Via Transportation IPO: Listing Date Approaches for Transit Tech Startup

Public transport is changing fast, and technology is leading the way. One company at the center of this shift is Via Transportation with IPO offer, a startup that builds smart transit solutions for cities around the world. Founded in 2012 in New York, Via has grown from a small ride-sharing idea into a global mobility tech provider. Today, it works with governments, transit agencies, and private operators to make public transport more flexible, affordable, and efficient.

Now, Via is preparing for its initial public offering (IPO). The company is getting ready to list its shares on the stock market, and investors are paying close attention. We know that IPOs often bring excitement, but they also raise questions about growth and risk. For Via, the IPO is not just about raising money it’s about proving that technology-driven public transit has a strong future.

As we explore this upcoming IPO, we will look at Via’s journey, its business model, its challenges, and what this listing could mean for the mobility industry.

Company Background

Via Transportation started in New York in 2012. The founders are Daniel Ramot and Oren Shoval. The company builds software that helps cities and agencies run better public transit. It offers microtransit, paratransit, school rides, and planning tools. The platform blends automation with hands-on support. It focuses on reliable pickup windows, optimized routes, and service for riders with special requirements.

Via sells to governments, schools, and private operators. The customer base keeps growing. The S-1 shows hundreds of active customers across major markets. That includes New York, London, Berlin, and many smaller communities.

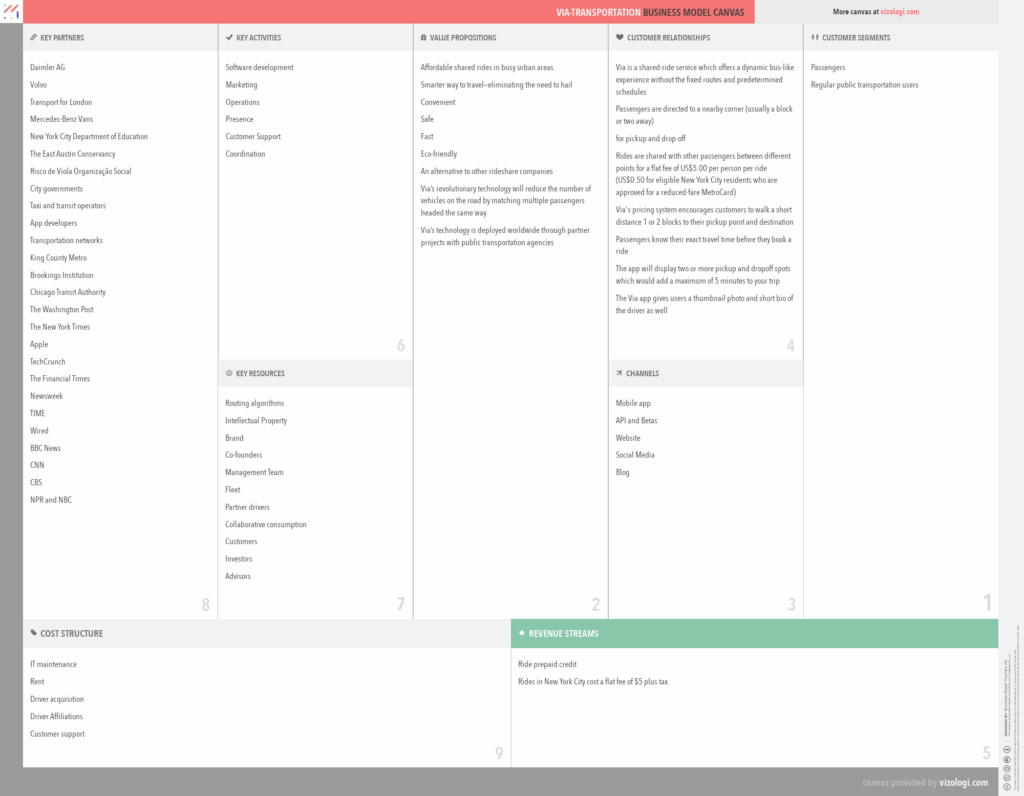

Business Model & Revenue Streams

The business runs on software subscriptions and managed services. Agencies pay for the platform and for operations support. That includes dispatch, driver tools, routing, and analytics. The mix creates steady contract revenue and long relationships.

Revenue is scaling. Via reported $337.6 million in 2024, up 36% from 2023. In the first half of 2025, revenue reached $205.8 million, up 27% year over year. Losses narrowed. The 2024 net loss was $90.6 million, down from 2023. In the first half of 2025, the net loss was $37.5 million, better than the prior year period.

The model leans on public contracts. Winning bids require compliance, service levels, and cost savings. That favors providers with proven deployments and procurement expertise.

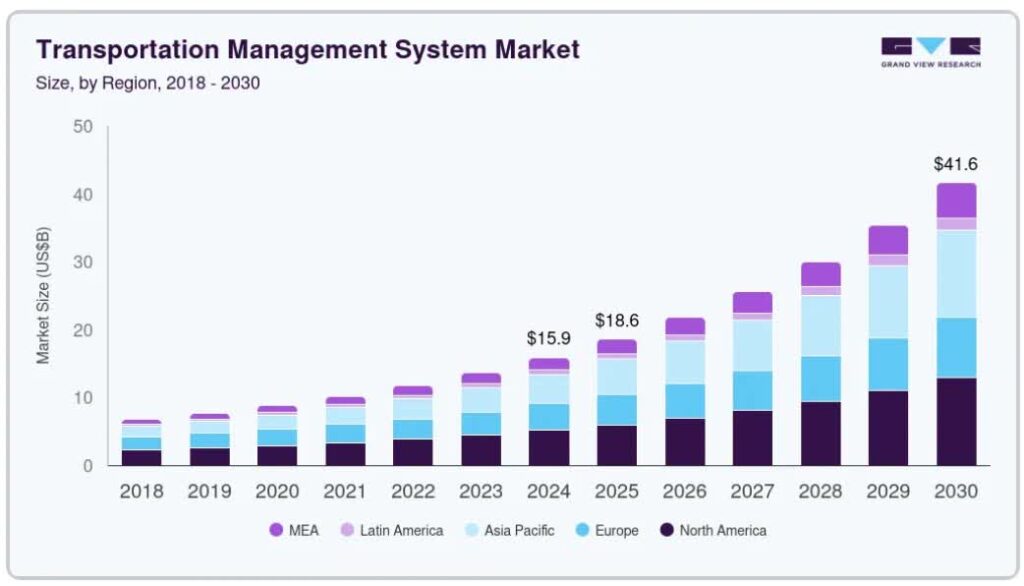

Market Landscape & Growth Potential

Cities face tight budgets and rising demand. Riders want reliable, accessible, and safe trips. Smart transit software fills the gap. Microtransit and paratransit are key growth areas. Agencies adopt dynamic routing to extend coverage without adding fixed routes.

Public markets are also more open to new listings again. The 2024 IPO window improved, and 2025 activity is building. That backdrop supports interest in mobility tech names like Via.

Competition exists on many fronts. Ride-hail companies fight for contracts. Specialized software firms target dispatch, paratransit, or planning. The field includes regional players and global tech vendors. Differentiation comes from reliability, price, and compliance wins.

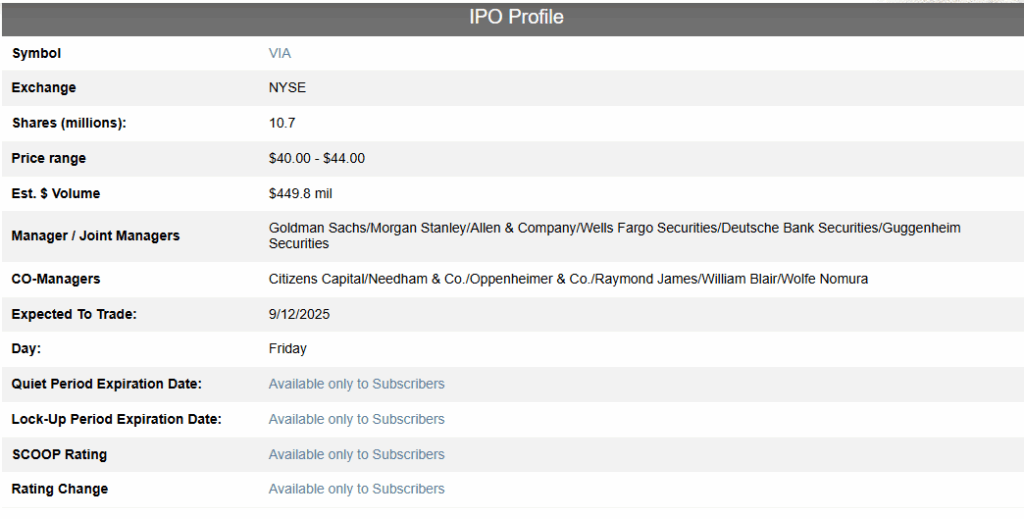

Via Transportation IPO Details

Via filed its S-1 on August 15, 2025. The planned listing is on the New York Stock Exchange under the ticker “VIA.” The underwriters include Goldman Sachs, Morgan Stanley, Allen & Company, and Wells Fargo.

New guidance shows a price range of $40-$44 per share. The deal could raise up to $471 million and value the company at up to $3.5 billion. That aligns with recent media reports as the roadshow gets underway.

Planned uses of proceeds are broad. The company points to general corporate purposes, working capital, sales and marketing, R&D to expand the platform, and geographic growth. It may also consider acquisitions, though none are committed.

Investor Sentiment & Market Expectations

Investors are watching revenue growth and contract quality. The filing highlights a multi-year climb from $100 million in 2021 to $337.6 million in 2024. Losses are narrowing, which helps the story. The market is also paying attention to the price range and the targeted $3.5 billion valuation.

Media briefings note that profitability is not here yet. The company warns that it may not achieve profitability soon. Still, the growth rate and government contracts create interest. In a friendlier IPO market, that mix can draw both institutions and retail investors.

Via Transportation IPO: Challenges & Risks

Policy and regulation can change. Transit rules, data privacy, and AI laws add cost and complexity. The S-1 calls out evolving AI regulation in the U.S. and Europe. Compliance work may increase. Product updates may be required.

Labor status is another risk. Past and ongoing disputes involve how drivers are classified. Legal outcomes can affect costs and operations.

Competition stays intense. Agencies test rival software and services. Some rivals undercut on price. Others bundle features. Contract wins can be lumpy and slow due to procurement cycles.

Execution at scale also matters. International expansion needs local support and secure funding. Any service failure can hurt renewals and references.

Future Outlook

The product roadmap leans into AI-driven planning, demand prediction, and dynamic routing. Better algorithms can raise on-time performance and cut deadhead miles. The platform can also expand in schools, healthcare, and rural mobility.

Growth capital from the IPO can fuel sales teams, partner ecosystems, and selective M&A. The focus areas include new regions and deeper footprints with current customers. If the company keeps improving unit economics, the path to break-even gets clearer.

Final Words

Via sits at the center of a clear shift in public transit. Cities want flexible networks. Riders want reliability. Software is now the lever. The IPO gives Via a larger stage and new capital. Success will depend on contract wins, service quality, and careful cost control. Execution against that plan will decide if the stock meets the early hype.

Frequently Asked Questions (FAQs)

Yes. Via Transportation filed for an IPO with the SEC on August 15, 2025. The company plans to list its shares on the New York Stock Exchange.

Via set a price range of $40-$44 per share. At the top range, the IPO could raise $471 million and value the company near $3.5 billion.

The IPO date is not fixed yet. Reports suggest the listing is expected in September 2025, depending on market conditions and final approval of the offering.

No. Via is not yet profitable. In 2024, the company lost about $90.6 million, though losses narrowed compared to 2023 as revenue grew to $337.6 million.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.