US Stock Futures Today Gain as Traders Monitor Political Gridlock

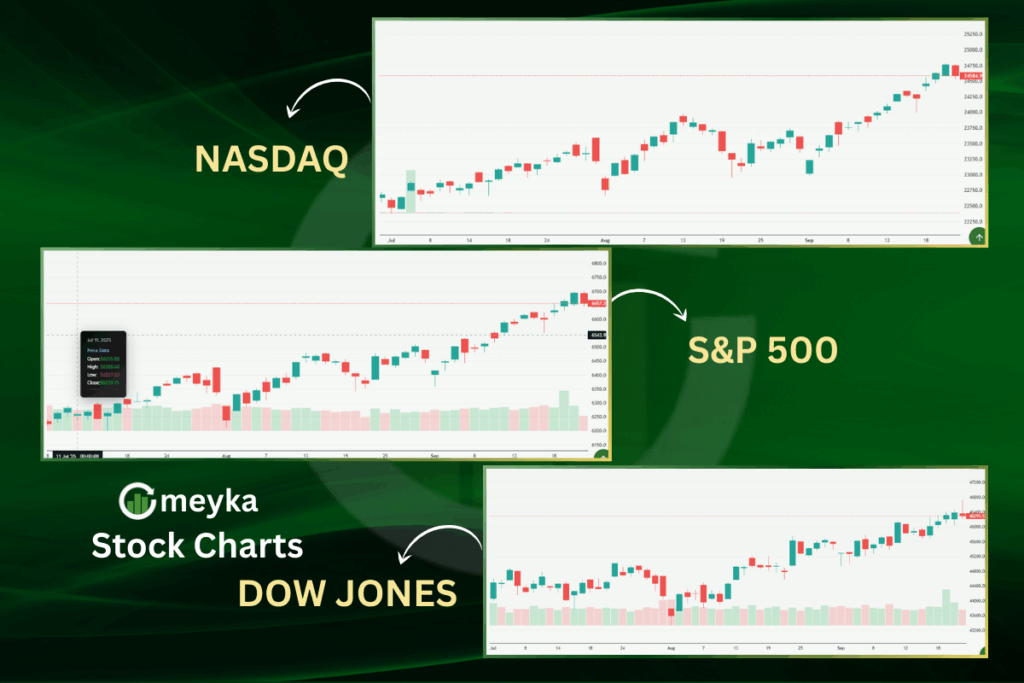

US stock futures climbed in early trading as investors reacted to a mix of political risk and market data. Traders showed cautious optimism even as the threat of a government funding gap loomed. The S&P 500 and Nasdaq futures were higher, while the dollar softened and Treasury yields slipped.

US Stock Futures rise amid political gridlock

Futures for the S&P 500 and Nasdaq were up roughly 0.3%, reflecting a modest rebound after recent losses. The Dow Jones showed similar upside in extended trading, with traders ready to buy dips while they watch political headlines closely. The mood is careful, not celebratory.

Why are markets reacting this way?

Traders are balancing two forces. On one side are data points and expectations that the Fed may cut rates soon. On the other hand, there is political risk: lawmakers and the White House were racing to avoid a government shutdown when short-term funding runs out. The clash of policy certainty and political uncertainty helps explain why futures rose but investors stayed guarded.

Why is this happening?

Futures rose because markets digested mixed news, inflation signals and rate expectations nudged buying, while shutdown fears kept traders cautious.

Wall Street’s broader outlook

Markets are watching Treasury yields and upcoming economic data. The 10-year yield dipped slightly, and that drop helped push futures up. Lower yields often make stocks look more attractive compared with bonds. Traders also noted that the government funding deadline (Oct. 1) could affect economic reports and policy signals if a shutdown occurs.

How does political gridlock affect markets?

A shutdown can furlough federal workers and delay official data releases. That reduces near-term economic activity and adds uncertainty to earnings and spending forecasts. Investors dislike uncertainty; it often raises volatility and can shave demand for riskier assets until the situation resolves.

How global sentiment shapes US Stock Futures

Asian markets rose alongside US futures, helping set a positive tone. Hong Kong gains and stronger Chinese data were part of the lift, while the dollar weakened on month-end flows and shutdown worries. That mix, stronger external demand plus a softer dollar, tends to support US equity futures.

Does Asia really move US futures?

Yes. Global markets are linked. Positive moves in Asia can boost global risk appetite, which often shows up in US futures ahead of the open.

Expert opinions and market reactions

Stock Market Analysts framed today’s moves as measured. Some said traders expect a last-minute political deal, which limits downside risk. Others cautioned that a failure to fund the government could hurt sentiment and the dollar. Market strategists also pointed to recent inflation readings that keep Fed policy on traders’ minds.

Social channels were active. Market observers and traders shared quick takes on X, reflecting both optimism and concern as the political calendar tightened.

What analysts are watching

- Treasury yields: Small moves can shift stock vs. bond decisions.

- Fed signals: Traders look for clues on the timing of rate cuts.

- Political calendar: Funding deadlines and Congress-White House talks can sway sentiment rapidly.

What should investors watch next?

Investors should track a few clear items: the Oct. 1 funding deadline, any public comments from negotiators, incoming economic data (especially inflation and jobs), and yields on the 10-year Treasury. If a shutdown looks likely, volatility could rise, but if negotiators reach a quick deal, risk appetite may return.

Tactical checklist for investors

- Keep an eye on S&P 500 and Nasdaq futures pre-market readings.

- Watch 10-year Treasury yield moves for signs of risk appetite shifts.

- Monitor headlines from Capitol Hill; political developments can move markets fast.

How long might this uncertainty last?

It depends on how quickly lawmakers meet a funding deal. Historically, markets often expect last-minute compromises, but any protracted stalemate would raise the risk premium for equities. Traders can easily scan results by using an AI stock research analysis tool to get the latest insight about US Stock Market.

The wrap: US Stock Futures and the path ahead

US Stock Futures rose modestly today as traders balanced hope for easier Fed policy with the risk of political gridlock. The mood is tentative: investors are willing to buy on dips, but not to overcommit while a government funding deadline and key economic data loom.

A quick political resolution would likely extend the rally, while a shutdown could trigger a sharper pullback. For now, traders will watch yields, Capitol Hill, and incoming data, and trade with care.

FAQ’S

When US Stock Futures rise, it signals investor optimism about the market’s opening. Higher futures often suggest stocks may start the day stronger.

The Dow may fall sharply due to fears of political gridlock, weak economic data, or rising Treasury yields. These factors weigh on investor confidence.

Today’s top gainers in US Stock Futures often include large-cap tech, energy, or financial stocks. The exact list changes based on market trends and earnings.

Traders often look at S&P 500, Nasdaq, and Dow Jones futures for liquidity and stability. The choice depends on risk tolerance and market outlook.

US Stock Futures can be bullish if investors expect growth, or bearish if concerns like inflation or political tensions dominate. It changes daily.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.