US Stock Futures Edge Higher Ahead of Apple Event

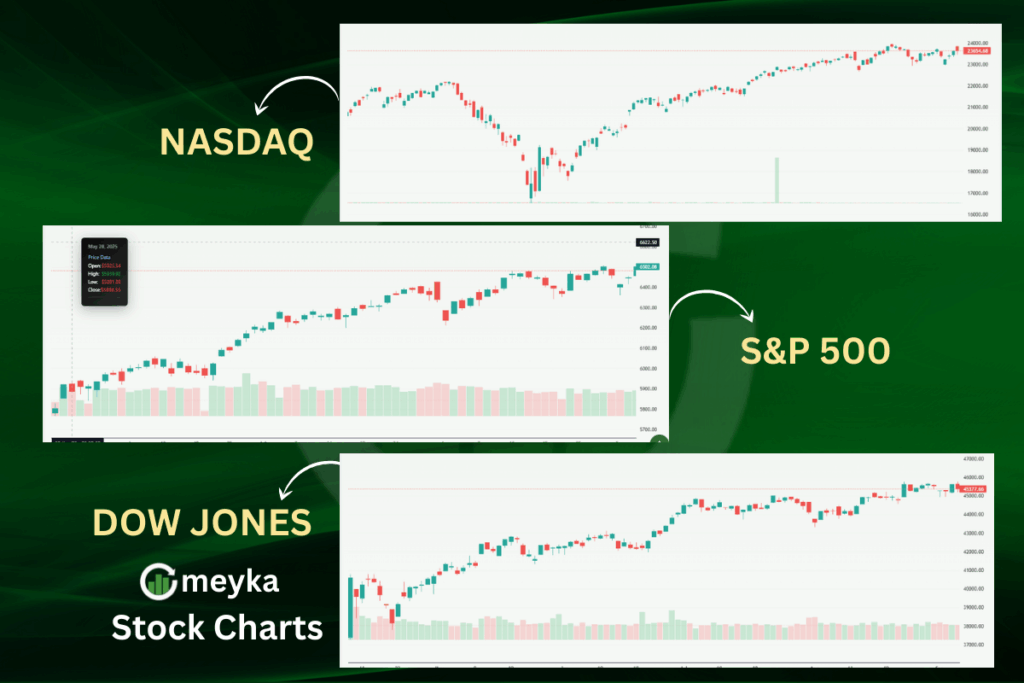

U.S. stock futures are showing modest gains as investors gear up for Apple’s highly anticipated iPhone 17 event and await key economic data later this week. The Dow Jones Industrial Average, S&P 500, and Nasdaq futures are all trading in positive territory, reflecting a cautiously optimistic mood among market participants. Analysts note that Wall Street is balancing excitement over potential tech sector catalysts with lingering concerns about inflation trends and Federal Reserve policy decisions, creating a delicate mix of optimism and caution.

Tech stocks are taking the lead in pre-market trading, with Apple in particular drawing significant attention ahead of its product launch. Investors are closely monitoring whether the iPhone 17 and related announcements, including rumors of the iPhone Air variant and AI-driven features, could trigger a broader technology upgrade cycle.

At the same time, traders are factoring in labor market reports, inflation benchmarks, and global economic developments, all of which could influence sentiment for the wider U.S. stock market. Early indications suggest a positive start, but analysts caution that volatility may increase as the day progresses and more data becomes available.

How Are US Stock Futures Performing Today?

As of early Tuesday morning, U.S. stock futures are experiencing slight upticks:

- Dow Jones Futures: Up 0.05%

- S&P 500 Futures: Up 0.13%

- Nasdaq 100 Futures: Up 0.20%

These movements suggest a steady start to the trading day, with investors balancing optimism about upcoming corporate events and caution ahead of economic reports.

Cheesky01 tweeted, “US stock futures climb as investors brace for Apple’s big reveal later today. Tech looks ready to lead the way #USStock #AppleEvent”

Briefingcom tweeted, “Dow, Nasdaq, and S&P futures all point higher this morning as market eyes Fed moves and corporate earnings #WallStreet #USStock”

Why Is the Apple Event Important for Wall Street?

Apple’s annual iPhone event, scheduled for today, is a significant event for investors. The tech giant’s product launches often influence market sentiment, particularly within the technology sector. Analysts are particularly focused on the introduction of the iPhone 17 and its potential impact on Apple’s revenue and stock performance.

The event is also expected to highlight Apple’s advancements in artificial intelligence, which could further bolster investor confidence in the company’s growth prospects.

TMResearch2025 tweeted, “Volatility may rise ahead of Apple’s event, but pre-market optimism suggests a positive open for US stock futures #MarketWatch #USStock”

What Role Does the Federal Reserve Play in the US Stock Market Outlook?

The Federal Reserve’s monetary policy decisions are a key factor influencing U.S. stock market performance. Recent economic data, including a weaker-than-expected jobs report, has led investors to anticipate potential interest rate cuts. This shift in expectations is reflected in the current futures market, with traders pricing in a 25-basis-point rate cut at the upcoming Federal Open Market Committee (FOMC) meeting.

The Fed’s actions will be closely monitored, as they can significantly affect market liquidity and investor sentiment.

How Are Investors Reacting to Global Economic News?

Global economic developments continue to impact U.S. stock market futures. Investors are particularly attentive to inflation data, with key reports on the Producer Price Index (PPI) and Consumer Price Index (CPI) scheduled for release later this week. These reports will provide insights into the inflationary pressures facing the economy and could influence the Fed’s policy decisions.

Additionally, geopolitical events and international trade policies remain areas of concern, as they can introduce volatility into the markets.

What Are the Key Factors Influencing Today’s Market?

Several factors are contributing to the current market dynamics:

- Apple’s Product Launch: The iPhone 17 event is drawing significant attention, with expectations of new product announcements and potential advancements in AI technology.

- Inflation Data: Upcoming PPI and CPI reports are anticipated to provide clarity on inflation trends and influence future Fed actions.

- Federal Reserve Policy: Speculation about interest rate cuts is affecting investor sentiment and market positioning.

- Global Economic Developments: International economic indicators and trade policies continue to play a role in shaping market expectations.

Conclusion: What to Expect in Today’s Trading Session

As the trading day unfolds, U.S. stock futures indicate a positive start, with investors balancing optimism from Apple’s upcoming event against caution ahead of key economic data. The performance of the technology sector, particularly Apple, will be a focal point, while broader market movements will be influenced by inflation reports and Federal Reserve policy expectations.

Investors should remain attentive to developments throughout the day, as they could provide insights into the direction of the market in the near term.

FAQ’S

U.S. stocks are showing modest gains in pre-market trading, with tech and large-cap shares leading the way.

Yes, the U.S. stock market is open today unless it coincides with a federal holiday.

Analysts predict cautious optimism as investors watch tech earnings, inflation data, and Fed policy for guidance.

No, the U.S. stock market is closed on Labor Day in observance of the federal holiday.

Not necessarily; portfolio adjustments and risk management are recommended rather than fully exiting the market.

Buying depends on strategy; long-term investors may buy during dips, while traders often follow momentum.

Historically, early in the trading day and during market dips can be favorable, but timing depends on individual strategy.

A crash can lead to rapid loss in portfolio value; investors often hold, diversify, or buy undervalued opportunities.

A bull market shows rising prices and investor optimism; a bear market indicates falling prices and pessimism.

Disclaimer

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.