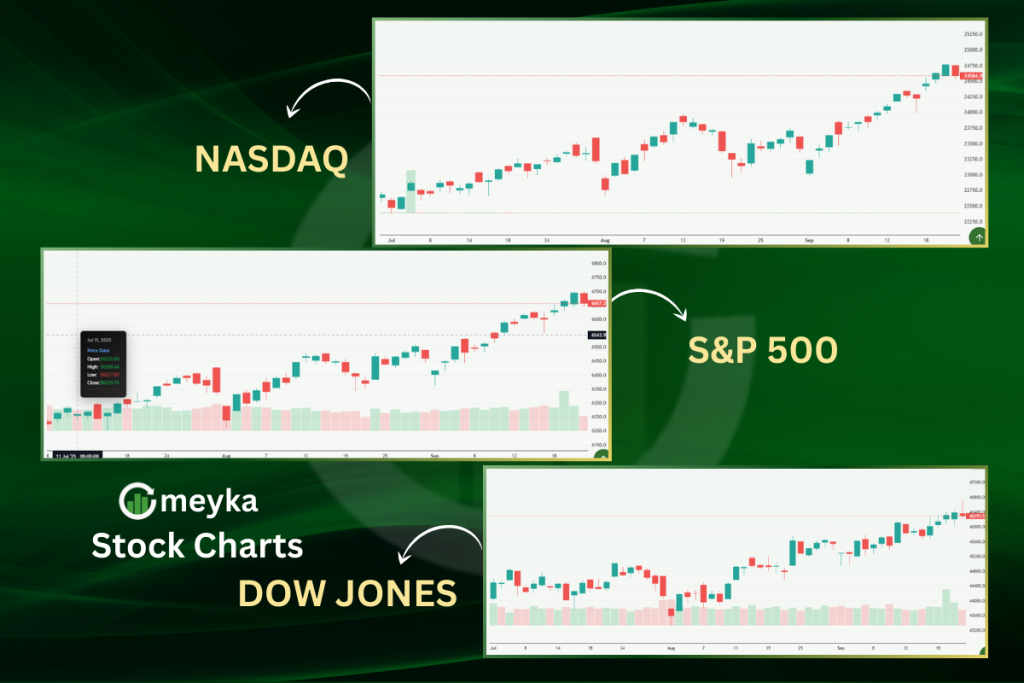

On the charts, the S&P and Dow show more resilience than the Nasdaq. Breadth has narrowed. That means fewer stocks lead gains. Traders note easing buying pressure in small caps. Technical traders will watch key supports and moving averages.

Also, AI-driven flow tools show a spike in options activity around major earnings. Those signals feed into AI Stock Analysis used by hedge funds and desks to size risk.

What This Means for Traders and Investors in US Futures Trade

Short-term traders should expect choppy sessions. Volatility often rises around earnings. Use tight risk controls and watch liquidity. For longer-term investors, this is a time to check fundamentals.

Ask whether earnings trends support current valuations. Key near-term triggers include:

- Tesla Q3 results, focusing on deliveries and margins.

- Follow-up commentary from Netflix (NFLX) and other big names.

- Fed commentary and October inflation data.

- Geopolitical news, such as US-China trade developments.

Quick checklist for traders

- Trim exposure if you cannot handle fast swings.

- Use options for hedges if appropriate.

- Watch volume and bid-ask spreads at open.

- Read earnings transcripts for tone, not just numbers.

Sector Watch: Winners and Losers

Tech remains the focal point. Consumer staples like Coca-Cola (KO) showed pockets of strength in recent reports. That helped the Dow find some footing. Energy and financials may react more to macro news than to tech earnings. Watch for rotation if growth names stumble and value names attract flows.

Final Thoughts for US Future Trade

US Future Trade is cautious but watchful. Netflix’s miss paused the rally. Tesla’s results will likely set the next tone. Traders should mix technical discipline with fundamental checks. Use data from company reports and Fed signals to guide moves.

AI-driven tools add speed, but they do not replace careful reading of the numbers. Keep trades small into this event window and respect risk limits.

Bottom line: this week is about clarity. The market wants proof that earnings and macro data support the gains. Until then, stay cautious and watch the prints.

FAQ’S

Netflix faces a mixed outlook: growth depends on subscriber trends, ad and pricing execution, and margin recovery; analysts see upside but warn of near-term pressure.

Shares have slid on slowing deliveries, rising competition, margin pressure, and investor concern about valuation and management focus.

Top picks change fast, but recent lists include names like NVIDIA, Taiwan Semiconductor, Alphabet, MercadoLibre, and The Trade Desk per October market roundups.

It can be a buy for investors who trust its long-term growth and margin plan, but risks remain from tougher comps and margin pressure; do your own risk check.

Tesla faces clear challenges, slower sales in some regions, stronger rivals, and margin squeeze, yet many analysts still see long-term potential if execution improves.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”