US Stock Futures Flat Amid Looming Government Shutdown Threat

U.S. stock futures were largely flat as traders waited for clarity from Washington on spending. Markets are watching a possible Government Shutdown that could begin if Congress fails to fund federal agencies. Investors are also parsing jobs data and Fed signals, leaving index moves muted and volatility elevated.

Government Shutdown Concerns Keep Wall Street in Check

Futures for the Dow, S&P 500, and Nasdaq showed little direction as the political standoff over federal funding neared a deadline. The threat of a Government Shutdown has traders cautious because it can delay key economic releases and add near-term uncertainty to corporate visibility.

That caution is the main reason futures are flat rather than strongly directional today.

Why does a Government Shutdown impact markets?

A shutdown can halt some federal services and delay economic data like the monthly jobs report. Delayed data makes it harder for investors and the Federal Reserve to read the economy.

Historically, short shutdowns have had limited direct effects on corporate profits, but they raise political risk and can dent sentiment.

Market Reactions and Investor Sentiment

Markets have shown a mix of calm and caution. After a mildly positive session on the cash market, futures crossed the line between flat and slightly down as headlines on the impasse circulated.

Social feeds reflected this mix; some traders flagged short-term hedging, while others stayed long in tech names.

Analysts are also running quick scenario work using AI Stock research to estimate how missing data might affect rate guidance and earnings seasons.

Why is sentiment mixed? Investors like clarity. With the shutdown threat and potential delay to the nonfarm payrolls release, many prefer to wait rather than place big directional bets. The market can look calm while positioning quietly shifts.

Sample social reaction: traders posted real-time takes on X about hedging and watchlists as the deadline approached.

What sectors are most at risk?

A short shutdown tends to hit government contractors, defense firms, airlines, and some financial services that rely on federal clearances or spending. Consumer-retail and tech can be hit indirectly if data delays change the Fed’s view on policy.

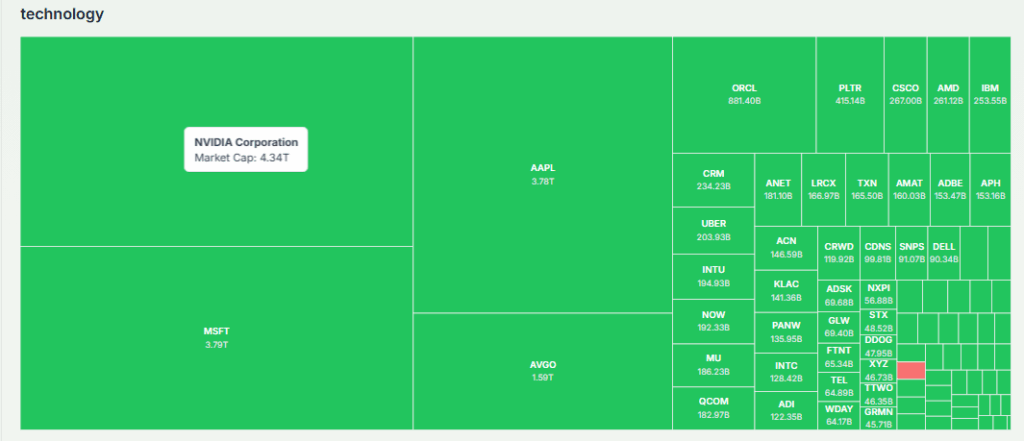

That said, tech remains a support for markets because of strong AI-related optimism. Sector exposure matters for traders who want to be selective rather than blanket risk-off.

Federal Reserve and Economic Data in Focus

Beyond Congress, the Fed and incoming economic figures shape near-term moves. With traders pricing in potential rate cuts later in the cycle, missing or delayed jobs data could complicate policy expectations. Analysts are layering Fed commentary into their models; many are using AI Stock Analysis tools to stress-test rate-path scenarios if data flow is disrupted.

How could delayed jobs data affect policy?

If nonfarm payrolls are delayed, the Fed may face more uncertainty about labor strength and inflation trends. That could widen the path of policy surprises and push bond yields and the dollar around, which in turn pressures equities in certain sectors. Investors watch these links closely because they feed back to earnings and multiples.

Short-Term vs Long-Term Investor Strategies

In the short term, traders often favor cash hedges, put protection, and safe-haven bonds while avoiding crowded levered positions. Over the long term, fundamentals and earnings outlooks remain the main drivers.

For some investors, this moment is a chance to rebalance toward quality cyclicals or defensive names. Use AI Stock sparingly in scans to spot anomalies in positioning and flows.

Should investors panic? No. A single short shutdown rarely derails the economy. But risk management is key, tighten stops, size positions conservatively, and watch the data calendar. Volatility can spike without warning around political deadlines.

Global Context and Market Linkages

The U.S. dollar and global yields react to U.S. political risk. A widening uncertainty premium can strengthen the dollar and push U.S. Treasuries lower (yields up), which changes the backdrop for global equity flows.

Overseas investors watch the pause in U.S. data releases and may adjust allocations, amplifying moves in emerging markets and FX. Global linkages mean a U.S. shutdown is not just a local story.

What should investors watch next?

- Congressional updates and any short-term funding stopgap.

- Nonfarm payrolls timing and whether the Labor Department delays the release.

- Fed speakers who can shift expectations about rates.

- Key sector earnings that may show resilience or exposure to government work.

- Intraday futures and options flows for signals about positioning.

Helpful tip: traders often watch volume and put/call skew for clues about whether market participants are buying protection or taking risk.

The Road Ahead – Can Markets Withstand Uncertainty?

Markets have grown used to political shocks. Investors now price in more geopolitical and policy noise than before, and central banks remain the main anchor for asset prices. If the shutdown is brief, history suggests the market will snap back quickly.

If it drags on and affects data flow or spending materially, the risk premium could widen, and volatility may rise. Either way, clarity from Washington and the data calendar will set the tone for the next few weeks.

Conclusion

Government Shutdown fears are keeping U.S. stock futures flat as traders weigh data risks and political outcomes. Short-term calm masks active repositioning. Investors should watch Congress, the jobs calendar, and Fed commentary closely, and use risk controls while staying ready to act when clarity returns.

Markets can tolerate brief shutdowns, but prolonged uncertainty will test that tolerance.

FAQ’S

Analysts say a full crash is unlikely, but Government Shutdown risks, high interest rates, and weak economic data can add volatility to markets.

Financial experts advise against panic selling. Instead of exiting during a Government Shutdown scare, many suggest diversifying and staying long-term.

Much depends on Federal Reserve policy, inflation, and political events like a Government Shutdown. Most forecasts see moderate growth if conditions stabilize.

Markets usually fall due to inflation concerns, rate hikes, or political uncertainty. A Government Shutdown can trigger short-term declines but rarely causes lasting crashes.

No, investors don’t lose everything unless they sell at the bottom. Even during a Government Shutdown-linked downturn, markets historically recover over time.

Historically, crashes like 1929 and 1987 occurred in October, but crashes are not tied to one month. Political risks such as a Government Shutdown can spark volatility anytime.

Gold often rises during stock declines, as investors seek safe-haven assets. In a Government Shutdown scenario, gold may gain if risk sentiment worsens.

Many advisors suggest reducing equity exposure near retirement, not exiting fully. Even during Government Shutdown events, balanced portfolios help preserve growth.

The Wall Street Crash of 1929 is considered the biggest, marking the Great Depression. Later crashes, often tied to events like a Government Shutdown or financial crises, were smaller in scale.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.