US Stock Futures Today Rise Slightly After Wall Street Rally Pauses

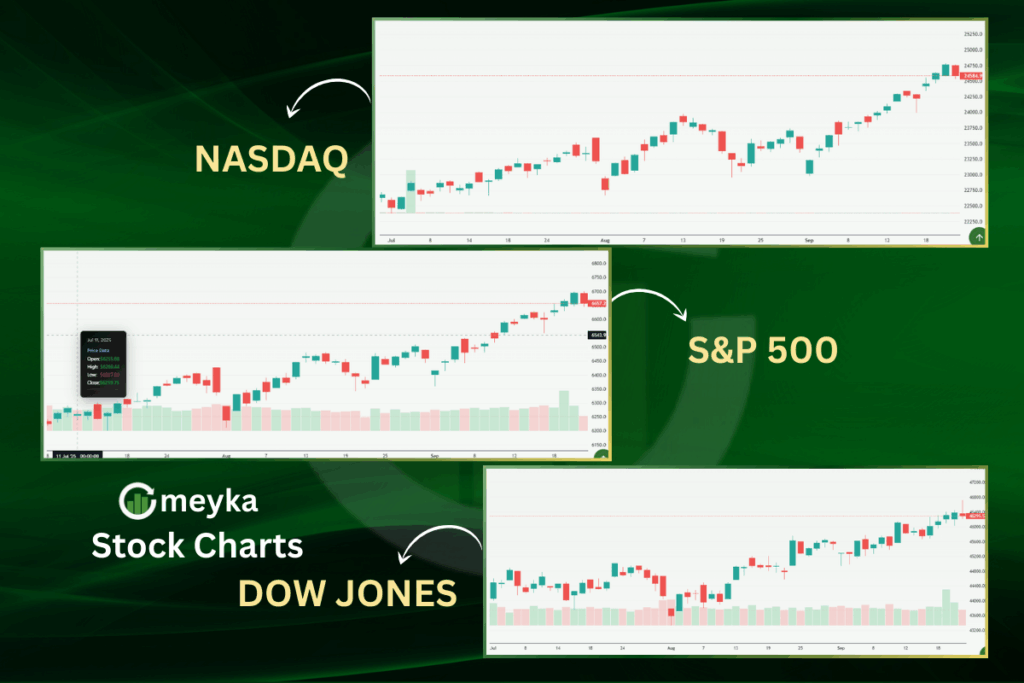

On September 24, 2025, U.S. stock futures are nudging higher. This comes after Wall Street’s recent rally lost its steam. We saw major indexes, the S&P 500, Nasdaq, and Dow, reach new highs for several days. Then, on September 23, they paused.

Investors now seem to be waiting. They are watching economic data. They are listening to what the Fed might say next. The optimism that pushed stocks upward now meets caution. We sense a tug-of-war between hopes for more gains and the risks that lie ahead.

In this calm but alert mood, futures rising slightly suggest people are leaning positive but not sure. They want confirmation. They want safe signals. And so today, every report, every number, and every word from policymakers feels more important than usual.

Snapshot of US Stock Futures

U.S. stock futures edged higher early on Sept. 24, 2025. Dow futures rose modestly. S&P 500 and Nasdaq futures also ticked up. The moves followed a short pullback after several days of record gains. Traders treated the rise cautiously. Volume in premarket trade stayed light. Markets looked for fresh signals before making big bets.

Why the Rally Paused?

The recent rally ran into profit-taking and political noise. Federal Reserve comments added to the caution. Fed officials warned that stock prices look elevated and that the jobs picture shows some weakness. Those remarks cooled the mood. Weak business activity readings also played a role. Together, these factors made investors step back and reassess risk. Historical patterns suggest strong rallies often slow before continuing.

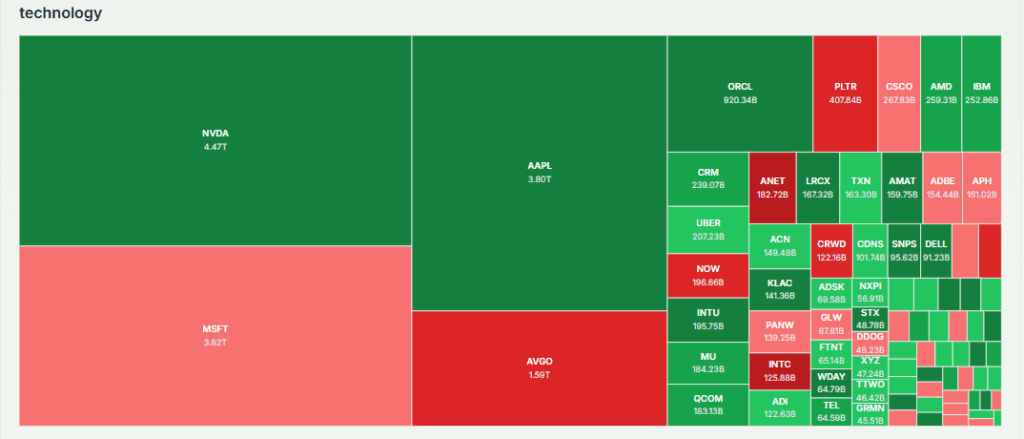

Sector Highlights and Pre-Market Movers

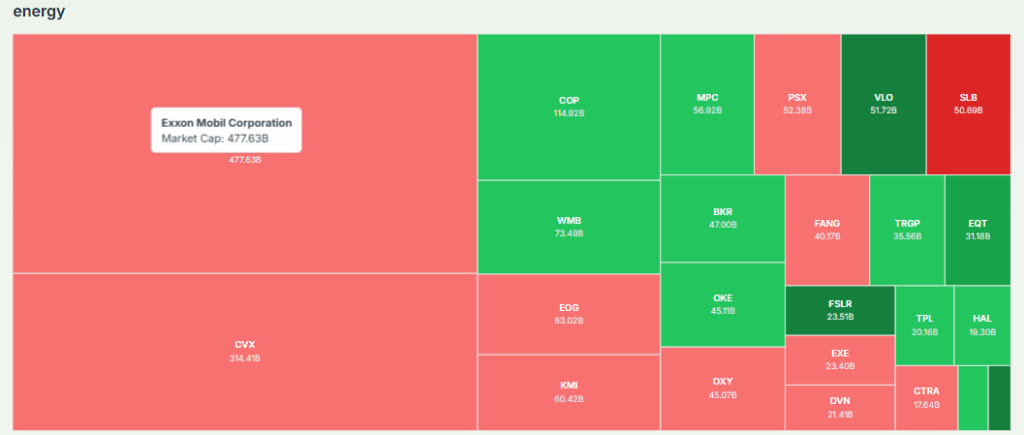

Technology stocks showed mixed action. Big chip names kept attention after strong AI-related demand. Micron lifted sentiment after upbeat guidance tied to AI memory chips. Energy names reacted to softer oil prices overnight. Bank stocks moved on bond yield swings and rate expectations. Several individual stocks jumped or fell after early earnings and guidance. Traders scanned results, sometimes using an AI stock research analysis tool to spot trends before the bell.

Federal Reserve and the Rate Picture

The Fed remains the major force in market thinking. Recent Fed speeches stressed caution. Officials said inflation is still a concern and that the labor market is cooling. This leaves room for debate over how fast or far rates will move next. Markets have priced some chance of rate cuts later this year, but confidence is fragile. Bond yields moved in short bursts. Those moves pushed bank and growth stocks in different directions.

Global Market Cues

Overnight trading abroad showed mixed signals. Asian markets posted gains in some hubs and losses in others. European stocks were slightly softer in early trade. The dollar strengthened against the euro and yen in response to U.S. data and Fed talk. Oil slipped a bit, which weighed on some energy names. Geopolitical headlines had a sporadic impact, but no single event dominated sentiment. Global cues kept the mood cautious rather than confident.

Investor Sentiment and Analyst Views

Sentiments are split. Some analysts call the pause healthy. They argue a breather can support more gains later. Other strategists warn that stretched valuations raise the odds of a deeper pullback. Many emphasize watching earnings and macro prints for confirmation. Short-term traders look for technical support levels. Long-term investors focus on earnings growth and margins. The mix of views keeps trading choppy.

What to Watch Next?

Key economic data will shape the next moves. Inflation reports, jobless claims, and durable goods numbers are on the calendar. Several Fed speakers will also give interviews and speeches. Corporate earnings continue to arrive, with a batch of major names set to report this week. Market reaction to these items could quickly amplify either optimism or caution. Traders should watch yields, the dollar, and headline CPI for immediate clues.

Practical Takeaways for Traders and Investors

Short traders may use tighter stops. Longer-term investors could look for buying chances on dips. Risk management matters more in a market that is both record-rich and fragile. Focus on companies with clear profit growth and reasonable balance sheets. Watch how earnings translate into forward guidance. If macro data surprises on either side, expect sharper moves. Clear signals will likely determine the next leg of the market’s trend.

Bottom Line

On Sept. 24, 2025, slight gains in futures reflected cautious optimism. The market paused after a strong run and now watches data and Fed signals closely. Moves from key sectors and fresh earnings will matter. For now, the tone is alert rather than euphoric. Traders and investors who plan both for upside and downside stand a better chance of navigating the next stretch.

Frequently Asked Questions (FAQs)

On Sept. 24, 2025, U.S. stock futures rose a little because investors waited for new data and Federal Reserve updates after the recent Wall Street rally slowed.

U.S. stocks may shift this week as traders watch inflation data, jobless claims, company earnings, and speeches from Federal Reserve officials for signals on market direction.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.