Vietnam Signs 5G Agreements With Huawei and ZTE Amid Warming China Ties After US Tariffs

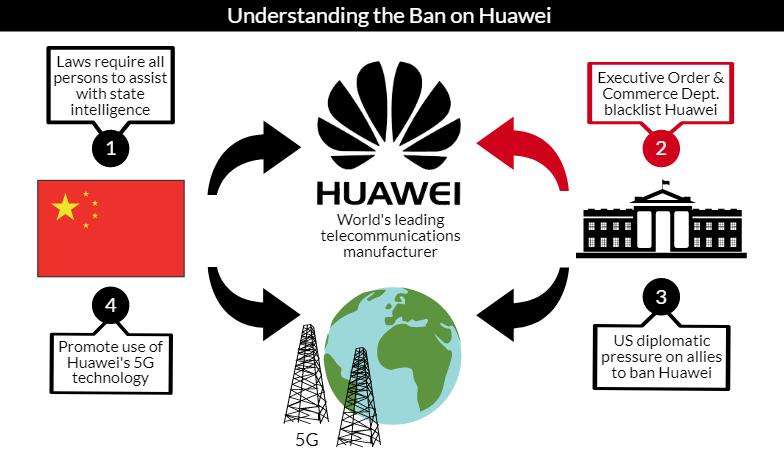

Vietnam’s push for advanced digital growth took a major turn in November 2025 when the country signed new 5G agreements with Huawei and ZTE. This move came right after the United States announced fresh tariffs on Chinese tech products earlier in the year. The timing surprised many observers. But it also showed how fast global tech alliances can shift.

Vietnam has been racing to launch full 5G services. The country wants stronger digital networks to support industry, e-commerce, and smart cities. But progress slowed due to high costs and limited access to advanced equipment. So, these new deals with two of China’s biggest telecom firms arrived at a critical moment.

The agreements also highlight changing political ties. Vietnam and China have been warming relations through trade and technology. At the same time, Vietnam is trying to balance pressure from both Washington and Beijing. This mix of economics and diplomacy makes the 5G decision more than just a tech upgrade. It marks a turning point for Vietnam’s digital future and its role in Asia’s fast-shifting tech landscape.

What Triggered the Move and the Immediate Context?

The dealmaking followed a burst of geopolitical friction in 2025. The United States raised tariffs and tightened export controls on certain Chinese technology in the first half of the year. That policy environment pushed many countries to rethink supply chains and vendor choices. On November 28, 2025, Reuters reported that Huawei and ZTE secured several 5G equipment contracts in Vietnam worth tens of millions of dollars. The awards came as Hanoi accelerated efforts to finish national 5G coverage targets set earlier in 2025.

Vietnam had set a public target to reach near-nationwide 5G coverage by the end of 2025. That target pressured operators to source equipment quickly. Domestic networks had launched pilot projects. But broad commercial rollouts required cheaper, mature kits and fast delivery. China’s vendors offered both. The Ministry of Information and Communications reported substantial gains in coverage through 2025, with 5G base station counts and urban deployments rising notably.

What the Agreements Actually Cover?

The public disclosures describe contracts for radio access equipment, antennas, and local integration services. One consortium that included Huawei reportedly won a contract valued at around $23 million in April 2025. ZTE won multiple antenna and equipment packages totaling over $20 million through later award rounds. Some agreements include technical support and components for macro sites and small cells. These deals are mostly secondary contracts rather than exclusive, national vendor monopolies.

At least one arrangement includes technology transfer and local assembly clauses. Viettel, the large state-affiliated carrier, has been mentioned as a partner in pilot programs. Other state operators, such as VNPT and MobiFone, continue to rely primarily on a mix of vendors, including Ericsson and Nokia. The Chinese contracts appear to supplement, not wholly replace, existing supply arrangements.

Strategic Motives behind Hanoi’s Choice

Cost and speed drove much of the decision. Chinese equipment is widely perceived as more affordable. Huawei and ZTE also offered rapid delivery and mature 5G software stacks. For a country racing to meet a 2025 coverage goal, these attributes carried heavy weight.

Political calculus also played a role. Vietnam’s economic ties with China have been growing. Bilateral trade and investment linkages have strengthened in parts of manufacturing and infrastructure. Signing telecom contracts signals a pragmatic approach: prioritize domestic development and connectivity needs while managing diplomatic balances. Analysts note Hanoi seeks deeper access to Chinese capital and technology, without fully severing engagement with Western partners.

Another factor is technology sovereignty. Vietnam wants local capability to maintain and expand networks. Contracts that include training, local assembly, or joint ventures offer an opportunity to build domestic expertise. That makes some Chinese offers attractive beyond price. Vietnam’s authorities appear to be using selective procurement to capture those benefits.

How did Washington and allies react?

Western responses were swift and cautious. The U.S. has long warned that Huawei and ZTE pose national security risks. The companies were placed on U.S. restricted lists years earlier, and the Federal Communications Commission continued tightening rules on Chinese telecom gear through 2025. Western capitals voiced concern about sensitive network components and called for risk mitigation.

Diplomatically, the decisions could complicate Vietnam’s ties with the United States. Washington views the exclusion of Chinese infrastructure as a condition for deeper collaboration on advanced technologies and intelligence sharing. Hanoi faces the difficult task of safeguarding relationships while pursuing fast, affordable network expansion. Some Western vendors and allies still expect Vietnam to keep critical core network elements diversified.

Security and Dependence Risks

Security worries remain the most discussed downside. Critics argue that Chinese hardware might allow foreign access to network traffic or permit hidden vulnerabilities. The Council on Foreign Relations and other security analysts have repeatedly outlined such risks for global 5G networks. Vietnam’s regulators must now weigh those warnings against economic imperatives.

Another risk is vendor dependence. Heavy reliance on one country for network components can create future bargaining power for suppliers. It can also expose operators to supply chain disruptions if diplomatic relations sour. Vietnam’s mixed procurement approach seeks to blunt that danger by retaining non-Chinese vendors for core elements. Still, secondary contracts and local assembly with Chinese firms increase exposure.

Economic and Technological Opportunities

The agreements can accelerate service rollout. Faster deployment improves rural and urban connectivity. That benefits digital commerce, telemedicine, and factory automation. Faster 5G also supports new services such as private industrial networks and real-time IoT control. Vietnam could leverage improved networks to attract investment in advanced manufacturing and software development.

Local employment and skills may also rise. Contracts that include training and local assembly build a workforce with telecom expertise. That talent pool can feed startups and support national ambitions in AI and semiconductor design. Investors and analysts tracking telecom supply chains might use an AI stock research analysis tool to model potential winners among local integrators and device makers. Such models can highlight how faster 5G growth changes valuations for infrastructure and services firms.

Huawei: What to Watch Next?

Watch how regulators enforce network segmentation and auditing. If Vietnam implements strict isolation of foreign components from sensitive systems, those steps could reduce political fallout. Also, watch procurement transparency and the pace of local technology transfer. Rapid, verifiable transfers of skills and manufacturing matter more than short-term cost savings.

International reactions will remain important. The U.S. and some European partners may ramp up incentives for alternative suppliers. That could offset some perceived strategic cost of using Chinese equipment. The next six months will be decisive for whether these contracts lead to deeper Chinese integration or remain tactical stops on a diversified path.

Bottom Line

The 5G contracts signed in 2025 mark a pragmatic, high-stakes choice for Vietnam. The country prioritized speed, cost, and local capability. That came against a backdrop of U.S. tariffs and tighter export rules. The decision creates both opportunity and exposure. How Vietnam manages security safeguards and vendor diversity will shape its digital trajectory. The outcome may also influence regional norms on how middle powers navigate the tech rivalry between Beijing and Washington.

Frequently Asked Questions (FAQs)

Vietnam chose Huawei and ZTE in November 2025 because their 5G tools were cheaper and easier to install. This helped Vietnam speed up its network goals and reduce project delays.

Some experts say there may be risks, but Vietnam says it will use strict rules to protect its networks. The country plans regular checks to keep systems safe.

The decision may create tension because the US warns against Chinese tech. Vietnam says it will balance ties with both sides while focusing on its own 5G needs.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.