US Stock Market Today: Dow, S&P 500, Nasdaq Climb as Investors Await Fed Outlook

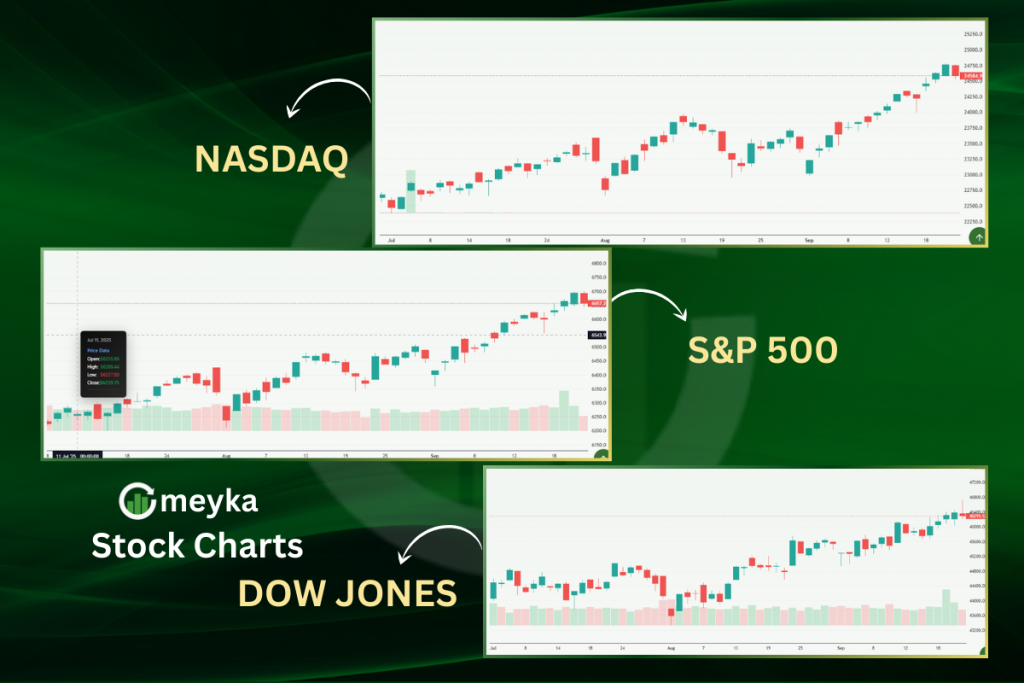

The US Stock Market rose today as traders priced in a calmer path for interest rates and awaited the Federal Reserve’s next outlook. The Dow Jones, S&P 500, and Nasdaq Composite all moved higher, led by strength in big tech and semiconductors, especially Nvidia, which jumped nearly 5% and helped lift the market.

US Stock Market: What happened in today’s session?

Market snapshot and movers

Stocks climbed across the board. The S&P 500 and Nasdaq pushed toward fresh records, and the Dow posted modest gains as traders positioned ahead of the Fed. Nvidia was a clear leader, rallying roughly 5%, while other tech names like Apple and Microsoft also helped the rally.

Why are investors optimistic today? Investors are expecting softer Fed rhetoric and possible easing later this year. That hope lowers the discount rate investors use, lifting prices for growth and tech stocks.

US Stock Market: Why the Fed outlook matters

Fed timing and investor focus

The market is focused on the Federal Reserve’s upcoming policy comments and guidance. Traders want clues on whether the Fed will signal further easing or pause; that guidance will shape bond yields, borrowing costs, and corporate profit forecasts.

What are markets pricing in? Current futures and analyst surveys show strong odds of a modest easing path. That expectation is a major reason equities, especially long-duration tech stocks, are bid up.

US Stock Market: Tech leads: Nvidia, Apple, Microsoft

Big tech’s outsize role

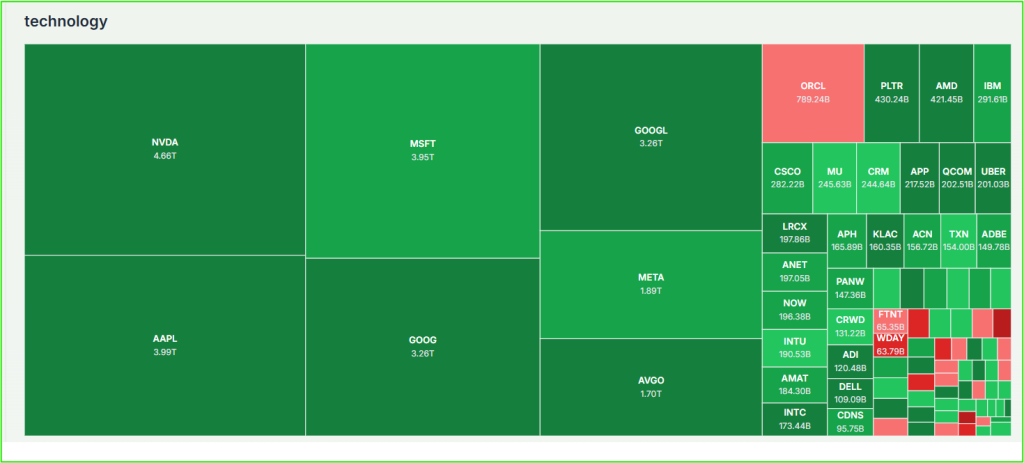

Nvidia (NVDA) led gains after fresh positive headlines and product optimism, and Apple (AAPL) and Microsoft (MSFT) also added to the market’s upward push. These names carry large weights in the S&P and Nasdaq, so their moves matter more than ever to index performance.

Which sectors drove today’s rally? Technology and semiconductors led, while cyclical sectors like energy and industrials showed mixed action. Banks traded cautiously as rate outlooks influence net interest margins.

US Stock Market: Bonds, yields, and inflation signals

What bond markets are saying

Longer-dated Treasury yields were subdued as investors positioned for a gentler Fed stance. Lower yields typically boost equity valuations and support growth stocks, but the bond market will react quickly if inflation data changes.

How does inflation affect stocks? If inflation keeps falling, the Fed can ease more, which usually supports stocks. If inflation rebounds, the Fed may tighten, and stocks can fall. Markets watch the data closely.

US Stock Market: Corporate news and earnings

Earnings and corporate catalysts

Earnings season is in focus, and early reports from big firms are shaping sentiment. Positive results or upbeat guidance can amplify the Fed-driven rally and add momentum to the indexes. Investors are parsing both top-line growth and margin commentary.

Are corporate profits supporting the rally? Yes, solid profit beats and upbeat guidance from major companies reinforce the view that growth can continue even as monetary policy eases.

US Stock Market: Global influences: trade and geopolitics

US-China trade optimism

Reports of progress in US-China talks and a softer tone from political leaders added a global tailwind. Hopes for easing trade tensions helped risk sentiment across markets and supported cyclical stocks.

Did trade news move markets today? Yes, headlines about potential trade de-escalation boosted confidence and helped lift the S&P and Nasdaq toward record levels.

US Stock Market: Sector winners and losers

Who gained the most?

Top winners included semiconductors and large-cap tech names. Energy was mixed amid fluctuating oil prices, and financials were tempered by rate expectations. Materials and industrials showed selective strength tied to trade optimism.

What should investors watch in sectors? Watch tech earnings and semiconductor order books for signs of durable demand. Also track bank earnings for indications of lending activity and margin pressure.

US Stock Market: Analyst views and investor sentiment

What experts are saying

Analysts note the rally is driven by both macro hopes (Fed easing) and micro strength (tech results). Some warn that the market lacks fear, valuations are high, while others argue that fundamentals and earnings justify the gains.

Investor chatter on social platforms echoed these themes. Early optimism and positioning were visible on X, for example, here:

Trading-volume comments and analyst snippets also circulated:

Is the rally broad or narrow? It’s somewhat narrow; large-cap tech accounts for much of the gain. That concentration raises questions about market breadth and sustainability if leadership shifts.

US Stock Market: End-of-day summary

Closing performance (session highlights)

- Dow Jones Industrial Average: modest gains, helped by industrial and tech components.

- S&P 500: moved higher, trading near record levels as big tech rallied.

- Nasdaq Composite: led by semiconductors and megacap tech, pushing toward fresh highs.

US Stock Market: What’s next: Fed, data, and earnings

Key events to watch

- Federal Reserve outlook and Powell’s comments will set the tone for rates.

- Upcoming inflation and jobs data will confirm if easing can continue.

- Earnings reports from major tech and financial firms will drive sector rotations.

How should investors prepare? Keep an eye on Fed guidance and earnings outcomes. Diversify to manage the risk that market leadership can change quickly.

Multimedia: Watch a market wrap

For a quick visual summary, Yahoo Finance’s market roundup and videos provide clear clips on today’s moves and what to expect ahead of the Fed. Search on YouTube for the latest highlights and interviews.

Conclusion

Today’s US Stock Market gains reflect a mix of Fed-driven optimism, strong tech leadership, and positive global headlines. While the indexes climbed and Nvidia led the charge, investors should watch the Fed’s outlook, upcoming data, and earnings for confirmation. As markets head into a key policy week, the next few days will likely decide if current momentum turns into a broader, more durable rally.

FAQ’S

Yes, stocks often rise when the Federal Reserve cuts interest rates. Lower rates reduce borrowing costs for companies and consumers, which can boost spending, profits, and overall market sentiment.

The Nasdaq climbs when tech and growth stocks perform well. Factors like strong earnings, innovation in AI and semiconductors, and lower Treasury yields often drive the Nasdaq higher.

Warren Buffett recommends the S&P 500 for most investors. He believes the index offers broad market exposure, steady long-term returns, and low fees, making it ideal for passive investing.

Federal Reserve decisions directly influence investor sentiment and market liquidity. Rate hikes often slow stocks by raising borrowing costs, while rate cuts usually boost equities by supporting growth.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”