Wakefit share price opens flat at Rs 195 on NSE; should investors act in December 2025?

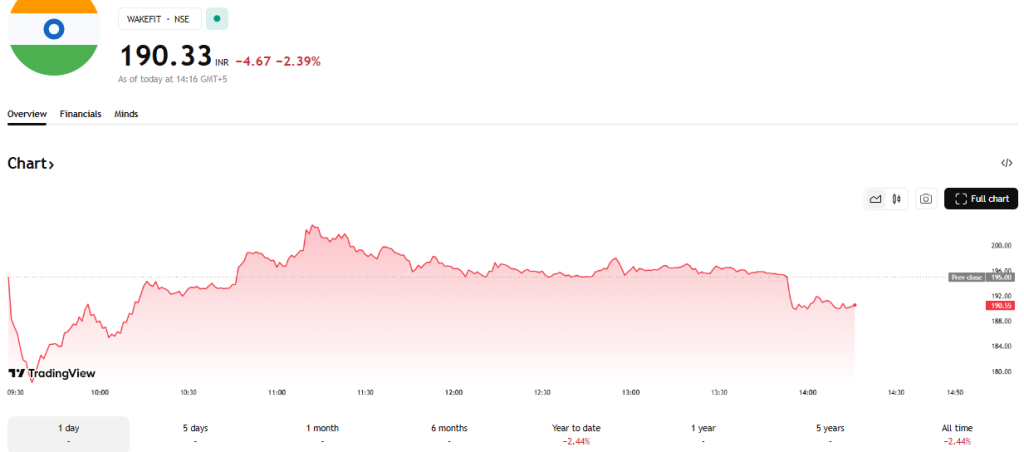

On December 15, 2025, Wakefit made its stock market debut on the NSE at ₹195 price per share. The opening was flat. No sharp jump. No sudden fall. For many investors, this quiet start raised a simple but important question. What does a flat listing really mean?

Wakefit is not an unknown name. It is a popular Indian brand of mattresses and home furniture. Over the past few years, it has built strong online demand and brand trust. That is why expectations around its listing were high. Still, the market response on day one stayed calm.

December is also a tricky month for stocks. Volumes are lower. Investors turn cautious. Big moves often take time. In such a setting, even a flat opening can carry a deeper signal.

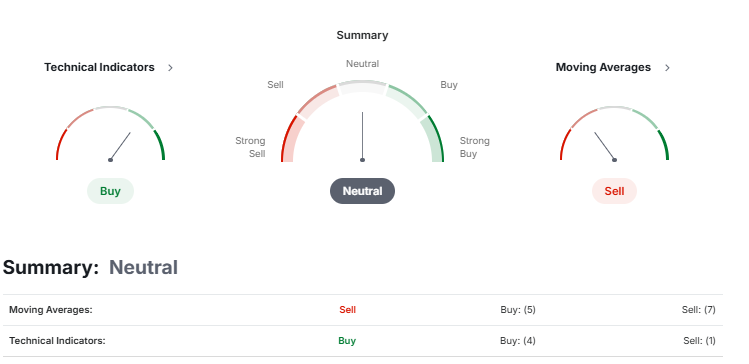

Some see this price as fair value. Others see it as a waiting game. With technology now guiding stock decisions, many investors are also turning to stock market chatbot APIs for quick analysis and grading.

So, should investors act now or stay patient? This question matters more than the opening price itself.

Wakefit IPO Recap: Expectations vs Reality

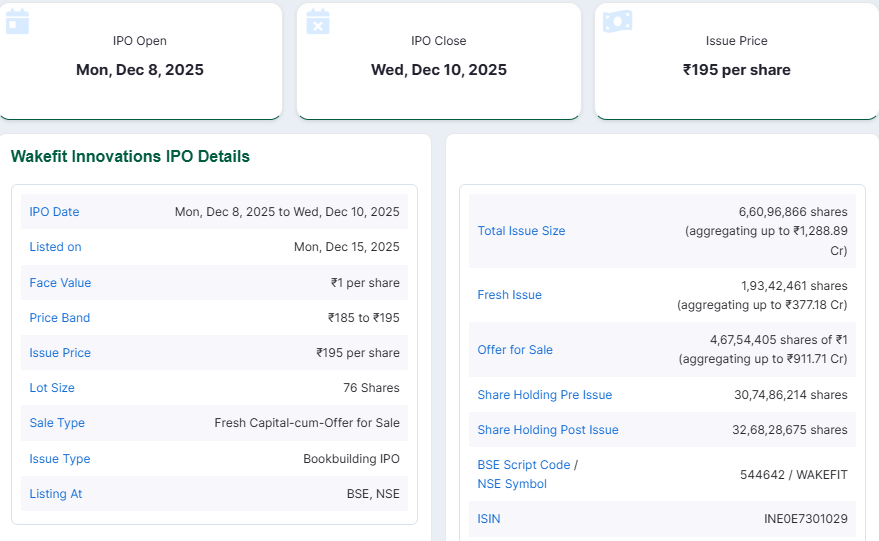

Wakefit’s IPO priced at a band of ₹185-₹195. The public offering closed in early December 2025 and was listed on December 15, 2025. The Wakefit share price opened at ₹195 on the NSE, which matched the issue price.

Grey market signals had suggested a small listing gain, but the debut did not deliver a clear pop. The allotment and listing sequence showed decent retail interest. Still, listing-day calm undercut hopes for a strong immediate upside.

First-Hour Trade Analysis: Who Was Buying, Who Was Selling?

Trading began with modest volume. Early activity pointed to more intraday churn than long-term buying. The stock moved below the issue price later in the day, touching around ₹177 at one point. That fall suggested some short-term sellers used the listing as an exit. Delivery numbers and institutional behaviour hinted at selective conviction rather than broad appetite. Retail investors who expected a quick listing profit found limited scope on day one.

Wakefit Business Model: Strengths the Market Is Watching Closely

Wakefit is a direct-to-consumer mattress and home solutions brand. The company built a strong online reach across major Indian cities. Margins improved as manufacturing and supply chains scaled up. The brand has repeat customers and decent online ratings. Expansion into furniture and adjacent home categories has driven revenue diversification.

Still, growth in smaller towns will raise logistics costs and demand localized distribution. Analysts look for steady margin improvement to justify long-term valuations.

Valuation Reality Check at ₹195

At the listing price, valuations put Wakefit in line with mid-growth D2C peers. Investors compared price-to-sales and EV metrics with other home retail players. The company’s recent financials showed improving profitability, but absolute margins remained modest. That mix created a valuation wedge: the market priced future margin gains, not just current sales. If margins expand as projected, the stock may justify its price. If margins stagnate, downside risk exists near support zones below the issue price.

December 2025 Market Backdrop: Why Timing Matters

Market liquidity tends to thin in mid-December. Year-end flows and portfolio rebalancing often create short-term volatility. RBI policy expectations in late 2025 kept fixed income yields stable but cautious. Consumer discretionary names face two pressures: slower festive-season uplift and macro watchfulness. In such an environment, flat or weak listings are not unusual. Macro tone makes patient entry and measured position sizing prudent.

Technical View: Key Levels Investors Should Track

Short-term resistance formed near the listing area of ₹198-₹205. Initial support appeared around ₹188, with deeper support closer to ₹175, where intraday buyers showed interest. Volume spikes that move the price above ₹205 would suggest renewed buying. Conversely, steady falls below ₹175 could indicate broader weakness. Traders like to watch delivery percentages and intraday volume for confirmation of trends.

Wakefit Share Price: Should Investors Act Now?

Long-term investors should focus on fundamentals and the company’s path to higher margins. Buying at a steady pace across dips reduces timing risk. Short-term traders should avoid chasing volatile moves and instead use tight stops. IPO allottees face a common choice: hold for potential medium-term gains or book partial profits to reduce risk.

For cautious portfolios, a phased approach to buying is safer than a single large purchase. Market tools, including an AI tool for instant sentiment and flow checks, can help time entries but should not replace careful fundamental review.

Role of Stock Market Chatbot APIs in Evaluating Wakefit

Automated analysis platforms now score IPOs on multiple axes. These systems parse filings, compare peers, and flag operational metrics. They also ingest real-time order flow to give quick risk grades. Such grades are useful as a starting point. Yet, these tools do not replace human judgment. Use them to screen and to speed research, not as the sole decision engine.

Final Verdict: Opportunity or Wait-and-Watch?

The listing on December 15, 2025, was flat to weak. That outcome makes patience the wiser posture for many. Long-term investors who trust the D2C thesis and margin expansion could start small buys on weakness. Short-term traders should stay disciplined and avoid emotional entries.

The company’s execution over the next two quarters will matter more than the opening price. Monitor quarterly margins, expansion costs, and actual retail traction before increasing exposure. If the business hits its margin targets, upside will follow; if it fails, downside risk will grow.

Frequently Asked Questions (FAQs)

Wakefit shares may suit long-term investors. The stock listed flat on December 15, 2025, showing fair pricing. Short-term gains look limited in a cautious market.

Wakefit listed flat on December 15, 2025, due to fair valuation, weak grey market signals, and low December trading volumes across Indian equity markets.

Wakefit’s outlook depends on margin growth and cost control. Stable earnings over the next few quarters may support gradual price movement, not sharp gains.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.