Vikram Solar IPO GMP Surges Ahead of Debut; Price Prediction After 54.63x Booking

India’s renewable energy sector is gaining momentum, and one of the names making headlines is Vikram Solar. The company’s initial public offering (IPO) recently closed with a massive response from investors. It was subscribed to more than 54 times, showing the strong confidence the market has in the solar energy story. Before its official market debut, the IPO has also created excitement in the grey market, where its premium (GMP) has been rising steadily. This surge is drawing attention from both retail and institutional investors who are looking for possible listing gains.

As we look deeper, the interest in Vikram Solar is not just about short-term profits. It reflects how investors see the future of clean energy in India. With the government pushing for more renewable power and global demand for solar energy increasing, companies like Vikram Solar are well-placed to grow.

Let’s explore the IPO details, financial performance, industry outlook, and possible listing price. Together, we will see if the hype matches the fundamentals and whether this IPO is worth the attention it has received.

Vikram Solar: Company overview

Vikram Solar is a large solar module maker and EPC (engineering, procurement, and construction) firm. The company started as a manufacturer and moved into project execution. Manufacturing sites include large plants in Tamil Nadu and elsewhere. Capacity targets grew fast over the past two years, with plans to scale from about 3.5 GW to much higher levels in the coming years. The firm also highlights newer cell technology and an increasing order book that supports near-term sales.

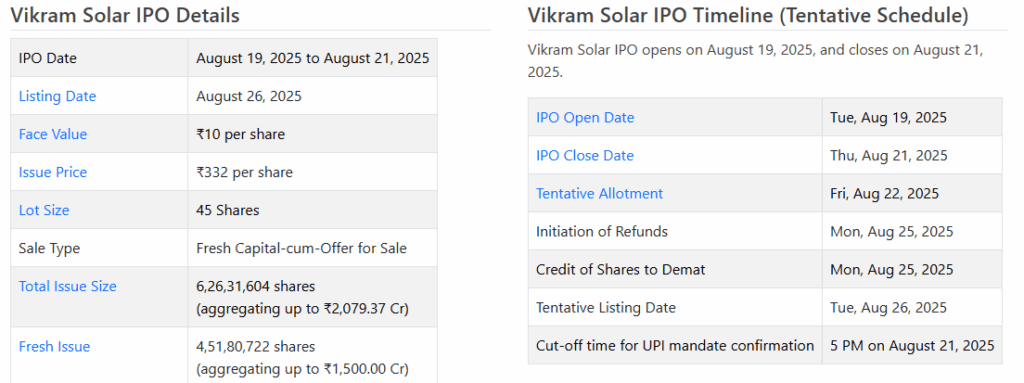

IPO Details

The IPO was open from August 19 to 21, 2025, with a share price range of ₹315 to ₹332. A single lot required 45 equity shares. The total issue size was around ₹2,079 crore and included both fresh issuance and offer-for-sale portions. Listing was scheduled for August 26, 2025, on both NSE and BSE. Lead managers and registrar details are in the prospectus and broker roundups.

Subscription Status and Investor Response

The IPO drew heavy interest across investor groups. On the final day of bidding, the total subscription reached about 54.63 times. Qualified institutional buyers showed the strongest appetite, followed by non-institutional investors. The retail portion was also comfortably subscribed, signaling healthy participation from small investors. Strong subscription indicates bullish sentiment for renewable energy plays at this point in the market cycle.

Grey Market Premium (GMP) Trend and Its Meaning

Grey market activity pushed the GMP into double-digit territory in the run-up to listing. Traders in the unofficial market placed a premium that suggested possible listing gains. GMP rose and fell over the final days, reflecting shifting dealer expectations. While GMP gives a hint of listing mood, it is not a formal price signal. Relying only on GMP can be risky because it captures short-term speculation rather than fundamentals.

Financial Performance and Balance-Sheet Snapshot

Recent annual reports show revenue growth and rising module sales. Module volumes increased significantly in the latest fiscal year. Profit margins have seen pressure from global input costs, but operating scale and a growing order book helped support topline growth.

The company reported investments in manufacturing automation and technology upgrades. Debt levels were manageable relative to cash flow, but capital needs for capacity expansion remain a focus. For full figures, the annual report and RHP provide detailed financial tables.

Industry Outlook and Growth Drivers

India’s clean energy drive remains a major tailwind. Central targets for renewable capacity and supportive policies aim to boost domestic demand. Schemes like Production Linked Incentive (PLI) help local manufacturers scale capacity and lower dependence on imports. Global appetite for solar modules is also strong as countries accelerate decarbonization. These trends create a favorable backdrop for module makers, project developers, and integrated suppliers. However, market competition is intense.

Price Prediction and Listing Expectations

Given the heavy subscription and the elevated GMP, short-term listing gains were widely expected. Broker notes and grey-market indicators pointed to a possible double-digit listing premium from the upper band.

Analysts warned that the actual listing move could be smaller if market sentiment turned cautious at the last minute. Long-term valuation depends on the execution of capacity projects, margin recovery, and order conversion. Short-term traders might profit from listing volatility; long-term investors should weigh growth plans against execution risk.

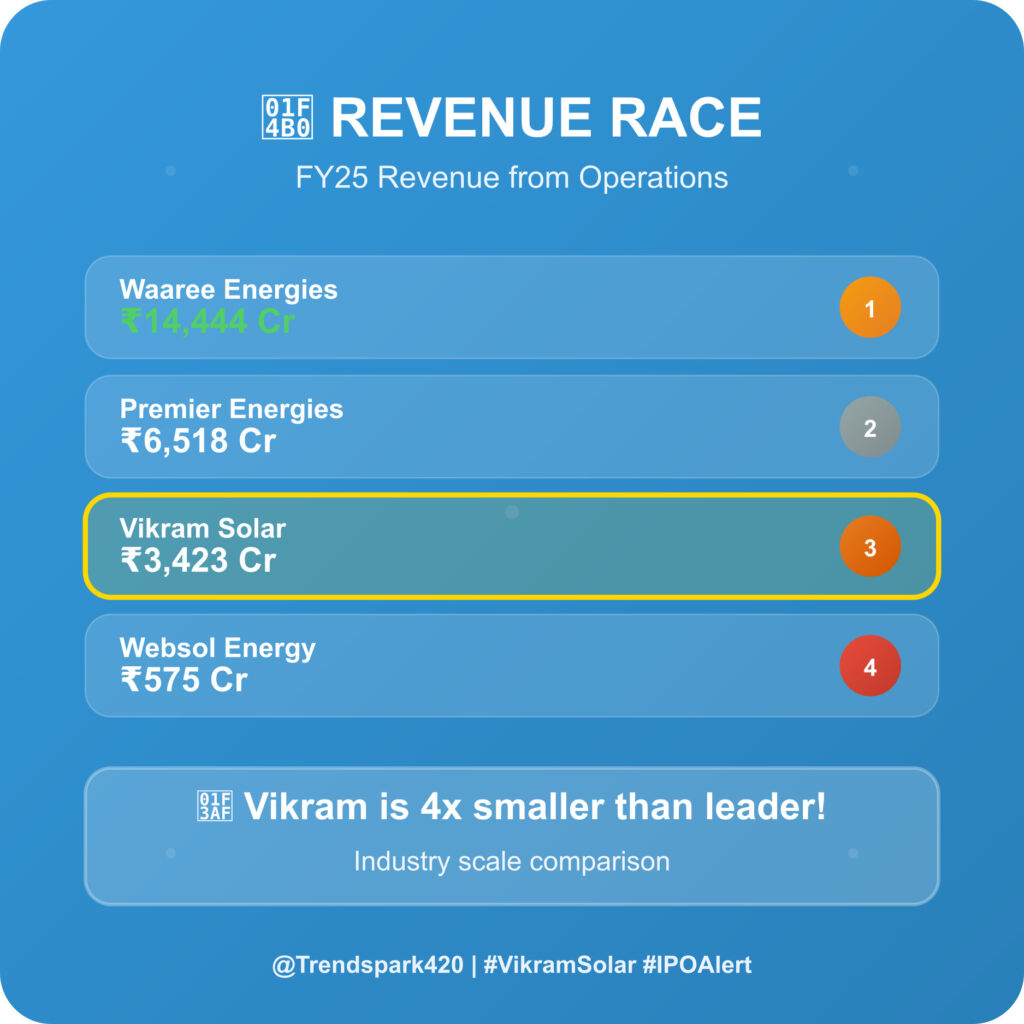

Vikram Solar IPO: Peer Comparison

Comparable listed firms include established renewable-energy and solar module companies. Valuation multiples for peers vary widely based on scale, project mix, and profitability. Some peers command premium multiples due to integrated project pipelines or stronger margin history.

Vikram Solar’s key strengths are its expanding manufacturing capacity and a strong order pipeline. Weaknesses include exposure to raw material cycles and intense competition from global suppliers. Comparing EV/EBITDA and price-to-sales ratios across peers helps place valuation in context.

Risks and Challenges

Raw material cost swings remain a big challenge. China-based competition can compress margins. Timely execution of capacity expansion is critical to meet sales targets. Policy changes or subsidy shifts can affect project economics. Currency volatility and logistics issues also pose downside risks. Investors should expect earnings to show variability until new capacity fully stabilizes and margins recover.

Bottom Line

Vikram Solar’s IPO captured strong investor interest. High subscription and lively GMP hinted at listing demand. Fundamentals look promising on paper because of capacity growth and policy support. Listing performance will reveal whether short-term sentiment aligns with long-term fundamentals. Investors seeking exposure to India’s solar growth must balance optimism with careful review of margins, debt, and execution plans.

Frequently Asked Questions (FAQs)

Vikram Solar’s IPO was finalized at ₹332 per share on August 26, 2025, marking the top end of its price band.

Grey Market Premium (GMP) is not a formal price. A high GMP shows excitement. A low GMP shows caution. It might not match the real listing price exactly.

Before the IPO, Vikram Solar raised ₹621 crore from anchor investors. Big firms like Goldman Sachs, Morgan Stanley, HSBC, and mutual funds took part.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.