US Stock Futures Steady as Investors Weigh Shutdown Risks and Earnings Outlook

US Stock Futures were largely steady on Monday, as traders balanced hopes for easier Fed policy against the very real risk of a prolonged US government shutdown. Markets in New York and on Wall Street showed calm early moves, while investors focused on a heavy week of corporate earnings and key economic data.

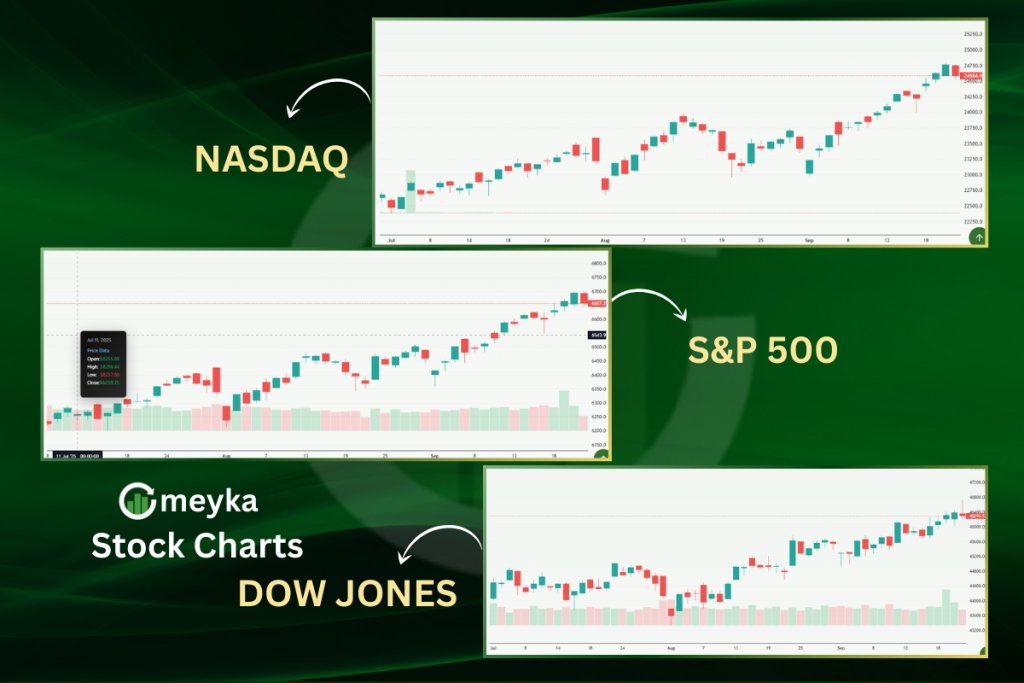

The tone was cautious, with the Dow, S&P 500, and Nasdaq futures each hovering near unchanged as many desks waited for fresh cues.

What will tip markets next, the shutdown or big tech earnings?

US Stock Futures Market Snapshot: a quiet start on Wall Street

US Stock Futures opened the week with a mixed but steady picture: Dow futures were flat to slightly positive, S&P 500 futures held near the prior close, and Nasdaq futures showed modest gains as traders leaned into tech earnings optimism.

Traders cited easing US-China trade rhetoric and growing Fed cut bets as supportive factors, even as the shutdown cloud lingered. Short term, liquidity remains thin, so small headlines can move futures quickly.

Why is this happening? Markets are in a wait-and-see mode, watching two big forces: the political risk tied to a government shutdown, and a packed earnings calendar that could deliver surprises from major companies. Both can move futures fast.

Tweet snapshot: “Futures steady as earnings loom, shutdown risk still on the table”, see this market note for quick color.

Which indexes are moving and why

The Dow, S&P 500, and Nasdaq futures tracked differently because sectors that lead each index are facing unique headlines. Industrial and financial names in the Dow were steadier, while large-cap tech stocks boosted Nasdaq futures as investors priced in better-than-feared earnings for some AI and cloud names. Energy and cyclical stocks remained sensitive to crude moves and global demand signals.

Earnings Outlook: big names set to steer futures

Earnings season is the main event this week. Companies like Netflix, Tesla, Intel, and Coca-Cola are on deck, and their results will shape the tone for the rest of October.

Analysts expect mixed results: some tech leaders could beat on revenue thanks to AI and cloud tailwinds, while cyclical firms may face margin pressure from slower demand.

What does it mean for investors? Strong beats could lift US Stock Futures and risk appetite, while weak prints may push futures lower and keep volatility higher.

Market chatter on social: “Earnings season will separate winners from laggards, futures could gap on surprises.”

Sector focus and analyst expectations

Tech, consumer staples, and industrials are the sectors to watch. Analysts are keyed on revenue beats and margin outlooks, plus guidance for the December quarter.

Many trading desks say that even if the Fed eases later this year, earnings traction is needed to sustain a rally in futures beyond short-lived reactions.

Shutdown Risk: political uncertainty keeps traders cautious

The looming government shutdown is a central market risk. A continued shutdown can slow data flow, delay federal spending, and weigh on confidence.

Traders are pricing two scenarios: a short shutdown with limited economic fallout, or a prolonged gridlock that dents growth and consumer sentiment.

How big a risk is this for futures? It is big enough that many desks hedge positions and keep exposures light until clarity returns.

Market voice: “Shutdown risk is being priced into short-term trades, but the bigger swing will come from whether earnings beat expectations.”

Short term liquidity and volatility

When Washington risks rise, liquidity often tightens, especially in thin pre market and early trading sessions. That makes US Stock Futures more sensitive to headlines. Traders advise smaller position sizes and stop discipline during these events.

Federal Reserve, inflation and the economic calendar

Rate cut speculation is central to the futures backdrop. Markets are pricing a growing chance of Fed easing later this year as inflation signals cool in some readings, but core inflation remains sticky in others.

Key US data this week, including the consumer price index, will be closely watched. If inflation surprises cooler, futures could rally on stronger Fed cut odds; if not, risk assets may wobble.

Will the Fed cut rates soon? That depends on incoming inflation and jobs data; markets expect relief but remain cautious. The CME FedWatch tool and Fed comments will be focal points for traders in New York.

Bond yields, dollar and impact on futures

Falling US Treasury yields tend to support equities by lowering discount rates, and recent dips in yields have helped futures stay steady. The dollar’s moves also matter, since a softer dollar can boost multinational profits and support S&P futures. Watch the 2 and 10-year Treasury spread for risk signals.

Global Context: China, oil, and world markets

Global cues are also shaping US Stock Futures. Easing US-China trade comments lifted risk appetite, while oil prices and Asian economic data provided mixed signals.

A calmer global tone helps US futures, but any renewed tensions or weak foreign data could quickly flip the script. Investors in New York are watching Asia and Europe for follow-through.

Conclusion

US Stock Futures are steady for now, balanced between hopeful signs from easing trade rhetoric and possible Fed easing, and the real threat of a US government shutdown. Traders on Wall Street will watch earnings results, the CPI print, Treasury yields, and any Washington developments.

Those are the triggers that will move futures next. Keep stops tight, watch liquidity, and look for clear signals from the earnings beat or miss cycle to decide bigger positions.

FAQ’S

According to analysts, US stocks are falling due to worries about a possible government shutdown, weak corporate earnings, and uncertainty over Federal Reserve policy. People say investors are staying cautious until they see stronger data.

Market experts link the 2025 volatility to slower global growth, tighter credit conditions, and political uncertainty in Washington. Many believe this is more of a correction than a full crash.

Most economists expect US stock futures to stay choppy in the short term but recover later in 2025 as inflation cools and interest rates ease. People are optimistic about tech and energy rebounds.

Financial planners say no, as long-term investors should avoid emotional decisions. Instead of pulling out, many experts suggest diversifying or buying during dips.

The FTSE drop reflects concerns about global demand, weak UK data, and spillover from the US market. Investors are adjusting positions amid global rate uncertainty.

No, the US stock market is not shrinking; it’s consolidating after rapid growth in previous years. Analysts say valuations are normalizing.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.