US Stock Market Dips on September 24 as Oil Gains, Gold Declines

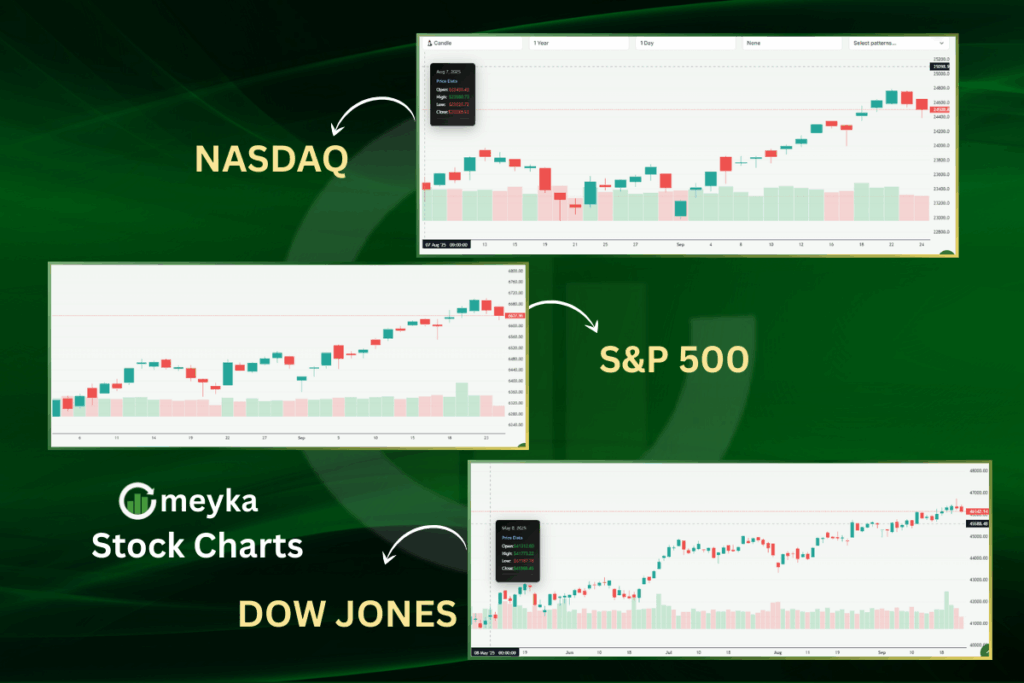

On September 24, 2025, the U.S. stock market pulled back. Major indexes fell for the second day in a row. The Dow Jones Industrial Average dropped 172 points, or 0.4%. The S&P 500 lost 0.3%, and the Nasdaq Composite slipped 0.3%. Earlier in the month, markets had been moving upward, so this marked a change.

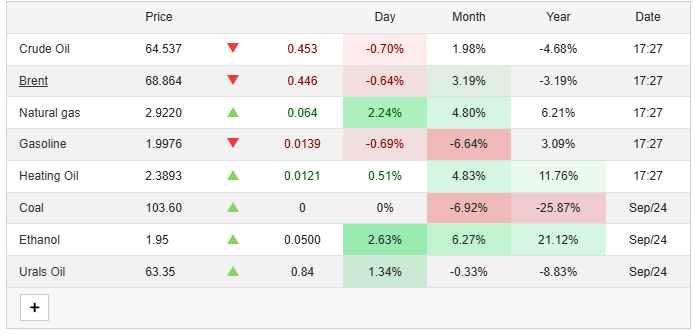

While stocks fell, commodities moved differently. Crude oil hit a three-week high. This happened because U.S. crude inventories dropped and geopolitical tensions tightened supply. On the other hand, gold fell after hitting record highs earlier. Investors sold some gold as the U.S. dollar strengthened and Treasury yields rose.

This mix of rising oil and falling stocks shows how markets can move in different directions. Economic reports, investor moods, and global events all play a role.

US Stock Market Performance on September 24, 2025

On September 24, 2025, the U.S. stock market fell slightly. All major indexes dropped for the second day in a row, the first time since early September. The S&P 500 lost 0.3%, closing at 6,637.97. The Dow Jones dropped 0.4% to 46,121.28, and the Nasdaq fell 0.3% to 22,497.86. Earlier in the month, these indexes had been rising. The S&P 500 was up 2.8%, the Nasdaq 4.9%, and the Dow 1.3% year-to-date.

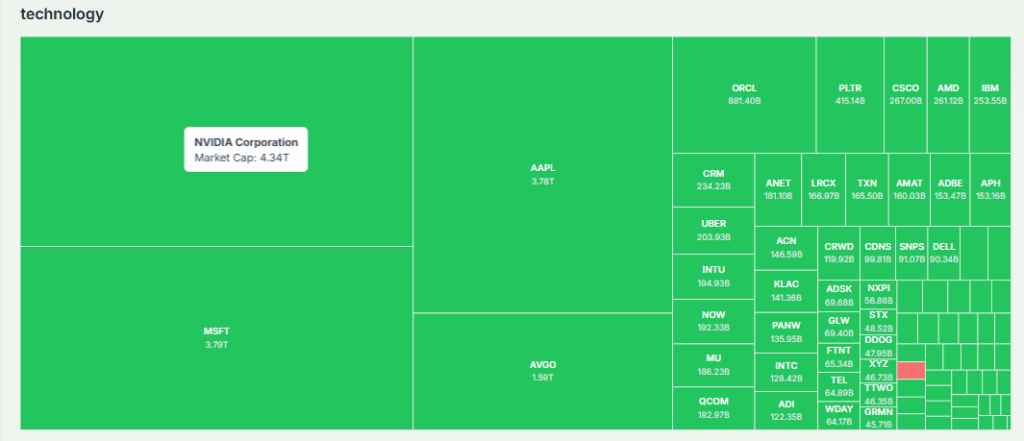

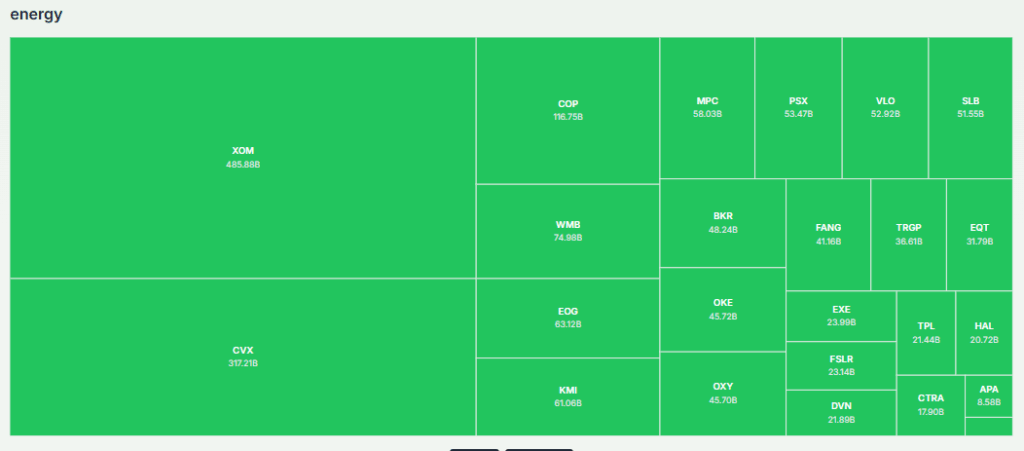

Some sectors did better than others. Energy stocks rose as oil prices went up. Technology stocks struggled, hurt by worries about interest rates and high valuations. Even though Micron Technology reported better-than-expected profits, its stock still fell. This showed that the market remained uncertain.

Crude Oil Prices Surge Amid Supply Concerns

On September 24, 2025, crude oil prices rose to a seven-week high. U.S. West Texas Intermediate (WTI) crude went up $1.58, or 2.5%, to $64.99 per barrel. Brent crude rose $1.68, or 2.5%, to $69.31 per barrel. The rise came after U.S. crude inventories dropped unexpectedly. This showed that supplies were tighter than expected. Problems with oil exports from Iraq, Venezuela, and Russia also added to worries about global supply.

Higher oil prices helped energy stocks. Companies like ExxonMobil and Chevron gained. But rising energy costs also caused concerns. They could lead to higher prices for consumers and affect company profits.

Gold Prices Experience a Minor Decline

Gold prices experienced a slight decline on September 24, 2025, after reaching near-record highs earlier in the month. The gold price index held steady around the $3,777 per ounce resistance level, just below its all-time high of $3,791 per ounce.

The dip in gold prices came from a stronger U.S. dollar and rising Treasury yields. These factors made gold less attractive as a safe place to invest. Despite the drop, experts are still positive about gold’s future. They point to ongoing economic uncertainty and steady investments in gold ETFs as reasons for optimism.

Market Drivers and Economic Indicators

Several macroeconomic factors influenced market movements on September 24, 2025. The Federal Reserve’s stance on interest rates remained a key concern for investors. Rising Treasury yields indicated expectations of higher borrowing costs, which could impact corporate earnings and consumer spending.

Upcoming economic indicators, including GDP growth and durable goods orders, were anticipated to provide further insights into the health of the economy. Additionally, earnings reports from major companies like Accenture and Costco were expected to influence market sentiment in the coming days.

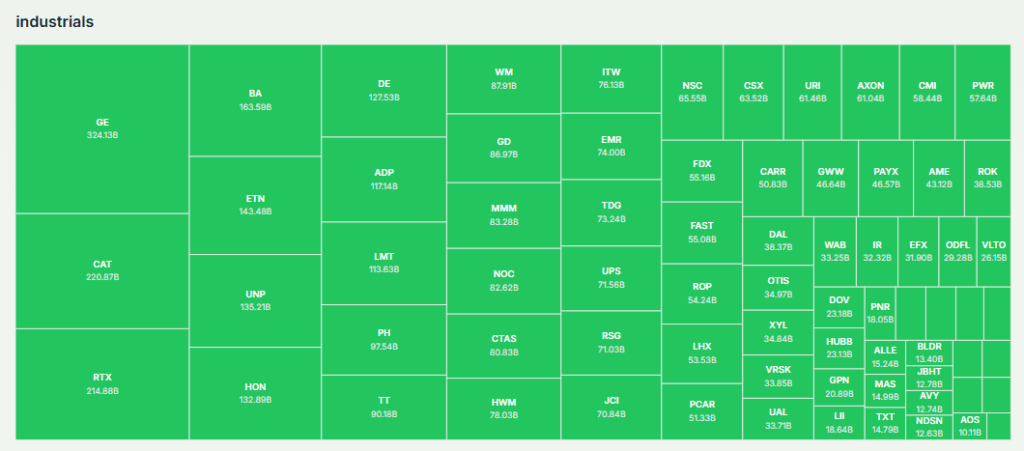

Sector Performance and Notable Stock Movements

On September 24, 2025, the energy sector outperformed, driven by rising oil prices. Companies such as ExxonMobil and Chevron saw their stock prices increase. This reflects the positive impact of higher oil prices on their earnings.

In contrast, the technology sector faced challenges. Despite reporting profits above expectations, Micron Technology experienced a decline in its stock price. This highlights investor concerns over valuation levels and interest rate hikes.

Dow Inc. stood out within the industrial sector, gaining 1.18% to $23.13, breaking a four-day losing streak. However, the stock remained 58.45% below its 52-week high. This indicates ongoing challenges despite the day’s positive performance.

Investor Sentiment and Market Outlook

Investor sentiment on September 24, 2025, was characterized by caution. The dual concerns of rising energy costs and potential interest rate hikes led to a risk-off approach among investors. While the market had experienced strong gains earlier in the month, the recent pullback raised questions about the sustainability of the rally.

Looking ahead, the market’s direction will depend on several factors, including upcoming economic data, corporate earnings reports, and developments related to interest rates. Analysts suggest that the recent dip could represent a healthy pullback, provided that buying interest resumes and new highs are achieved, maintaining market momentum.

Wrap Up

The events on September 24, 2025, showed how different market factors interact. Stocks fell slightly, oil prices rose, and gold dipped a little. This shows that global markets can change quickly. Investors need to watch economic reports, company earnings, and world events to make smart decisions in today’s market.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.