US Stock Futures Slide Sharply After Fed Move as Oracle Drags Markets

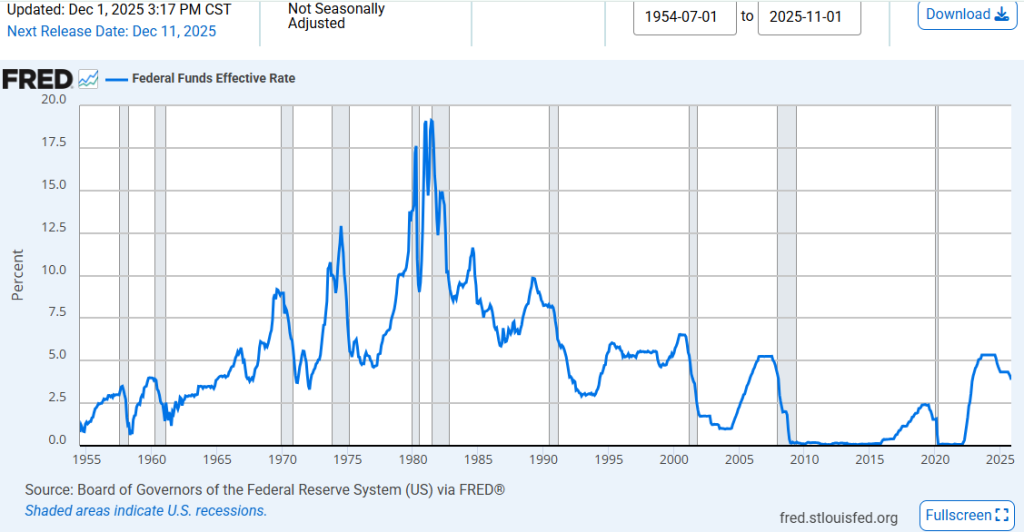

On December 11, 2025, U.S. stock futures turned sharply lower. Traders were reacting to two big developments in the market. First, the Federal Reserve cut interest rates again, pushing its key rate down to 3.50%-3.75%. The move was meant to support growth, but it left some investors unsure about the future path of rates.

At the same time, Oracle’s stock plunged more than 11% after its earnings report disappointed Wall Street. The weak outlook for cloud revenue and high spending on AI projects shook confidence in tech stocks.

The result was weak momentum in the overall market. Futures for major indexes like the Nasdaq and S&P 500 slipped, signaling pressure before the official opening bell.

This reaction shows how sensitive markets are right now. Even good news from the Fed can be overshadowed by a bad signal from a major tech company.

What Exactly Triggered the Stock Futures Selloff?

The immediate spark came from two big moves on December 10-11, 2025. The Federal Reserve cut its policy rate by 25 basis points on December 10. The move was meant to support growth. Markets had already priced in some easing. Still, the Fed’s statement and projections left parts of the market uncertain about the timing of future cuts.

At the same time, Oracle reported results after the close on December 10. The company’s revenue and near-term guidance missed analyst expectations. That dual surprise, a mixed Fed message and a weak Oracle outlook, flipped early optimism into selling in premarket futures on December 11.

Oracle’s Role: The Unexpected Tech Anchor

Oracle’s numbers mattered more than usual. The company flagged slower cloud growth and signaled higher capital spending tied to large AI projects. Investors were particularly uneasy about rising costs and a cautious revenue forecast for the next quarter.

Oracle also disclosed big spending plans for AI data centers and partnerships that look essential but costly. This made traders question whether AI investments are priced fairly across the sector. Oracle’s stock fell sharply in after-hours trading. That loss spilled into Nasdaq futures because investors see Oracle as a bellwether for big tech’s AI spending cycle.

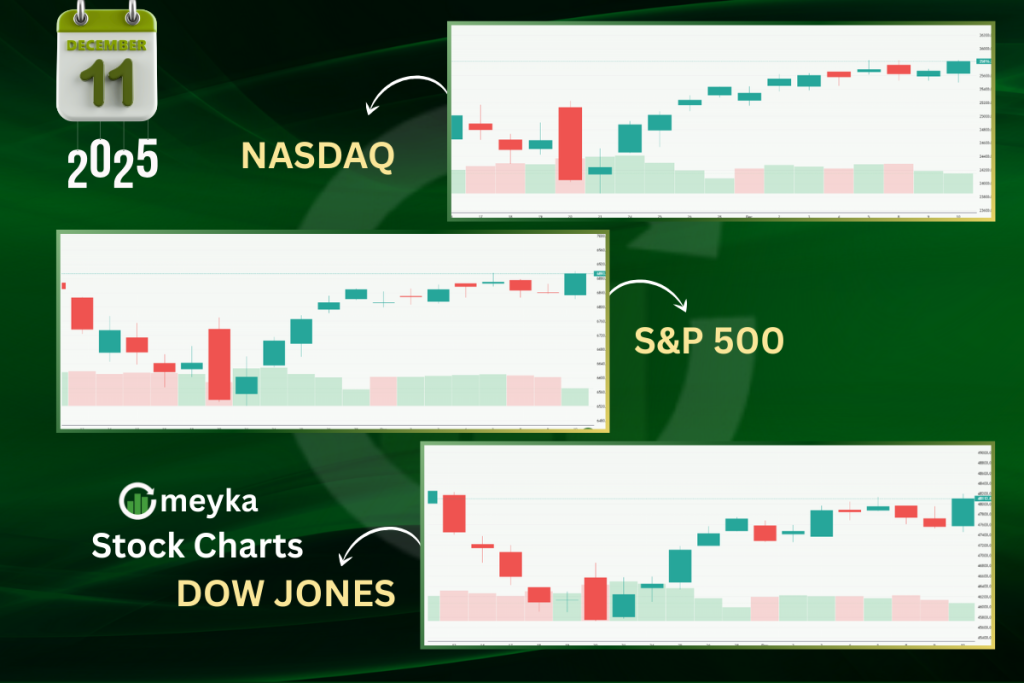

Futures Breakdown: Dow, S&P 500, Nasdaq

The moves in futures were not uniform. Nasdaq 100 futures showed the steepest fall. Tech exposure and the Oracle shock hit the index hardest. S&P 500 futures also slipped, though by a smaller margin. Dow futures fell less than the tech-heavy futures, reflecting a mix of sectors that are less sensitive to AI spending news.

At one point in early trading on December 11, Nasdaq futures were down around one percent while S&P futures declined roughly half a percent. Traders cited heavy selling in large-cap tech names as the main drag.

Fed Messaging: Why Traders are Rattled?

The Fed’s choice to lower the rate by 25 basis points on December 10 was conventional. The surprising part was the nuance in the Fed’s message. Officials signaled a pause could follow and projected only limited easing beyond this cut. That raised the risk that rates will stay higher for longer than some had hoped.

Higher terminal rate expectations tighten discount rates on future earnings. Tech firms, which have higher valuations based on future growth, feel the pinch first. The Fed also updated its projections and left room for dissent within the committee. That internal split amplified uncertainty in markets on December 11.

Market Reactions Outside Equities

The fallout did not stop with stocks. Treasury yields moved in both directions during and after the Fed release. Shorter-dated yields fell as traders digested the cut. Longer yields, however, showed volatility as investors reassessed growth and inflation prospects. The dollar saw bouts of strength.

Commodity markets diverged: gold initially climbed on lower real rates, while oil reacted to mixed demand signals. Volatility metrics rose, reflecting a higher fear premium after Oracle’s guidance disappointed on December 10, and futures slipped on December 11. These cross-asset moves confirmed that the market reaction was broad and not limited to equities.

How Trading Mechanics Amplified the Move?

Algorithmic systems and options flows added fuel. After a major after-hours move in a big name like Oracle, many trading algorithms recalibrate risk models quickly. That can trigger rapid position reductions in correlated names.

Options expirations and hedging flows also forced dealers to trade underlying equities to rebalance books. Those mechanical flows can make initial price moves much larger in the near term. This dynamic helps explain why futures moved faster than cash markets in the early session on December 11.

Analysts’ Take: Is This a Correction or an Overreaction?

Market strategists split on the likely path forward. Some argue the selloff is a short-term overreaction. They point to the Fed’s intent to be supportive and to strong macro data that still underpins corporate profits. Others warn that Oracle’s warning exposes a bigger risk.

If AI spending ramps up but yields lower margins, profit growth could disappoint across several big tech names. Several firms have already trimmed price targets and warned of more cautious guidance ahead. The debate centers on how fast AI investments will convert into predictable revenue and stable margins.

What Traders are Watching Next?

Attention will focus on multiple near-term items. First, any follow-up comments from Fed officials could change the rate outlook again. Second, earnings updates from other large tech firms will be scanned for similar margin pressure or higher capex plans. Third, economic data on inflation and jobs will help determine the Fed’s path.

Finally, trading desks will monitor liquidity and options positioning, because technical strains can magnify moves. Market participants are also using an AI tool to screen large-cap exposure to AI-related capex. That scan will shape how quickly traders re-enter tech names.

Wrap Up

The December 10-11 stock futures episode shows how fragile market calm can be. A policy tweak from the Fed and a disappointing report from a major tech firm combined to produce outsized moves in futures. The immediate pain centers on tech. The deeper question is whether AI investments deliver the returns markets expect.

For now, traders will reassess positions and watch for clearer signals from earnings and policymakers. The next few sessions will reveal whether this is a brief shock or the start of a broader reassessment.

Frequently Asked Questions (FAQs)

US stock futures fell on December 11, 2025, after the Fed cut rates and gave an unclear outlook. Traders also reacted to weak tech news, which increased market pressure

Yes. Oracle’s earnings on December 10, 2025, showed slow cloud growth and higher AI costs. The stock fell, and that drop pulled Nasdaq futures lower the next morning.

The Fed cut rates on December 10, 2025, but also warned about future risks. This message created doubt. Markets turned cautious, and futures dropped as traders reassessed expectations.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.