US Stock Earnings Season Kicks Off as Futures Rise Amid Shutdown Concerns

The U.S. stock market has entered its third-quarter earnings season, which started on October 1, 2025. Despite a partial government shutdown, investors remain optimistic. About 900,000 federal workers are furloughed. Key economic reports, like September jobs data, have been delayed. Traders are focusing on corporate earnings and signals from the Federal Reserve.

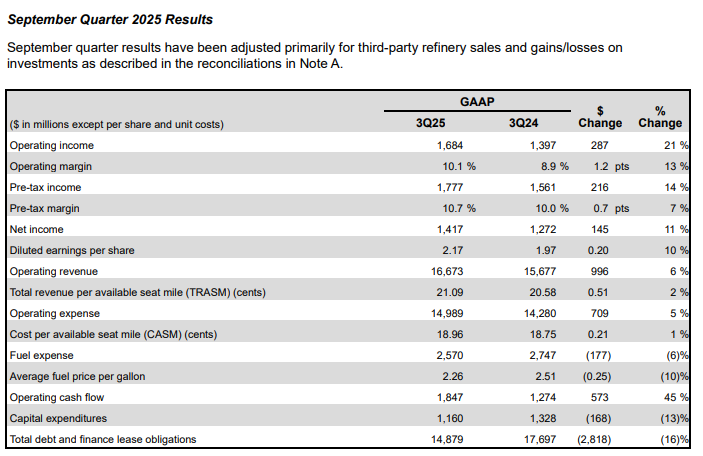

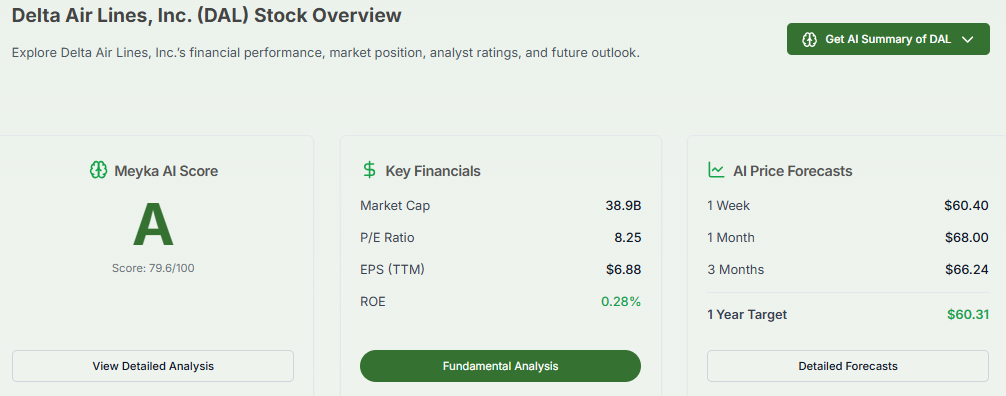

As of October 9, 2025, major indexes such as the S&P 500 and Nasdaq have hit record highs. Technology and consumer goods stocks are performing strongly. Delta Air Lines reported higher net income and raised its 2025 earnings forecast. This shows the airline industry’s resilience despite the shutdown.

The government shutdown is creating uncertainties. The SEC has eased IPO rules temporarily. Companies can proceed without usual approvals, which may affect the market. Some critical data from agencies like the USDA is missing. Farmers and traders lack essential information during the peak harvest.

Investors are carefully watching earnings reports and economic signals. They aim to understand the market and make informed decisions in this uncertain environment.

Overview of US Stock Earnings Season

The third-quarter earnings season in the U.S. commenced on October 1, 2025, with major companies like Delta Air Lines and PepsiCo reporting early results. Despite the ongoing government shutdown, which has delayed key economic data, corporate earnings have become the focal point for investors seeking insights into the economy’s health. Analysts anticipate that strong earnings reports will continue to support market optimism, especially in sectors such as technology and consumer goods.

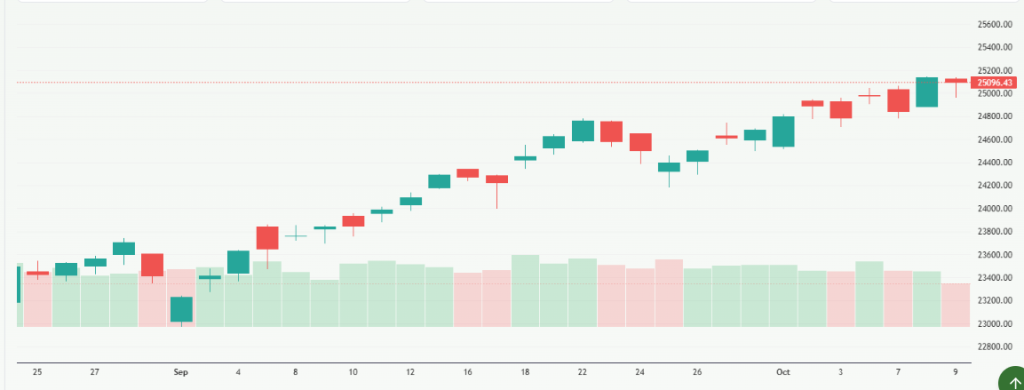

Market Reaction to Earnings Season Start

As of October 9, 2025, U.S. stock futures experienced slight declines following a period of record-setting gains. The S&P 500 and Nasdaq had reached new highs earlier in the week, driven by robust performances in technology stocks.

However, with the government shutdown extending into its second week and the Federal Reserve’s upcoming policy decisions on the horizon, investors are exercising caution. The lack of fresh economic data has left traders relying heavily on corporate earnings reports and Federal Reserve commentary to gauge the market’s direction.

Impact of Government Shutdown Concerns

The ongoing government shutdown, which began on October 1, 2025, has introduced significant uncertainties into the market. Key economic reports, including the September jobs data, have been delayed, leaving investors without crucial information to assess the economy’s performance. This lack of data has heightened concerns about potential economic slowdowns and increased market volatility. Furthermore, the shutdown has disrupted federal services, affecting various sectors and contributing to investor apprehension.

Key Stocks to Watch in the Current Earnings Season

Several companies are drawing investor attention during this earnings season. Delta Air Lines reported strong third-quarter results, with an 11% increase in net income and a 4% rise in operating revenue, exceeding Wall Street expectations. The company raised its 2025 adjusted earnings forecast and increased its cash flow target midpoint by $250 million, reflecting confidence in continued demand for air travel.

In the technology sector, Alphabet’s launch of “Gemini Enterprise,” a new AI subscription service for businesses, has positioned the company as a strong player in the growing AI market. Despite a slight drop in stock price at the time of the announcement, Alphabet shares remain up 28% year-to-date, outperforming the S&P 500.

Investor Strategies Amid Volatility

In light of the current market uncertainties, investors are advised to adopt cautious and diversified strategies. Focusing on companies with strong balance sheets and consistent earnings growth can provide stability. Additionally, utilizing AI-powered stock research analysis tools can offer valuable insights into market trends and individual stock performance, aiding in informed decision-making.

Expert Opinions and Analyst Insights

Analysts remain cautiously optimistic about the market’s outlook. While acknowledging the short-term challenges posed by the government shutdown, they emphasize the resilience of the economy and the potential for strong corporate earnings to drive market growth. However, they caution that prolonged uncertainty could lead to increased market volatility, advising investors to stay informed and prepared for potential fluctuations.

Bottom Line

The U.S. stock earnings season is underway amid a backdrop of political uncertainty and economic data delays. While the government shutdown has introduced challenges, strong corporate earnings and strategic investments in technology sectors offer a positive outlook. Investors are encouraged to monitor earnings reports closely and consider utilizing AI-driven tools to navigate the complexities of the current market environment.

Frequently Asked Questions (FAQs)

As of October 10, 2025, the U.S. government is partly shut down. Many federal services are delayed, slowing economic reports and creating uncertainty for businesses and investors.

On October 10, 2025, Delta Air Lines reported higher third-quarter earnings. Strong travel demand boosted revenue, and the company continues operations despite the ongoing government shutdown.

The U.S. stock market is cautiously positive as of October 10, 2025. Earnings reports are strong, but the government shutdown may cause uncertainty and short-term market swings.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.