US Market Today, Dec 8: Dow, S&P 500, Nasdaq Futures Hold Steady Ahead of Fed Rate Decision

The US market opened with a calm tone on December 8, 2025. Futures for the Dow, S&P 500, and Nasdaq moved in a very tight range. This steady setup is rare before a major policy week. Investors are watching the market closely, but they are not making big moves. The reason is simple. The Federal Reserve will share its rate decision next week, and traders want clear signals before they act.

This wait-and-see mood is shaping today’s trade. Bond yields are stable. Volatility is low. Tech stocks are quiet. Even strong sectors are holding their breath as the market looks for clues about the 2025 rate path. This creates a slow but meaningful market tone. It shows caution, not fear.

Today’s calm start also tells us something important. Investors are not betting on big surprises. They want clarity. They want direction. And they want to understand how the next Fed update will guide the market into the first quarter of 2026.

What’s Keeping Futures Flat?

Futures for the Dow, S&P 500, and Nasdaq stayed in a narrow band on December 8, 2025. Traders showed caution ahead of the Federal Reserve meeting set for December 9-10, 2025. Markets widely priced a 25 basis-point cut, but traders also eyed mixed signals inside the Fed. This mix pushed traders to wait rather than trade hard. The U.S. dollar steadied on the same day as investors digested central bank calendars around the world.

Bond yields added to the caution. The 10-year Treasury yield rose modestly during the past week, but it did not spike. That stability kept equity moves limited. Low volatility readings also kept momentum traders sidelined.

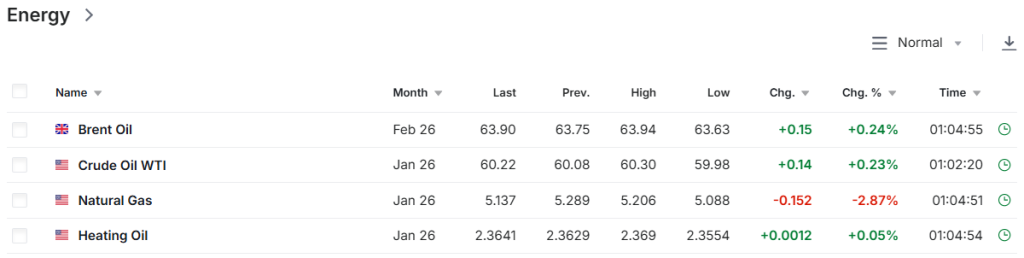

Oil prices near two-week highs also helped steady some energy names. Higher crude can support energy stocks but can also pressure growth sectors by raising input costs. That dynamic made traders selective about adding risk.

Deep dive: How is each index reacting?

Futures showed a quiet but steady tone on December 8, 2025. Dow Jones Industrial Average futures traded near 48,006, up only 5 points, which showed how defensive names held the index in place. Industrials and dividend stocks acted as stabilizers, and their strong cash flow kept the Dow from sharp moves. The focus stayed on earnings stability as traders avoided big bets.

S&P 500 futures hovered around 6,890, adding about 11 points in pre-market trade. The index showed rotation under the surface. Large tech did not lead. Instead, some cyclicals gained small momentum as traders looked for alternatives to overstretched growth stocks. The flat trend reflected caution, not weakness.

Nasdaq‑100 futures traded near 25,795, up about 64 points, showing only mild strength. AI-linked stocks paused after strong gains, but no broad selloff appeared. Many major tech names moved sideways as traders waited for the Fed’s policy signals. Short-term players also cut leverage, which kept Nasdaq futures from making big swings.

What traders are actually pricing in for the Fed

Market pricing ahead of the meeting leaned toward a 25 bps cut on December 10, 2025. Traders are focused less on the headline move and more on the Fed’s forward guidance. The dot plot showing officials’ rate views will likely matter most. If the dot plot suggests fewer cuts in 2026, risk assets could wobble. Conversely, a signal of continued easing could lift equities quickly.

Bond traders have shown unusual behavior this year. Some bond flows contradicted simple expectations from Fed moves. That tension raises the chance of rapid shifts after the Fed’s press conference. Market participants remain alert to any change in tone.

Sector watch: Where Smart Money is Moving Today

Tech momentum cooled. Investors paused to reassess valuations. Select chip and software names still showed strength in earnings or fresh contracts.

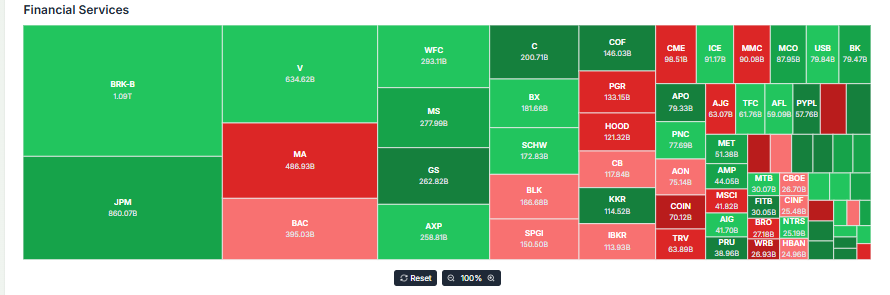

Financials found support from steady yields. Banks performed quietly as lenders priced loan growth under stable short-term rates. Financial stocks benefited from clarity on credit trends and funding costs.

Energy names got a lift from higher oil. Producers with strong cash flows outperformed smaller, debt-heavy peers. Commodity strength also helped some materials stocks.

Consumer staples and utilities acted defensively. Their steady cash flows attracted traders who wanted market exposure without big rate-sensitivity. This defensive demand helped keep major indices from falling.

Company-Specific Movers to Watch

Premarket screens showed a mix of earnings and analyst moves influencing individual names. Some midcap tech firms rose on upbeat guidance. A few old-economy firms edged higher after better sales. Watch for late releases and analyst notes around the close. Market scanners and chatter picked out names with unusual options flow or upgraded forecasts. Some newsletters even referenced AI-driven scans highlighting these moves.

For real-time trading, premarket movers and corporate news can set the tone for intraday performance. Traders often treat single-stock action as a short-term leader for sector rotation.

Economic Data that Actually Matters for Today

Today’s focus included consumer sentiment readings and wholesale inventories. Consumer sentiment can move risk appetite quickly. Strong sentiment could lower the chance of aggressive easing next year. Weak sentiment could reinforce the case for more Fed support.

Wholesale inventories give clues about supply chain slack. Rising inventories can cool price pressure and influence the Fed’s view on inflation. These readings matter more than distant monthly data when markets are close to a policy pivot.

What could move US markets later today?

Key catalysts include any late Fed speaker comments, Treasury auctions, and new geopolitical headlines. Earnings surprises from heavyweight firms can also cause abrupt index moves. Minor technical breakouts in the S&P 500 or Nasdaq may trigger algorithmic trades and expand ranges quickly. Traders will watch the Fed’s tone and the dot plot the most.

Analyst commentary: Why some see a quiet rally setup?

Some strategists argue that sideways trading is consolidation. They say accumulation can precede another leg up if the Fed signals easing. Others warn that any hint of a more hawkish path could prompt a sharp reprice. This split explains the muted moves. Analysts recommend watching confidence in earnings growth and the next inflation prints for clarity.

Investor Strategy Guide: How to Approach Today’s Flat Futures

Short-term traders should expect narrow ranges. Risk controls matter more than chasing small rallies. Use position sizing and tight stops. Long-term investors can look to add to high-quality holdings on modest dips. Avoid overpaying for momentum names without fundamental support. For all investors, clarity from the Fed on December 10, 2025, will likely change the short-term playbook.

Conclusion: Calm Today can set up a Big Move Tomorrow

The steady futures on December 8, 2025, reflected caution ahead of the Fed meeting on December 9-10, 2025. Markets priced a likely 25 bps cut, but the real market mover will be the forward guidance and the dot plot. Stay alert to bond and dollar moves. They will signal if risk appetite can expand or if volatility will return after the decision.

Frequently Asked Questions (FAQs)

US markets are steady on December 8, 2025, because investors wait for the Fed’s rate plan. Traders avoid big moves and watch bond yields, oil prices, and global market signals before acting.

The Fed decision on December 10, 2025, may guide stock trends. A steady rate could support markets, while a strict tone may slow buying. Investors respond based on future rate signals.

US futures move with key data like consumer sentiment, inflation trends, and bond yields. These reports help investors guess the Fed’s next steps and shape short-term market behavior today.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.