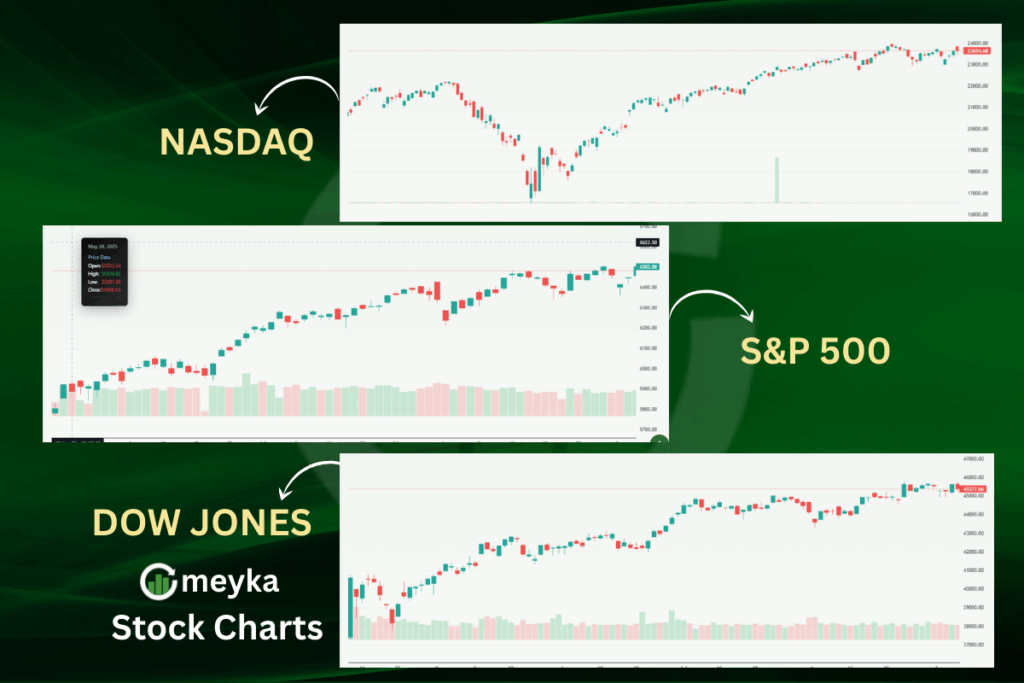

US Stock Market Today: Dow, S&P 500, Nasdaq Edge Higher Ahead of Inflation Data

Today, the US stock market is showing signs of cautious optimism. The Dow Jones, S&P 500, and Nasdaq all edged higher as investors prepared for the release of crucial inflation data. Markets have been moving carefully in recent weeks, reacting to mixed economic signals and global developments. As we watch the numbers, we notice that investors are balancing hope for growth with concern about rising prices.

Tech stocks led the gains on the Nasdaq, while industrial and financial companies pushed the Dow higher. The S&P 500 showed steady growth, which reflects broad market confidence. However, many traders are holding back from making big moves, waiting to see how the inflation report could influence the Federal Reserve’s next steps on interest rates.

We find this moment important because inflation numbers often set the tone for the market. Even small surprises can spark sharp moves. Today’s trading is a reminder that while optimism is present, caution still rules as investors try to read the signals from both the economy and corporate earnings.

Market Summary

U.S. stock futures experienced modest fluctuations on Sunday as investors focused on upcoming key inflation data due later in the week. Futures for the Dow Jones Industrial Average briefly climbed over 100 points before settling just 20 points higher. S&P 500 and Nasdaq-100 futures also reversed early losses to trade slightly positive.

The Dow Jones Industrial Average closed at 45,400.86, down 220.43 points or 0.48%. The S&P 500 ended at 6,481.50, declining by 20.58 points or 0.32%. The Nasdaq Composite closed at 21,700.39, down 7.31 points or 0.03%.

Factors Driving Market Movement

Investors are closely watching the August producer and consumer price indexes, along with revised jobs data, for signs of inflation trends. The Federal Reserve’s next steps on interest rates depend on these reports. Treasury Secretary Scott Bessent defended Trump-era tariffs and warned of significant fiscal impacts if they are overturned.

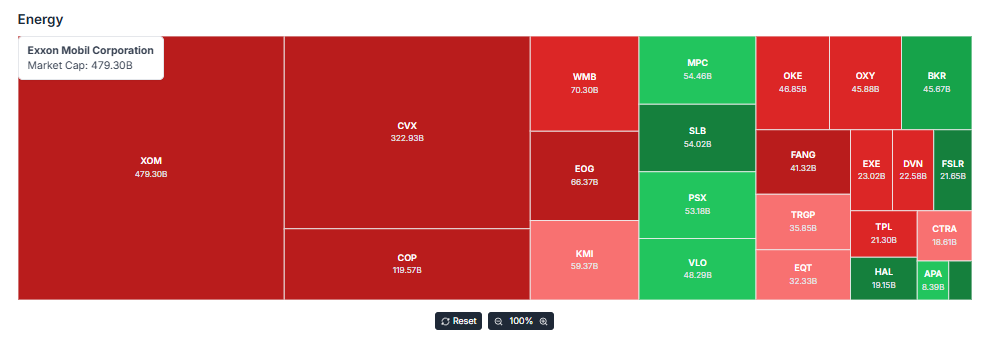

Sector Performance

Sector ETFs were mixed, with homebuilders surging and energy stocks falling. Investors are advised to stay selective with new buys and remain invested in leaders. Keep close watch on economic data and upcoming earnings from Oracle and Rubrik.

Inflation Data and Market Implications

Economists expect August CPI to rise 0.3% month-over-month and 2.9% year-over-year, with core CPI holding steady at 3.1%. A broader rise in services inflation could dampen rate-cut expectations. Additional labor data could revise down job gains by up to 1 million, which would reinforce economic softness.

Expert Opinions and Investor Response

Following weaker job data in August, Wall Street investors are confident the Federal Reserve will cut interest rates at its September 17 meeting. Nonfarm payrolls rose by just 22,000, and previous months were revised downward, leading Fed-funds futures traders to fully price in a rate cut, with an 11% chance of a larger 50 basis point cut.

However, Federal Reserve officials, including Chicago Fed President Austan Goolsbee, caution that inflation data such as the upcoming consumer price index (CPI) will still play a critical role.

Bottom Line

The U.S. stock market is showing signs of cautious optimism as investors await key inflation data. While some sectors are performing well, overall market sentiment remains mixed. The upcoming inflation reports will play a crucial role in determining the Federal Reserve’s next steps on interest rates, which in turn will influence market direction.

Frequently Asked Questions (FAQs)

As of Monday, September 8, 2025, the U.S. stock market is experiencing mixed movements. Major indices such as the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite are showing slight declines. Investors are awaiting key inflation data later in the week, which could influence market trends. The market’s performance today reflects cautious optimism amid ongoing economic uncertainties.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.